Money Category

Money in the news and how you are going to pay and pay and pay

How to be good at body language and make other people listen and obey

I was once taught how to shake hands – by an idiot. His theory went that so long as you didn’t get too close to other person. stuck out your hand and make eye contract, the shakee would think you smart, confident and trustworthy. Until you opened your mouth. That was his mistake. But body language can matter. Body language does exist. Do not put your hands on your hips. Do not do the ‘fig leaf’. Try to avoid the power pose, so beloved by politicians. Keep your palms up. Be expansive. Take a look at “Make Body Language Your Superpower”, an address by students of Stanford’s Graduate School of Business. It’s worth a watch. You might feel nervous and clammy as you address a group, but you can mask it with a few tricks.

Posted: 24th, August 2021 | In: Money | 0 Comments

Of course Manchester City have bought success – but so what?

“Each club has its own reality, its own history,” says Pep Guardiola, the Manchester City manager. “And every owner of every club decides how he wants to live. Our owners do not want to benefit, they want to reinvest in the team. There is Chelsea with [Roman] Abramovich and our club with Sheikh Mansour. They want to be in this world, they want to be buying into football. What is the problem?”

Like Manchester City, Chelsea before a mega-rich owner game in and splurged loads of cash on news players, was a club that had won a few tin pots and were easy for the winning teams to beat. Fans of each club don’t seem to mind where the cash comes from. So why should it matter to the rest of us?

“The reality is what it is: adapt and go forward,” says Guardiola. He’s right. Live with it.

Posted: 15th, August 2021 | In: Manchester City, Money, Sports | 0 Comments

Blockchain and Money: watch free lectures from MIT

You can bone up on crypto currencies and the blockchain with this terrific lecture by MIT professor Gary Gensler. Blockchain and Money is “for students wishing to explore blockchain technology’s potential use – by entrepreneurs and incumbents – to change the world of money and finance. The course begins with a review of Bitcoin and an understanding of the commercial, technical, and public policy fundamentals of blockchain technology, distributed ledgers, and smart contracts. The class then continues on to current and potential blockchain applications in the financial sector.:

If you like this one, there are 23 more lectures on YouTube. And more on MIT’s website.

Posted: 23rd, June 2021 | In: Money, Technology | 0 Comments

Regulators and rivals seek new ways to kill Bitcoin

The powers that be are dreaming up new ways to throttle Bitcoin and other cryptocurrencies, aren’t they? China want users to pick its State-backed coin and approved projects. And won’t someone think of the kids, rare breeds and the planet? Bitcoin’s energy use has more than doubled in 12 months from 55 terawatt-hours (TWh) to 125 TWh – giving it a carbon footprint similar to Poland. In May 2021, West Midlands Police looking to raid a cannabis farm in Sandwell, discovered around 100 bitcoin mining machines running off the electricity supply. One site argues that “for regulatory purposes, bitcoin should be considered similar to the global trade in Chinese tiger parts.”

More than 50 companies dealing in cryptocurrencies could be forced to shut after failing to comply with UK anti-money laundering rules.

The City watchdog said an “unprecedented number” of crypto firms are withdrawing applications from a temporary permit scheme that allowed companies to continue trading while their applications were being assessed.

The Financial Conduct Authority said: “A significantly high number of businesses are not meeting the required standards under the money laundering regulations resulting in an unprecedented number of businesses withdrawing their applications.”

They’ll use the old ways and news ways to regulate he rival.

Spotter: Telegraph

Posted: 5th, June 2021 | In: Money, News, Technology | 0 Comments

The Queen’s Beasts commemorative coin

Anyone watching Sky News will be forgiven for not realising when the show ends and the adverts start. Today’s news is peppered with the story of a “giant” gold coin weighing 22lb (10kg) marked with a £10,000 denomination.

Produced at the Royal Mint, this gold coin (cue patriotic-sounding music and posh-toned voiceover by man in waistcoat) “marks the end of the mint’s Queen’s Beasts commemorative coin collection, inspired by 10 stone statues which lined the Queen’s route to Westminster Abbey at her coronation in 1953.” (Coin revolves. Spitfire flies over white cliffs. Queen waves. Hurst scores.) “The coin reunites all 10 beasts in one design, including a lion, griffin, falcon, bull, yale, greyhound, dragon, unicorn and a horse.”

Other beastly creatures not featured include the Duke and Duchess of Sussex.

Posted: 29th, April 2021 | In: Money, News, Royal Family | 0 Comments

Brands not fans killed Super League

Super League had a naff name and an agenda based on greed. Told the billionaires had been plotting the heist for years, you boggle at how ignorant so many mega-rich people can be. They ignored the fans but didn’t even get Amazon on side. Aside from the greedy club owners, who was backing the big project? The fans rebelled. And the narrative is that fan protests the got the horror show shut down. But the clubs owners’ big failure was in not selling Super League to broadcasters and huge brands. Where was the feature length Nike ad with Lionel Messi and Ronaldo extolling the virtues of Super League and how it would improve the planet / climate change / BLM and whatever noble causes the money machines can latch on to to give their quest for profits some soul? Grace Robertson makes the point:

If you were listing important commercial partners to top European clubs, you’d put Nike pretty high on the list, right? Right. Nike are pretty damn important to the football industry.

Take a look at how Nike’s big splashy ad of the past year, titled “You Can’t Stop Us”.

Let’s read that monologue, delivered by Megan Rapinoe, in full:

“We’re never alone. And that is our strength. Because when we’re doubted, we’ll play as one. When we’re held back, we’ll go farther. And harder. If we’re not taken seriously, we’ll prove that wrong. And if we don’t fit the sport, we’ll change the sport. We know things won’t always go our way. But whatever it is, we’ll find a way. And when things aren’t fair, we’ll come together for change.

We have a responsibility to make this world a better place.

