Money Category

Money in the news and how you are going to pay and pay and pay

Political manipulation of money at root of housing crisis

The narrative running through political and media characterisation of the housing market goes like this: ‘ever increasing demand for houses, turbo-charged by foreigners looking for a safe-haven, has been met by limited supply causing prices to rise dramatically, writes Jason Leavey. Fortunately, our politicians and the City are on hand to ensure cheap mortgages are available to help you onto the property ladder to prosperity.

Is it not also plausible that the rapid expansion of cheap mortgage credit has been a causal driver of house price inflation rather than a consequence of it?

On the face of it you might expect widening access to ever cheaper money simply means more people can buy houses more cheaply. But if the number of houses doesn’t increase to meet demand then more people with more money chase the same properties and prices rise rapidly. Without an excess of supply, above and beyond demand, there is no downward pressure on prices. That is not to say an increasing population and other demographic changes don’t influence house prices but the impact is limited without an associated increase in mortgage lending.

Prices are set for entire streets and beyond by the last price paid for one house – a price agreed between a buyer (most probably a willing borrower), a seller and a willing lender. Few people would doubt that a rise in interest rates limits people’s ability to borrow thereby reducing house prices. Yet the material effect of borrowing costs on house prices isn’t widely understood. An abundance of credit steadily ratchets up prices. Valuations that would have seemed insane a few years ago now seem reasonable. Other than an adequate increase in supply the only factor which can temper demand and limit ever increasing price rises is a restriction in the supply of credit.

Rising prices are only possible if someone has access to money – either savings or money created through lending. In our system of money when banks make loans they don’t go to a pot of carefully accrued savings, they create new money, quite literally, at the touch of a button. It is money printing. 97% of money consists of deposits created out of thin air by commercials banks. To enable a house purchase there is a limited cost to a bank.

In the absence of new construction, no new wealth is created. We still have the same number of houses. Credit enabled price rises reallocate money in the form of ‘paper claims’ from one pocket to another while the actual, consumable, wealth remains the same. More claims for the property haves and less for the property have-nots, who are left facing ever higher rents and mortgage costs. Given that the City is also taking its cut is a high level of wealth inequality really such a surprise?

The effect on the young is particularly pernicious. A substantial levy will be taken from their future incomes and passed to the banks and others benefiting from rising house prices, largely the older generation. The Conservative’s help to buy programme, established under the guise of helping young people get on the housing ladder, is therefore dishonest.

For politicians, unable to structure economic growth yet believing it to be the means to gain and retain power, housing presents a powerful temptation. It is a conduit for large scale money printing which produces a sense of rising wealth and increased purchasing power for those who own houses. This creates a series of consumption driven knock on effects throughout the wider economy. It is a policy pursued with zeal by both Labour and Conservative governments. In this light, their claims to have the long-term interests of the economy at heart seem false.

We are told that interest rates are low to motivate investment in new ventures and grow the real economy. The reality is that house price inflation has ensued with an associated boost in consumption by all those with newly printed money in their pockets.

The fundamental cause of the 2007 financial crisis was lending by the financial sector for property and consumption, rather than investment. Continued misallocation of credit into housing is more of the same. Extraordinary monetary policy measures – such as quantitative easing – are taken to fill the void which appears when reality rears its head and the bubble collapses. This exacerbates inequality and economic instability.

Hubris underlies the widespread belief that high house prices are an intractable consequence of the UK’s economic success. While high house prices have delivered a short-term boost to consumption and some economic growth it is paid for by the young.

There is an astonishing lack of public debate about credit driven house prices and the consequences of such a large redistribution of wealth. Little attention is paid to the role of credit, a political and regulatory matter, yet it is at the root of the housing crisis.

By Jason Leavey

Posted: 28th, November 2018 | In: Key Posts, Money | 0 Comments

Everton and Liverpool United for Sean Cox

Nice one, Everton defender Seamus Coleman. He’s donated €5,000 (£4,300) donation to Sean Cox, his fellow Irishman. Mr Cox was attacked by Roma supporters before their Champions League semi-final against Liverpool at Anfield in April. Says Coleman:

“We have to be together. I think football is great for sticking together. Rivalries go out the window with stuff like that; you don’t see a crest or a jersey, you see a man who came to support his team and unfortunately it didn’t end too well for him that night.

