What the Co Op bank tells us about the financial crash

SO it looks like the Co Op Banks has only just managed to avoid going tits up:

SO it looks like the Co Op Banks has only just managed to avoid going tits up:

The Co-operative Group has plunged to a £559m first-half loss as bad debts in its banking arm wiped out profits from its supermarkets.

The group said there would be no quick fixes as it embarked on a four-year turnaround plan, after reporting pre-tax losses of £709.4m in the Co-operative Bank in the six months to the end of June.

This tells us something about the financial crash itself. That financial crash we all know was caused by a lethal combination of several things. Firstly, there was that greed of shareholders for profits. Get anything, do anything, to make profits! Second there were those bankers chasing bonuses. They’d do a short term deal to boost their bonus without caring whether it made money for the bank in the long term. And thirdly of course there was that awful mixture of casino banking alongside government guarantees. The too big to fail problem: the banks got to gamble and if they won then they got the profits, if they lost then we all bailed them out.

And the Co Op shows us that this is all a load of cobblers. The Co Op Bank did not do investment banking, did not have a department that even tried to do it. It also doesn’t have shareholders: it’s mutually owned by the customers of the Co Op. And their bankers didn’t work for bonuses.

But it still has gone bust, or would have done if all those people who own a piece of the Co Op hadn’t lost money instead. So, what the Co Op Bank really teaches us is that everything we’ve been told about what caused the financial crisis is wrong.

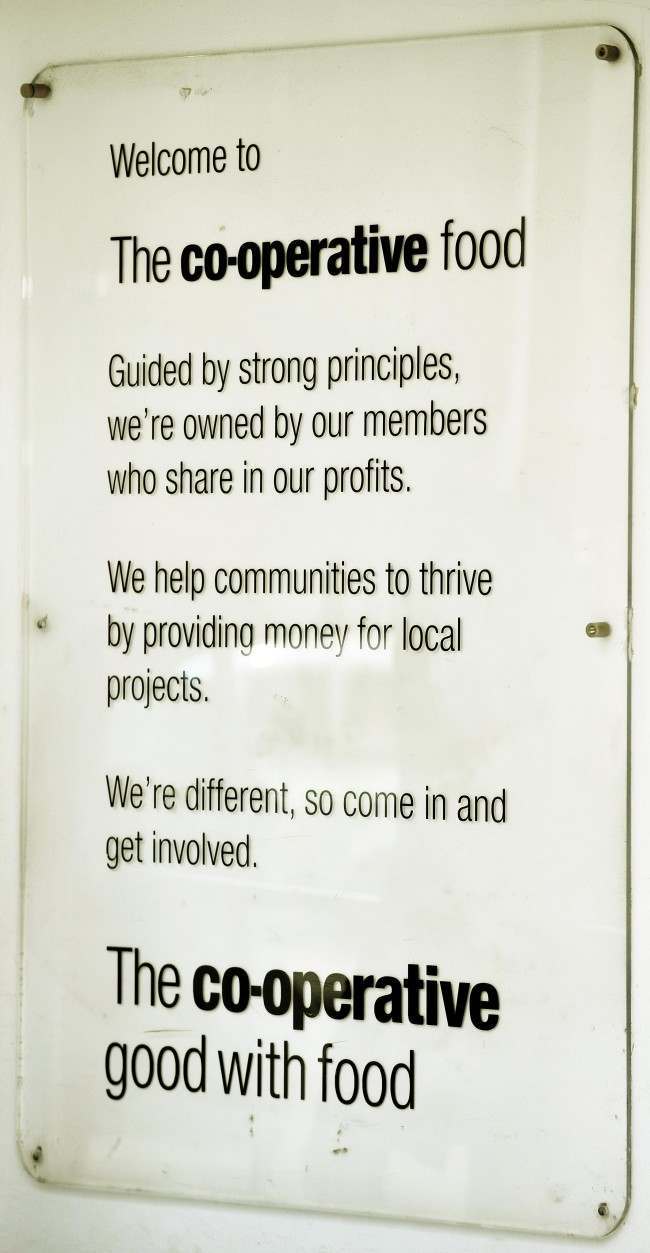

Photo: A general view of a Co-operative mission statement in the entrance to a food store, in the Strand, central London.

Posted: 2nd, September 2013 | In: Money Comments (2) | TrackBack | Permalink