And no matter how bad it gets, we will always come back stronger. Because nothing can stop what we do together.”

…The message is very obvious: “We are a caring company that shares your values. So buy our shit.” …

If a corporation decides to put itself front and centre on a sponsorship deal with the Super League, what brand values is it communicating? Not the values they all seem to want to go for. It’s the brand values of the early 90s and the Premier League. It’s that of greed and wealth. It’s exactly what they don’t want to be associated with.

For years big clubs wielded their power to get what they wanted. Do as we say or else we will leave. Well, they tried it. And – boy – did they fail. In the longterm, football fans could be big winners with better competition and the rise of mid-ranking sides.

Posted: 22nd, April 2021 | In: Key Posts, Money, News, Sports | 0 Comments

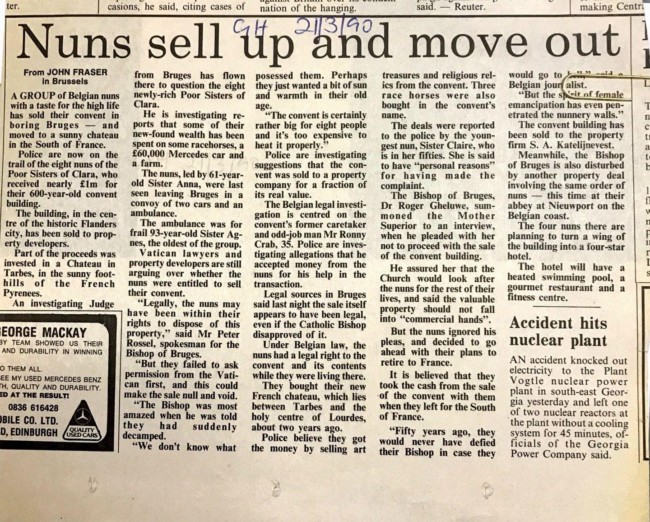

Nuns sell convent, ‘buy £60,000 Mercedes, some racehorses’ and escape to new chateau in south of France

In 1990, 8 nuns of the Poor Sisters of Clara sold their convent in Flanders, Belgium, allegedly bought a £600,000 Mercedes car, some racehorses and disappeared to a new chateau in the south of France.

As @brennajessie_ notes: ‘I want to be clear that when I talk about inspirational women this is who I mean.’

Posted: 8th, April 2021 | In: Money, Strange But True | 0 Comments

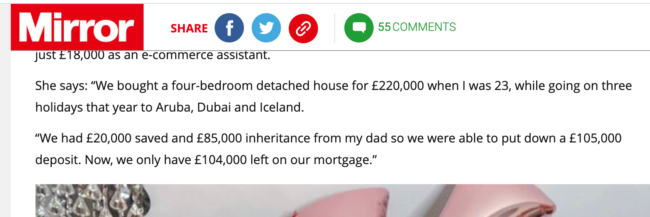

Daily Mirror introduces another ‘super saver’

“Saver who ‘never pays full price’ bought £220k house at 23 and haggled £15k off wedding,” screams the Mirror. Meet “Savings-obsessed Chloe Carmichael, 28.” She’s “sharing her top tips after she managed to put down a £105,000 deposit on a four-bedroom property with her husband five years ago.” You might confuse her with Gemma Bird. In February, the Sun wanted to share her journey to wealth in the story: “PENNY PINCHING – I paid off £225,000 mortgage on £25,000 wage… here’s how you can do it too.” Like Gemma, we’re told Chloe shares her tips on Instagram.

Tip One:

The story then name checks a number of brands and shops.

More news in the trusty tabloids every day…

Posted: 2nd, April 2021 | In: Money, Tabloids | 0 Comments

The neoliberal gym epidemic makes Stalinists blush

Do you see gyms and jogging as fallout from neoliberalism, those market-oriented reform policies which serve to protect private property from external interference. Nicole Karlis has view in Salon. It’s a view that makes you wonder if she ever saw the Communists compete at the Olympics and fascists doing callisthenics in the park:

“The last half-century may be considered the age of fitness, and it is no accident that it coincides with the age of neoliberalism,” Martschukat writes. “Rather than a generalizing call to arms, here neoliberalism denotes an epoch that has modeled itself on the market, interprets every situation as a competitive struggle and enjoins people to make productive use of their freedom.”

The timing is about right – neoliberalism was a response to 1970s stagflation. But socialism has been pretty keen on exercise.

Lead image: “All World Records Must Be Ours!”

Posted: 1st, April 2021 | In: Money, News, Sports | 0 Comments

Deliveroo: losing money off nothing

Did you buy shares in Deliveroo, the restaurant food delivery business, perhaps accepting the company’s offer for customers to buy shares via its app? Hard cheese if you did. At one stage, the company’s shares lost 30% of their value on the first day of trading. Boosted by the Covid-19 pandemic, bringing food from restaurants to housebound customers was a good idea. The company lost £244 million last year but revenues soared by 54%. But now that we’re about escape, what’s its unique selling point? And then there is the issue of how Deliveroo treats its workers.

Frances O’Grady, of the Trades Union Congress, got to the root of it:

“There’s nothing stopping Deliveroo from paying their workforce the minimum wage and guaranteeing them basic rights like holiday and sick pay. Plenty of employers are able to provide genuine flexibility and security for their workforce. Deliveroo have no excuse for not following suit. The company’s reluctance to offer benefits now is because they want to dodge wider employment and tax obligations by labelling staff as self-employed.”

And in the US? The FT compares Deliveroo’s debut to that of Doordash, which offers. similar service. Its shares rose over 86% on the first day of trading in New York.

Posted: 31st, March 2021 | In: Money, News | 0 Comments

After Horizon : salvation for Postmasters but Post Office gods escape

The Post Office believed the data churned out by Horizon, its flawed computer system, over the statements of more than 900 postmasters who said they had not stolen money. Postmasters were responsible for cashing up and balancing their books with the Horizon system. Any error was the postmaster’s responsibility to correct. And those errors were mounting up.

