Fracking madness: In what way is a higher than normal tax rate a tax break?

I HAVE to admit that there are certain minds that I just cannot worm my way into. Just cannot grasp what is going on in the minds of people who say such stupid things:

George Osborne has infuriated environmentalists by announcing big tax breaks for the fracking industry

Has he? My word.

Lawrence Carter, a Greenpeace energy campaigner, said: “The chancellor is telling anyone who will listen that UK shale gas is set to be an economic miracle, yet he’s had to offer the industry sweetheart tax deals just to reassure them that fracking would be profitable.

So, what is this sweetheart deal on offer?

The Treasury has set a 30% tax rate for onshore shale gas production. That compares with a top rate of 62% on new North Sea oil operations and up to 81% for older offshore fields.

So, yes, that’s lower than offshore oil or gas. But standard Corporation Tax these days is 26%. So fracking is going to be charged a higher tax rate than all those windmills, solar plants, biogas digesters and geothermal plants is it? And this is to be described as a tax break for fracking for shale?

Oh, and don’t forget: fracking doesn’t get any of the subsidies that all of those renewables do. No extra money added to energy bills to pay for it, no contracts for difference and all that. They just get to pay a higher tax rate than everyone else and this is described as a tax break?

Remind me, which planet is it that Greenpeace lives on?

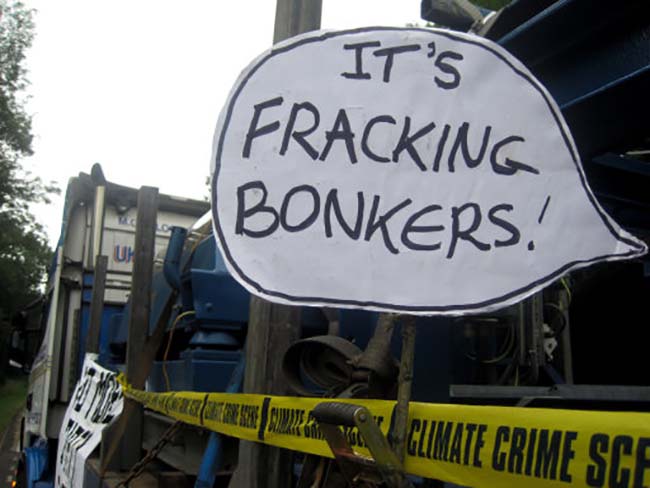

Photo: Anti-fracking protesters at Balcombe, East Sussex, as fracking firm Cuadrilla tries to move equipment on site for exploratory drilling for oil.

Posted: 4th, August 2013 | In: Money Comment | TrackBack | Permalink