Debt Lessons For School: Ed Balls Plays Penny Up The Wall

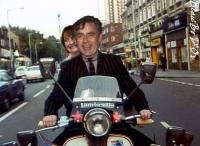

A NEW subject called “Economic wellbeing and financial capability” is to be introduced into the nation’s schools to teach teenagers how to handle financial pressures. (Pic: Beau Bo D’Or)

A NEW subject called “Economic wellbeing and financial capability” is to be introduced into the nation’s schools to teach teenagers how to handle financial pressures. (Pic: Beau Bo D’Or)

And they might as well start learning now as in years to come the poor buggers will still be paying off their parents’ debts.

The new course, aimed at 11 to 16 year olds, is part of an overhaul of the Key Stage 3 curriculum, which is being overseen by the Children, Schools and Families Secretary, Ed Balls. Says he: “Money plays a crucial part in all our lives. I want teenagers to start learning early how to make the most of their money and savings once they start work.”

And the subject couldn’t be more relevant. With home repossessions up 10 per cent in the pat year, debt is dominating our lives and the future doesn’t look any brighter for Britain’s next generation of benefits slaves.

Lib Dem education spokesman, David Laws, says: “This generation of young people is certainly going to need financial education to cope with the huge debts from a combination of high tuition fees and skyrocketing house prices. Young people will also need to cope with one of the most complex pensions systems in the world, which they will find themselves automatically enrolled into not long after they start work.”

According to Government research published in the Leitch report, around five million Britons are considered functionally innumerate while apparently 17 million struggle to work out their change in a shop.

Most of them are believed to vote for New Labour…

Posted: 9th, July 2007 | In: Money Comment (1) | TrackBack | Permalink