Discrepancies between the money in the till and the money Horizon said was there began in the pennies. Gary Brown, a former postmaster from Yorkshire, tells the Times what happened when he called the Post Office helpline. He’d ask, “Is this happening only to me?” He says the answer was always “Yes”. Gary and his wife Maureen, who lived over their shop, hired a private auditor who spent five days studying their books. “No one could find a solution. The till’s shortfalls grew to thousands of pounds. They were losing money. But how? They worked longer hours. They sold hot food and decorated cakes. Gary took a loan to cover the cash shortfall. But the losses grew. They remortgaged their home. They borrowed from family and friends. Gary began taking antidepressants. In 2014, Horizon said the till was £32,000 short. Auditors from the Post Office searched their home. “It was stomach-churning. I’ve never stolen in my life. I burst into tears,” says Gary. “I was frightened,” says Maureen. “He was falling to pieces.” Gary tried to take his own life. They say the Post Office “stole our home and stolen our future”.

Postmaster Seema Misra was pregnant when she was sentenced to 15 months in prison in 2010 for stealing £74,000 from her branch in West Byfleet. In court she pleaded her innocence. “If I hadn’t been pregnant, I would have killed myself,” she says. “It was so shameful. I trusted the Post Office. I trusted I was working with a good company and this is how I’m treated.” Paying back the Post Office left her family financially destroyed.

The Post Office said computer errors could not be responsible for the missing money. In 2020, the BBC’s Panorama claimed to have seen internal Post Office emails which show its legal department was told about Horizon errors shortly before her trial.

One email from the Post Office Security Team to the Criminal Law Team is about a bug in the Horizon computer system that makes money “simply disappear”. In one case, £30,611 went missing.

The security team tell the legal team they are worried the bug may have “repercussions in any future prosecution cases”.

An attachment to the email says that “any branch encountering the problem will have corrupted accounts”.

The document was printed out by the Post Office legal department just three days before Seema Misra’s trial, but it was never disclosed to her defence.

Postmasters were prosecuted using unreliable evidence.

This year the Post Office agreed not to contest 44 of the first 47 cases referred to the Court of Appeal by the Criminal Cases Review Commission. hearing at Southwark Crown Court . Oxfordshire sub-postmaster Vipinchandra Patel has had his 18-week prison sentence quashed. He did not steal £75,000. “The past nine years have been hellish and a total nightmare, but today I feel I can start living again. I can look forward and focus on enjoying life,” he says. “I feel euphoric as I have finally been vindicated. This conviction has been a cloud over my life for almost 10 years.”

Not everyone lost. Japanese company Fujitsu, the company that devised horizon, was paid handsomely.

And the boss? Paula Vennells was Chief Executive Officer of the Post Office Limited from 2012 to 2019. In 2019 she became chair of the Imperial College Healthcare NHS Trust in London. In December 2020 it was announced that she would be leaving this role early, for personal reasons.

Vennells is an Anglican priest. “I hear from my parishioners if the Post Office does something they don’t like,” she told the Times in 2014. “They have no compunction – I’ll roll up one Sunday and somebody will come and say something and I’ll say, ‘Look, would you mind just holding it till the end of the service?’” Vennells said her faith “influences my values and how I approach things”. She’s busy:

She is a Non-Executive Director of Morrisons Plc, a member of the government’s Financial Inclusion Policy Forum and of the Ethical Investment Advisory Group for the Church of England. She’s been a Trustee for the Hymns Ancient and Modern Group and a member of the Future High Street Forum. She served as a Non-Executive Board Member at the Cabinet Office between February 2019 and March 2020.

In the 2019 New Year Honours, Vennells was appointed a Commander of the Order of the British Empire (CBE) “for services to the Post Office and to charity”.

When she left her role, Post Office chairman Tim Parker said:

“Paula has served the Post Office with great distinction: under her leadership the business has been transformed from an organisation making substantial losses into one that is now fully profitable and on an upwards trajectory… In the course of radically improving the business, Paula has ensured that the Post Office values of care, challenge and commitment are deeply embedded in the business and we have remained true to our underlying mission as a commercial business with a social purpose. I would also like to say on a personal note, that Paula’s decisiveness, approachability and calm disposition have made her an excellent CEO to work with, and have won her many friends right across the business.”

Paul Vennells told the Times she suffers from claustrophobia. Innocent of all and any wrongdoing, she has, of course, never been locked inside a prison cell. Postmasters have. One ended up dead. Her name was Dawn O’Connell.

This is Ben Gordon QC’s statement to the court, via Post Office Central. Read it and weep:

“My Lord, Ms Dawn O’Connell is not here today, having passed away in September of last year. I myself never had the chance to meet Ms O’Connell. Her appeal against her conviction is advanced or continued in her son Matthew’s name. Matthew O’Connell and Dawn’s brother, Mark, as I understand it, my Lord, are present in court today, next door in the overflow court.

My Lord, in the years following her conviction in 2008, and the serving of her suspended sentence, Ms O’Connell’s health, both physical and mental, declined dramatically. According to her family and loved ones, her personality also changed, irrevocably. She became increasingly isolated, ultimately reclusive, as described by her family, and struggled desperately to deal with the stigma of her conviction.

She suffered, my Lord, with severe bouts of depression. She did receive treatment, medication and counseling, but she sunk inexorably into alcoholism. In her latter and final years, my Lord, I understand that Ms O’Connell made repeated attempts upon her own life. In September of last year, her body succumbed to the damage caused by her sustained abuse of alcohol and she died tragically at the age of 57.

My Lord, on behalf of her son, her brother, and all her surviving family members and friends, I feel compelled to tender to the court their sincere regret and deep anguish that Dawn is not here today to hear her case being argued.