“Thankfully there is a fundraising page and I don’t know the ins and outs of how he is but hopefully they can raise some money for him.

“I saw on social media the Liverpool manager had donated some money and saw there was a link to a GoFundMe page. I wanted to put my name to it because sometimes that raises more publicity. That’s what the Liverpool manager did.

“You think ‘Do you put your name towards it or not?’ because you might get people saying ‘He might have put more money in’ or whatever.

“It’s not about Liverpool and Everton, this is about a man who unfortunately was part of something he did not intend to be. I’ve had people in the street, Liverpool fans, stop me and say ‘Thanks very much’.”

You can go here to donate to Sean Cox.

Posted: 6th, November 2018 | In: Liverpool, Money, News, Sports | 0 Comments

Chow Yun-fat has $714 million to give away

The Shanghaist reports on the minted star of Crouching Tiger, Hidden Dragon:

Chow’s wife, Jasmine Tan, says that her husband manages to live so frugally in one of the world’s most expensive cities by frequenting street food stalls and rarely buying new things, according to an Oriental Daily report from last week. For example, for 17 years, Chow stuck with his trusty Nokia flip phone, only recently purchasing a new smartphone when his old device finally stopped working.

The 63-year-old Chow is often seen riding public transportation where he rocks a simple wardrobe — a shirt costing him 98 yuan ($14) and sandals costing another 15 yuan ($2). When asked why he likes to shop at discount shops despite his tremendous net worth, Chow replies, “I don’t wear clothes for other people. I just wear whatever I find comfortable.”

Chow Yun-fat, everyone, the most popular man in Hong Kong – which might explain why he doesn’t give his fortune away in his own lifetime…

Posted: 18th, October 2018 | In: Celebrities, Money | 1 Comment

Ohio bar accepts food stamps for lap dances and drugs

This is a rather joyous affirmation of everything the right thinks is true about welfare more generally. That the amount people gain in welfare is vastly too high, that the rest of us are taxed at heinous rates so that the welfare queens can live in the lap of luxury without having to do a damn thing. That it might only be true at the margin doesn’t make it less true as a story:

Ohio bar loses alcohol licence after accepting food stamps for lap-dances – Undercover agents bought heroine, cocaine and lap-dances during 5-month investigation

Ah, no, that’s the well known reality curvature at The Independent which confuses strong independent women with a street drug that kills. Easy enough mistake to make, obviously.

An Ohio bar has been forced to shut down after authorities discovered they were allowing customers to buy drugs and lap dances using food stamps.

Allowing customers to buy drugs isn’t normally on the list of things a bar should do anyway:

Over nearly a half-year span, police say, undercover agents from the Ohio Investigative Unit were able use nearly US$2,500 worth of food stamps to buy dances and drugs, including heroin, fentanyl, cocaine and methamphetamines, from Sharkey’s, an adult entertainment lounge in a neighbourhood north of downtown.

And isn’t that cool? It took half a year of observing the naked ladies and consuming the booze ‘n’ drugs before it was possible to bring the investigation to an end?

But just to explain. In the American system instead of getting child tax credits and the like you get food stamps. This is a card, charged up with near money, which can only be used to buy food at certain stores. And what sort of food you can buy is pretty strictly controlled. They’re not like Green Shield stamps any more, the shop needs a special card reader.

So, the bar had to have the card reader. So it’s not just buying all these things, it’s buying them on a debit card, a special one that supposedly only works to buy food. They must have been properly set up to do this, not just some occasional possibility.

Making that 5 months to investigate rather interesting, no? I wonder how much the investigators had to pay their boss to get assigned to the case?

Posted: 25th, September 2018 | In: Money, News, Strange But True | 0 Comments

Coca Cola cannabis and the volatile world of marijuana investing

Invest in cannabis? BNN Bloomberg says Coca Cola is looking at working with Canadian marijuana producer Aurora Cannabis to create drinks laced with marijuana. “Along with many others in the beverage industry, we are closely watching the growth of non-psychoactive cannabidiol as an ingredient in functional wellness beverages around the world,” said Coca-Cola in a statement. Unlike the cocaine Coca Cola used to put into its products, cannabidiol contains no psychoactive effect. But it can relieve pain.

