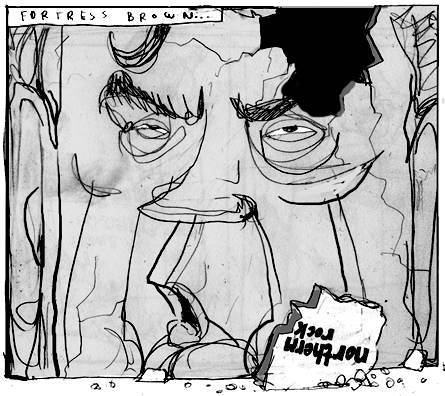

Northern Rock Watch: Adding The Numbers In Today’s Media

NORTHERN ROCK is nationalised. It is now as Safe as the Bank of England.

NORTHERN ROCK is nationalised. It is now as Safe as the Bank of England.

Hereunder is a round-up of Northern Rock facts in today’s media.

Northern Rock money is now your money, so it’s good for journalists to be precise:

DAILY EXPRESS (front page): “NORTHERN ROCK: NOW IT’S A TAXPAYERS’ NIGHTMARE”

This time last year, the bank was worth around £5.3 billion. It is now worth just £375 million.

DAILY MAIL (front page): “£100m GAMBLE WITH YOUR CASH”

The move severely dented Labour’s reputation for economic competence and leaves taxpayers responsible for the crippled bank’s £100billion in mortgage debts – just as the housing market has entered a downturn.

Facts:

The Conservatives claimed the decision meant every family in Britain was effectively being saddled with a “second mortgage” of £4,000…

The Government now faces the prospect of being blamed for the repossession of the homes of defaulting Northern Rock mortgage-holders and for job losses from the bank’s 6,500-strong workforce in Labour’s North-Eastern heartland…

There is also likely to be a drawn-out legal battle with the 180,000 shareholders who face getting nothing back from their investment.

DAILY MIRROR (front page): “WHAT IT MEANS FOR YOU”

At the moment, taxpayers are propping up the Rock with £55billion in loans and guarantees. The bank, worth £5.3billion this time last year, is now worth just £375million

THE SUN: “Crisis Rock To Be Nationalised”

But Chancellor Alistair Darling said it was the only way to safeguard the £26billion of taxpayers’ cash that had kept the bank from going under…

An independent panel will decide the amount of compensation for the bank’s shareholders — at least 150,000 of whom are small investors

THE TIMES (front page): “Rock takeover brings back nationalisation”

“Gordon Brown signed off the decision to mount the first national-isation in modern times of a major high-street bank yesterday afternoon, adding a £90 billion liability to the Government’s balance sheet… The mortgage lender already owes taxpayers £25 billion, but its total liabilities have been assessed at £91 billion, for which the Government is responsible…”

The bank employs “more than 6,000 people”

THE GUARDIAN (front page): “Darling under fire as Northern Rock is nationalised”

Since it emerged five months ago that Northern Rock had sought help from the Bank of England, it has relied on £55bn of taxpayers’ guarantees to stay in business

Later:

Martin Jacques: The economic and political consequences will be of such a scale that they are impossible to comprehend. The present crisis has been long in the making, even if it has been obscured by the US spending over a decade in denial, as illustrated by the absurd post-9/11 neoconservative hubris about America becoming a latter-day Rome and the failure to address the growing imbalances between the US as a huge over-spender and East Asia as a massive saver.

DAILY TELEGRAPH (front page): “NORTHERN ROCK NATIONALISED”

The unexpected move left the taxpayer liable for close to £100 billion and led to a furious reaction from shareholders, who threatened legal action… Investors in Northern Rock, which has about 144,000 small shareholders, are likely to take legal action.

THE SCOTSMAN (front page): “Humiliated chancellor takes Rock public”

Says Shdow Chancellor George Osborne:

“Gordon Brown has dithered his way to the disaster of nationalisation. Now the taxpayer will bear the full risk of lending £100 billion of mortgages in an uncertain housing market. We will not back nationalisation. We will not help Gordon Brown take this country back to the 1970s.”

What’s a few billion between friends…

Posted: 18th, February 2008 | In: Money Comments (9) | TrackBack | Permalink