My Lord, Mrs O’Connell’s conviction dates back to August of 2008 and Harrow Crown Court, where, upon her own pleas of guilty, she was convicted of five counts of false accounting. One further count alleging theft of approximately £45,470 was ordered to lie on the file on the usual terms and was not proceeded with. A pre-sentence report was ordered and, a month later, in September, Ms O’Connell was sentenced to 12 months imprisonment suspended for two years, with a requirement for the completion of 150 hours of unpaid work.

My Lord, between 2000 and 2008, Ms Dawn O’Connell worked as a branch manager, a Post Office branch manager in Northolt. My Lord, as with many others which are before the court today, and as my learned friend Mr Saxby did, where it is applicable to Mrs O’Connell’s case, if I may, I echo and commend to the court my learned friend Mr Moloney’s submissions. But Mrs O’Connell’s case was one in which the Horizon data was central, central to the prosecution and her conviction. The prosecution arose from an unexplained shortfall, or deficit on the system at her branch. When audited, Mrs O’Connell reported the shortfalls and indicated that she was unable to explain the anomaly. Initially, as she explained, she had hoped that the error would correct itself, but over the ensuing months it grew and accumulated.

Ultimately, my Lord, having admitted falsifying the accounts in an attempt to conceal the deficit in the hope of preserving her job, she pleaded guilty to the offences of false accounting. Throughout the audit, throughout the investigation and throughout the prosecution, Ms O’Connell repeatedly and strenuously denied theft. As I have said, this count was left to lie on the file.

My Lord, as conceded by the respondent in relation to her appeal, there was no evidence of theft or any actual loss at her branch, as opposed to a Horizon generated shortfall. There was no other evidence to corroborate the Horizon data. On the contrary, my Lord, evidence was collected from other employees which attested to Ms O’Connell’s honesty and probity.

As further conceded by the respondent in her case, no attempt was made by the Post Office, as private prosecutor, to obtain or interrogate the ARQ data. There was no investigation into the integrity of the Horizon figures, and it is recognised that the appellant herself was severely limited in her ability to challenge the Horizon evidence and therefore that it was incumbent upon the Post Office to ensure that the reliability of the evidence was properly investigated and, my Lord, this was not done.

The Post Office failed, in my respectful submission, in its duty as a private prosecutor both to investigate properly the reliability of the system by obtaining and examining the data, and to disclose to the appellant or the court the full and accurate position in relation to the reliability of the system. No disclosure was forthcoming in Ms O’Connell’s case, my Lord, in relation to any concern or enquiry raised into the functionality of the system.

Ms O’Connell’s case file demonstrates that the focus of the investigation in her case was on proving how the accounts were falsified, which of course she had admitted, rather than examining the root cause of the shortfall. In fact, as it seems, no effort was made to identify or discover the actual cause of the shortfall or deficit. During the internal audit process, and her interviews under caution, my Lord, Ms O’Connell raised the issues she had encountered with the system and its recurring anomalies. No investigation or disclosure followed.

Notwithstanding, and by reference to the balancing exercise which the court is required to undertake in a submission of this kind, Ms O’Connell was a lady of hitherto good character, about whom people were, it seems, lining up to attest to her honesty and integrity. My Lord, in the papers I have seen, I have counted somewhere in the region of 30 character statements, which I think were obtained on her behalf. My Lord, it is conceded by the respondent that for these reasons it was not possible for Mrs O’Connell’s trial to be a fair one, thereby amounting to first category of abuse of process.

However, as set out, only a short while ago by Mr Moloney on behalf of his clients, and as set out in our skeleton argument, dated 21 January, we would respectfully submit that for the same set of reasons, or in respect of the same failures in the investigative and disclosure exercises, the prosecution against Ms O’Connell was rendered unconscionable, and that bringing it was an affront to the national conscience. Accordingly, my Lord, on her son Matthew’s behalf, we respectfully invite the court to quash her conviction on both grounds, or both limbs of abuse of process. My Lord, unless I can assist you any further, those are my submissions on Ms O’Connell’s behalf.”

What next? And who knew?

Posted: 25th, March 2021 | In: Key Posts, Money, News | 0 Comments

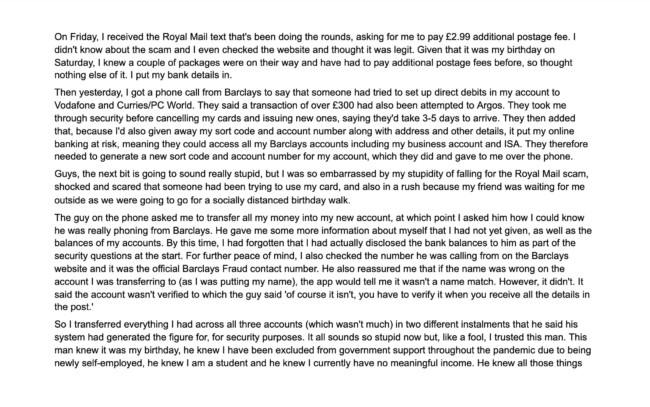

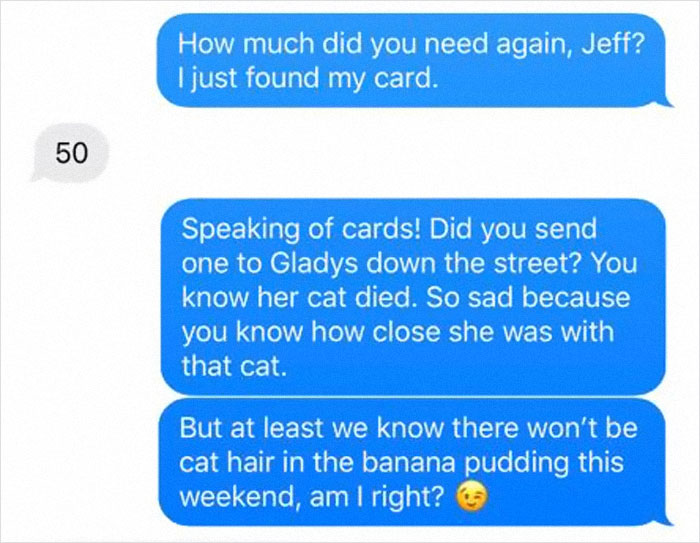

How I got scammed by the Royal Mail postage fee scammers

“I mentioned yesterday that I’d been scammed out of every penny I had,” tweets Emmeline Hartley. “Thought I’d post what happened in case it helps anyone avoid being in the same position. Please save the lectures, I don’t think it’s possible for me to feel any stupider.”

