Why Banking Regulation Doesn’t Work

WE’D all like it to work, obviously. We’d really rather prefer to have a few bureaucrats stopping them from going bust than having to throw hundreds of billions at them every generation for sure.

WE’D all like it to work, obviously. We’d really rather prefer to have a few bureaucrats stopping them from going bust than having to throw hundreds of billions at them every generation for sure.

However, the problem seems to be that such regulation doesn’t actually work:

The Financial Services Authority (FSA) has conceded that it was outwitted by hedge funds who realised that the bank’s loan book could not be as healthy as stated by the figures using the International Financial Reporting Standards (IRFS).

The regulator’s report found the “anticipation that large loan loss provisions might arise…. was highly relevant to the collapse in confidence in RBS in autumn 2008. And while this confidence effect was general across the banking system, RBS was particularly affected because of market concerns that its loan portfolio might be of relatively poor quality.”

But rather than blaming the “speculators” the FSA agreed their view was correct. “This perception of relatively poor loan quality (compared with some, but not all, other banks) was confirmed post facto by the scale of RBS’s provisions in 2009 and 2010,” it found.

This isn’t confined to the UK and the FSA either. Germany spent even more cleaning up their banking system than we did ours, Eire famously allowed the banks to bankrupt the entire country and in the US the SEC was just as gobsmacked as everyone else.

It’s not even true that if we just had the right people as regulators, or the regulations themselves had more teeth, that she’d be right. It’s quite simply that the regulators are always going to be two steps behind those trying to make money.

This doesn’t mean there’s no solution, just that the solution isn’t going to be more rules. It’s actually to have fewer: we should get rid of the rule that says we’re going to bail out banks. Make sure they’re small enough that we can allow them to go bust and that will concentrate the minds of the managers better than any number of bureaucrats will.

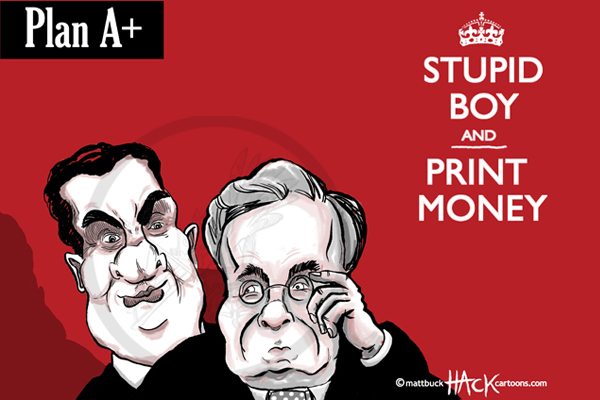

Image: Hack

Posted: 13th, December 2011 | In: Money 0 Comments | TrackBack | Permalink