It follows news that Constellation Brands (US-based producer of Corona beer and a raft of spirits and wines brands) is pumping lots of cash into Canada cannabis producer Canopy Growth.

Released in 1880, this is the very first publicly sold bottle of Coca-Cola. It contained around 3.5 grams of cocaine.

Why Canada? In June this year, the Canadian government pretty much legalised the use of recreational cannabis. Weed should go legal in Canada on October 17, 2018. You’ve got to feel for Mexico, which should fully legalise the drug exported illegally into the US via cartels. The market is there for the taking. And the money is huge.

Yesterday, shares in Canadian marijuana cultivator, distributor and producer Tilray – the first weed company to IPO in the US – reached an intraday high of $300, closing up 38.1 per cent on the day. The surge was based on news that America’s drugs regulator would allow loss-making Tilray to export a cannabis-based medicine to the US. Tilray shares have soared by – get this – 1,288 per cent since the company floating on the Nasdaq stock exchange two months ago. At one point Tilray was a bigger stock than 59 percent of S&P 500. Not too shabby for what is essentially a farming company – even if it does look absurdly overpriced and highly volatile.

But here’s the thing: no-one can be certain what form a legal market in marijuana will take once prohibition ends. Why would a consumer pay a big corporate farmer for their hit when they grow it themselves? Weed isn’t like moonshine – you really can grow a decent crop in your airing cupboard. And if the market for products gets huge and varied – cheap supermarket own-brand weed drinks? – won’t the price for weed fall? Marijuana is just commodity that grows in the ground.

Posted: 20th, September 2018 | In: Money, News, The Consumer | 0 Comments

Facebook users should sue over 1.3billion fake accounts

When you busy ad space on Facebook, be warned: robots are not brand loyal unless programmed to be so and they’ve got no cash. When Facebook’s chief executive noted in July 2017, “As of this morning, the Facebook community is now officially two billion people! We’re making progress connecting the world, and now let’s bring the world closer together”, he omitted to mention the bit about 1.3billion on those accounts being fake.

That’s how many accounts Sheryl Sandberg, Facebook’s chief operating officer, told the Senate Intelligence Committee the social media giant had deleted between October 2017 and March 2018. You know that weird thing when your follower numbers went down? Well, you didn’t lose anything other than numbers.

What advertisers who believed the bogus numbers lost has yet to be calculated, but if you paid to reach, say, a million people, chances are you were charged 50% over the odds. Next time Facebook offers you the chance to pay $20 to reach 2,000 people in your area (your own followers!), ask them to prove the accounts are all genuine…

Posted: 10th, September 2018 | In: Money, Technology | 0 Comments

The Archbishop Of Canterbury is wrong: higher taxes don’t make people happier

There was a time when to become the Archbishop of Canterbury one had to be a decent, if not good, religious philosopher. This clearly isn’t the case today as Justin Welby is a retired oil company executive among other things. And on current evidence not a good logician at all.

For he’s claiming that higher taxes will make us all happier. No, that’s really not the case at all:

Raising taxes will make people happier, the Archbishop of Canterbury has said at the launch of an IPPR report.

Speaking as the think-tank launched its report about finance and inequality on Wednesday, Archbishop Justin Welby said that prosperity was driven by wellbeing as well as income.

He suggested that higher taxes could fund the improvement of the environment and culture, which could improve overall happiness.

That’s an absolutely vital point being missed here.

The Archbishop of Canterbury has called for a fundamental rethink of how the economy works, including more public spending and higher taxes on technology giants and the wealthy.

In an interview with the BBC to mark the launch of a major report by the Commission on Economic Justice, of which he is a leading member, Archbishop Justin Welby said the present economy was “unjust”.

It is possible that a larger state will make us happier, that more government spending, more of the economy being disposed of by government, will make us happier. I think it’s unlikely, you might think it’s a great idea or not, but that’s not the same as saying that more tax will make us happier.