She’s brave for sharing this. It could happen to any one of us. Here’s how the Safe Account scam works:

Can’t something be done to stop these scams? These criminals are utter ****s!.

Posted: 22nd, March 2021 | In: Key Posts, Money, News | 0 Comments

Aphex Twin sells Virtual art for virtual fortune

Electronic musician Aphex Twin, aka Richard James, has sold an NFT (non-fungible token) for $127,000 in Ether. The genuine digital artwork called “/Afx/weirdcore,” features an animated version of the artist’s face with sound. Fans will recognise it as harking back to the cover of Aphex Twin’s I Care Because You Do studio album released in 1995.

Says Aphex Twin: “We will spend a portion of the money on planting trees* and either donating to permaculture projects or setting them up ourselves, depending on how much we get.”

*Real trees?

Posted: 16th, March 2021 | In: Money, Music, News, The Consumer | 0 Comments

‘I deserve a £500 ASOS gift voucher because’ – you bought TopShop and I lost my job

Complete this legend and win: “I deserve a £500 ASOS gift voucher because…

mel at @midnightpinkish delivers: “”u bought topshop n now i’m unemployed during a pandemic.”

She adds: “just for the record im literally not blaming asos, i’m just trying to win a free £500 voucher by making light of a shit situation!!”

Posted: 6th, March 2021 | In: Money, News | 0 Comments

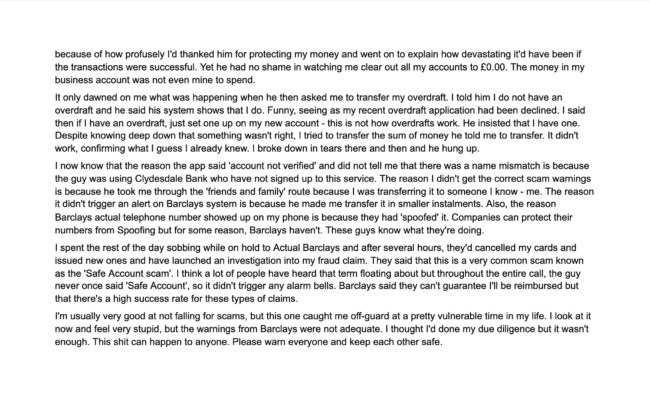

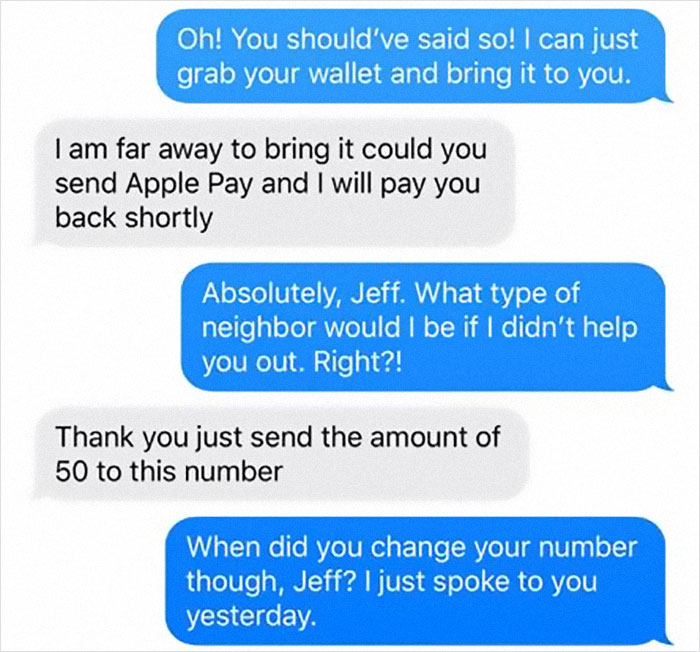

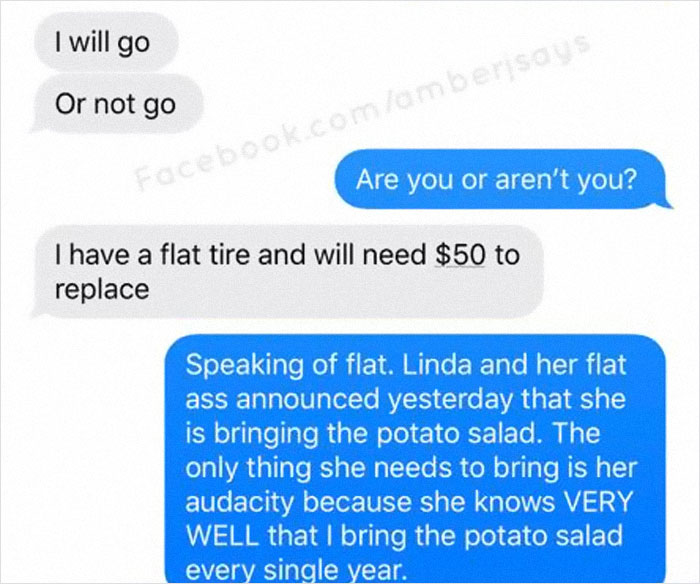

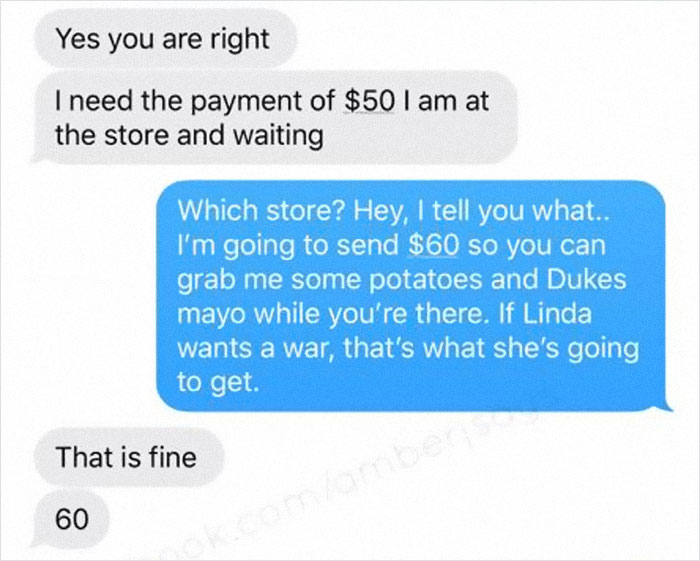

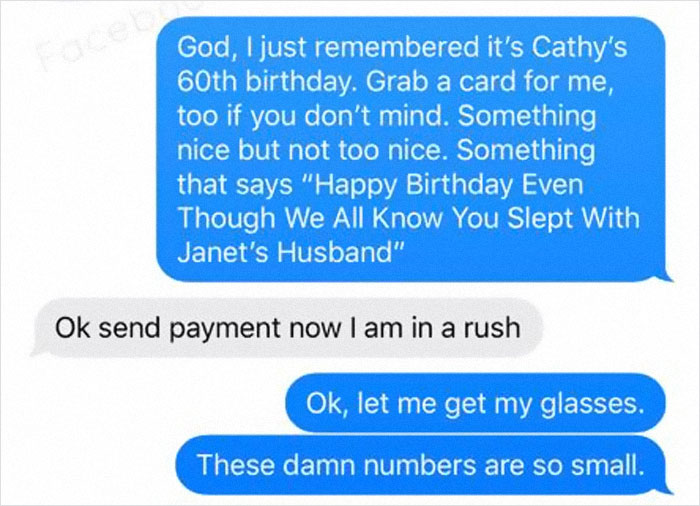

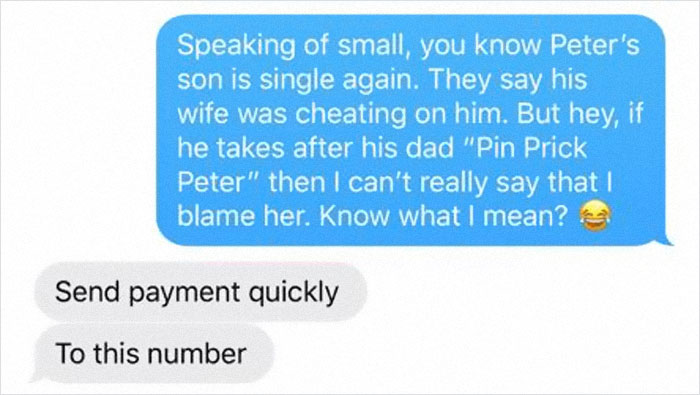

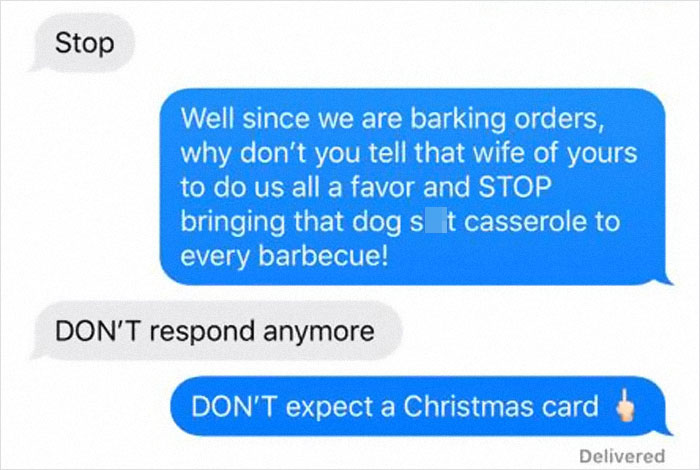

Amber Says : Facebook scammer uninvited to potato salad BBQ

The message asked Amber Jacobs for $50 to fix a flat tyre. “Hello it is your neighbor with some car trouble can you assist me.” Amber replied: “What type of neighbor would I be if I didn’t help you.”

Spotter: Amber Says

Posted: 25th, February 2021 | In: Money, Strange But True | 0 Comments

Queen’s Consent makes a mockery of democracy

Is Her Majesty the Queen an elitist? The Guardian has seen papers from 1973 suggesting Liz’s personal lawyers “successfully lobbied ministers to change a draft law in order to conceal her private wealth”. It’s to do with ‘Queen’s Consent’, which Buckingham Palace calls a “purely formal” process – or what you cynics might call a well-designed loophole. The paper says in seeing the proposed rule change that would affect her, Her Maj was able to debate it and possibly get it altered it in her favour before agreeing to it. Says the BBC: “A revision to the draft law subsequently enabled her as a head of state to sidestep the new regulations.” The Palace is dismissive:

“Queen’s consent is a parliamentary process, with the role of sovereign purely formal. Consent is always granted by the monarch where requested by government. Any assertion that the sovereign has blocked legislation is simply incorrect.

“Whether Queen’s consent is required is decided by parliament, independently from the royal household, in matters that would affect Crown interests, including personal property and personal interests of the monarch.

“If consent is required, draft legislation is, by convention, put to the sovereign to grant solely on advice of ministers and as a matter of public record.”

Good job we’re living in a democracy where we are all equals, right?

Posted: 8th, February 2021 | In: Broadsheets, Key Posts, Money, Royal Family | 0 Comments

How to secure a 9 times salary mortgage – the Sun shares a secret

How did Gemma Bird get to live the dream? The Sun want to share her journey to wealth in “PENNY PINCHING – I paid off £225,000 mortgage on £25,000 wage… here’s how you can do it too.” Bird is not 105 years old. She’s 39. And her achievement is all the more impressive when you consider her tax bill – on £25,000 a year, take home pay is around £20,650.

You might be wondering how she got a £225,000 mortgage on that income. A mortgage lender will let you have about 3-5 times salary – not the nine times salary Bird seems to have secured. Maybe it’s down to her powers of persuasion, after all she is an Instagram “influencer” with a decent following. The Sun’s article name-checks her favourite supermarkets, and links to MoneyMumOfficial, the social media account where “she shares money-saving tips” – “the business is so successful that Adam has quit his role in sales to work for Gemma full time.”

Well done! Remind us how much that mortgage was.

Now read on and see if you can work out how hard-working Gemma did it. (A salary of £12,000 a year typically equates to take-home pay of around £975 a month.)

So how do you pay off a £225,000 / £375,000 / £800,000 mortgage on £25,000 a year?

Posted: 8th, February 2021 | In: Money, News, Tabloids | 0 Comments

Free hotels with full board for all British and Irish Covid-19 travellers

Jet off on your hols to one of 33 destinations on the “red list” and on your return British and Irish travellers get to stay free at an airport hotel for 10-days. The Government is block-booking rooms at hotels at airports a cost of around £85 a night – tea, coffee and three meals a day included. Hotels will be reserved exclusively for quarantining travellers.

If you want to go out, a security guard must accompany you. These pre-paid security guards will patrol inside and outside the hotel to “prevent unauthorised access”. Anyone wanting to smoke outside or get fresh air will also be escorted by security staff.

If you’re hard up and want a tip to Portugal or Dubai, two of the destinations on the “red list”, why not get a cheap flight there, stay in a cheap hotel for a few days and then on your return put your feet up in one of the Government’s new chain of free Covid-19 Hotels?

Offer begins February 15.

Posted: 5th, February 2021 | In: Money, News | 0 Comments

Billionaire Leon Cooperman is here to save the world one hedge fund at a time

Leon Cooperman (net worth $3.2 billion) is upset about money and how it’s being used by the little people to make GameStop shares soar – and in so doing cost hedge funds that bet on the store’s share price tanking. He tells CNBC: “The reason the market is doing what it’s doing is people are sitting at home getting checks from the government. This fair share, is a bullshit concept. It’s just a way of attacking wealthy people and I think it inappropriate and we all gotta work together and pull together.”

Cooperman was always a plonker:

Posted: 29th, January 2021 | In: Money, News | 0 Comments

GameStop : short selling casino banking

The performance data on shares in GameStop, the video games chain of high street stores, represents past performance. It is not a guarantee of future results. GamesStore had planned to shut 450 stores in 2021. But hold on – GameStop shares are rocketing.

Triggered by a push by users on Reddit, small investors have piled in, buying shares and causing the stock to soar. In April 2020, a share in GameStore was worth $3.25. Last Tuesday that same share was selling for $148. But this isn’t about the small investors making money. It’s about their plan to cause pain to Wall Street traders who shorted the stock (betting on it tanking).

About 71.66m GameStop shares are currently shorted – worth about $4.66bn. Year-to-date, those bets have cost investors about $6.12bn, which includes a loss of $2.79bn on Monday. Monday’s stock gain of 145% in less than two hours, which extends GameStop’s gains for the year to more than 300%, is the latest sign that frenetic trading by individual investors is leading to outsize stock-market swings.

“We broke it. We broke GME [GameStop’s stock market ticker] at open,” one Reddit user wrote on Monday after the NYSE halted trading…

“This is the new day and age in which no one listens to the analysts: ‘Why bother, let’s just go out and buy it ourselves?’” Lars Skovgaard Andersen, investment strategist at Danske Bank Wealth Management, told the Wall Street Journal. “It is a sign of high complacency.”

And the hedge funds? One tells the FT:

“It’s not rocket science — massively reduce your shorts or risk going out of business,” Mr Block said. “This phase will pass, but in the meantime it’s best to be a spectator rather than a participant.”

“Will it end badly?” asks Thomas Hayes, managing director at Great Hill Capital hedge fund. “Sure. We just don’t know when.”

Who has the greater resources money and the stamina for the long position? And isn’t shorting a stock a good way to prick a price bubble?

Posted: 27th, January 2021 | In: Money, Technology | 0 Comments

Computer programmer forgets password – gets locked out of $220m Bitcoin wallet

Stefan Thomas, a German computer programmer living in San Francisco, can’t remember his password. If he can, Thomas gain control of the 7,002 bitcoin on his IronKey hard drive. But he can’t. He has two attempts left before he reaches his quota of 10 password attempts before the drive locks him out permanently and encrypts the content – leaving his $220 million virtual fortune gone.

“There were sort of a couple weeks where I was just desperate – I don’t have any other word to describe it,” Thomas told KGO-TV. “You sort of question your own self-worth: ‘What kind of person loses something that important?'”

File under: cash is king.

Spotter: NYT

Previously: Newport man throws away £210m Bitcoin hard drive

Posted: 16th, January 2021 | In: Key Posts, Money, Technology | 0 Comments

Newport man throws away £210m Bitcoin hard drive

James Howells “believes” the hard drive he threw away in 2013 contains £210m-worth of Bitcoin, the super-traceable cyber currency that may well be or not be a fad. Howells’ 7,500 bitcoins are possibly languishing in landfill site news his home in Newport, Wales. And he wants the local council to help him search for it. If they find it, Newport city will be in for 25% of the amount.

Nice idea but even if he finds it, should the bitcoin millionaire sell his haul, the price of his holding will go down or even collapse. Sell more than the market could take and watch the price skid. Increase supply with no corresponding rise in demand and price falls. No?

One question would be: can’t he find a hacker to crack into his holding? If bitcoin all that secure? And can’t he just use the promise of buried riches to create his own cyber currency?

Spotter: BBC

Posted: 14th, January 2021 | In: Money, News, Technology | 0 Comments

Robbie Savage, gambling on Spurs and the Mirror’s journalism of attachment

After Spurs easily saw off Arsenal with a 2-0 win, BBC radio DJ and Daily Mirror columnist Robbie Savage told his Twitter followers: “I went early on Spurs winning the league

Tom the Arsenal fans is clearly delusional, unable to see that club manager Mikel Arteta is learning on the job and the Gunners squad is populated by many players who’d struggle to get a game for Fulham. But what of Savage and his to-deadline opinions? You can find out more of what Savage thinks at the Daily Mirror:

In order, this is how Savage predicted the Premier League table, from first to last: Liverpool; Manchester United; Chelsea; Manchester City; ARSENAL; Wolves; Spurs… So that’s Spurs in 7th place, two behind Arsenal.

This guesswork is brought to readers in association with the Mirror’s latest betting partner. It might be that Savage didn’t write the thing, just saw his name added to to the top to give it a bit of omph and authenticity. After all he’s an ex-pro who works for the State broadcaster. You can trust him. Savage might know a thing or two. So place your bets!

Given the damaging impact gambling can have on people’s lives and that the Mirror pitching Savage’s words in an article which encourages betting – the prediction piece ends with a large button stating “BET HERE” – might it be useful to tell readers that Savage’s views are liable to change with the wind?

A radio phone-in is a bit of fun, a distraction from the important things in life. Losing your money and health because those same opinions encouraged you to gamble is far more serious.

Posted: 7th, December 2020 | In: Arsenal, Back pages, Key Posts, Money, Sports, Spurs, Tabloids | 0 Comments

Tech killed the department store – supermarkets are next

The internet and lack of foresight and nimbleness killed the department store. Them going will have no bearing on our ability to get stuff. It’s just sad to hear of lost livelihoods, empty hulks on the high street and the failure by companies at the top to embrace change. It’s the end of department stores in the UK. It’s the same in the US. Samantha Oltman, editor of Recode, writes:

As we near the end of 2020, the prognosis for the American department store is grimmer than it’s ever been. The reasons extend far beyond Covid-19 or even the continued rise of online shopping, and have more to do with trends in the American economy that have been shrinking the middle class while enriching the already wealthy. That’s why the decline of these retail giants is something to pay attention to. They employ hundreds of thousands of people and occupy an outsize space in our communities; their gradual disappearance, as well as what is replacing them, tells us something about where we’re headed.

It’s about spending money. A corporate-run department store at the heart of a community should not be missed. They were ruthless in their murdering of mom and pop stores. You should open wide and say ‘ahh’ and check if Tesco has opened a branch inside you. Tech killed the department store. The ones still in existence are just roofed concession and franchise stands. And tech will kill supermarkets. Speciality can be delivered to your door at a click.

Posted: 5th, December 2020 | In: Money, News | 0 Comments

Yellow Journalism: The BBC goes full tabloid over Sir Philip Green and the death of Top Shop

Following its article ‘Sir Philip Green: From ‘king of the High Street’ to ‘unacceptable face of capitalism’, the BBC asks readers: “Has Topshop boss Philip Green done anything wrong?” Any question presented as a headline can be answered ‘no’. This is the BBC using tabloid-style clickbait to get readers and pander to prejudice. But the BBC is funded by tax so why bother with this sort of journalism?

Arcadia is a high straight stable. But the high street is dead. So goodbye Arcadia, including its brands like Miss Selfridge, Topman, the fantastic TopShop Wallis and Evans, unless someone buys them. Arcadia has lost to the internet, thumped at the tills by online-only fashion retailers such as Asos, Boohoo and Pretty Little Thing.

So what of Green, who built the company? This is how the BBC begins its profile on the tycoon:

Business periodically throws up pantomime villains who vault from the financial pages to the front of the tabloids and become the subject of public vilification.

And this deference to lawyers:

But has he actually done anything wrong? Lawyers will argue that the company – not its owners – is the legal entity responsible for maintaining the financial health of the pension scheme.

Green has form, of course. He was “accused of having sold BHS to Dominic Chappell “deliberately to avoid the retirement plan liability, a claim he vigorously denied. He later paid £363m to make good the scheme.”

But citing what lawyers “will argue” in answer to a headline question is nonsense. Lawyers will argue whatever their clients pays them to argue. And on it goes:

As far as is known, Arcadia did not ignore any directions from the pension regulator to mend the pension, and indeed received an endorsement from the Pension Protection Fund for a company voluntary arrangement – a form of insolvency that allows a business to restructure its finances – in June last year.

“As far as is known…” As far as is known the moon is not made of fudge? As far as is known the moon landings were not faked? As far as is known the BBC is the unbiased media of record. And then get a load of this:

There may be no infringement of the law, but what attracts attention to Sir Philip’s case is that he and his wife have become immensely rich on Arcadia’s back.

The writer is at it again. “There may be no infringement of the law…” So flip that about, give it the side eye and you get “There may an infringement of the law”. Is that the writer’s inference? If it is, Green’s lawyers may well have more work in their inbox. Or may not… Fun to guess, though, right?

And to put the BBC’s slack journalism another way: “Has the BBC done anything wrong over its Sir Philip Green report?”…

Posted: 1st, December 2020 | In: Money, News | 0 Comments