As it happens the taxation level is the highest, as a portion of the economy, that it has been for 49 years. If it were true that more taxes will make us happier you might think we’d have voted for them by now. But even that’s just an observation, not a failure of logic.

Taxes are, of course, the cost of gaining all those other lovely things. And we all prefer to have lower costs even while we’ll also argue for greater benefits. That’s why it’s always a shout for them over there to be taxed to pay for something nice for me over here, isn’t it? Further, we’ve even proof. Do all people pay all the taxes they should do because that makes them happier?

Err, no, there’s tax evasion and tax avoidance all over the place, isn’t there? Thus paying more tax doesn’t make us happier, does it? Given that at least some are willing to risk jail not to pay more tax we’d rather have to assume that more tax makes at least some people very unhappy indeed.

So, no, the Archbish fails basic logic, doesn’t he?

Posted: 8th, September 2018 | In: Money, News | 0 Comments

Respected Manchester United Jose Mourinho gets a suspended jail sentence for greed

Just one more reason to admire and respect Manchester United manager José Mourinho: he’s earned one-year suspended sentence (two six-month prison sentences) in a long-running tax fraud case with the Spanish government. Spain’s El Mundo newspaper says Mourinho has been fined €2m.

The graceless manager stood accused of failing to pay over €3m in undeclared image rights earnings for 2011 and 2012. At the time he was manager of Real Madrid. Mourinho disputed the claim.

He won’t got to prison. Any sentence of under two years for a first offence can be served on probation.

But what does it mean for the all-important Manchester United brand? Tax evasion, especially when you’re stinking rich, is not a good sell. But then, United are all about the money so look out for The Brand finding an official ‘tax efficiency’ partner and a club tour of The Cayman Islands…

Posted: 4th, September 2018 | In: manchester united, Money, Sports | 0 Comments

Pound Falls On Brexit Fears – The Solution Has Already Happened

It’s entirely possible to be concerned about Brexit, the costs and pains of leaving the European Union. I think anything is worth the joy of doing so but am aware that not all share that view. However, there’s less to worry about when the pound falls because everyone thinks that it’s going to be more terrible than we all thought it was yesterday. Because the pound falling is the very cure for it all being more terrible than we thought it was going to be yesterday.

Thus Mark Carney, Governor of the Bank of England, says that a Hard Brexit has become more likely. The pound falls – this is good, this is the correct reaction to, the solution to, a Hard Brexit becoming more likely:

Sterling dropped against the dollar in early Friday trading after Bank of England boss Mark Carney said he believes the chances of a no deal Brexit are “uncomfortably high” and warned the government needs to do all it can to avoid leaving the EU with no agreement in place.

Contained within that reaction to the news is the solution to the news:

The pound declined on the currency markets in the wake of Mr Carney’s comments, falling below the $1.30 mark, but had recovered by early afternoon.

Mr Carney said that if a no-deal Brexit were to happen, it would mean disruption to trade and economic activity, as well as higher prices for a period of time.

Well, yes, a Hard Brexit would make Britain’s trading position more difficult. The cure for that is a lower pound:

Sterling went as low as $1.2975, or down 0.3%, following the comments, while British government bond prices rose.

Britain would be forced to revert to trading under World Trade Organisation rules it fails to reach an agreement on the terms for its exit from with the EU in March 2019.

WTO rules would mean that British exports would face tariff barriers when exported into the EU. That makes it more difficult to export and presumably, prices having this sort of effect, mean that we’d export less.

So, what do we want to happen in such circumstances? We’d like some method of making our exports cheaper even though they face those tariff barriers. A decline in the value of the pound does that nicely, it makes our exports cheaper. That is, a fall in the value of the pound is the cure for a no deal Brexit and the imposition of WTO barriers to our exports. The cure is in the very reaction to the news.

It’s worth pointing out that the pound has fallen, since the referendum vote, by more than we would need to compensate for a no deal Brexit. The reaction to the possibility has already taken place.

Posted: 24th, August 2018 | In: Money, News, Politicians | 1 Comment

Thank heavens we regulated Wonga into bankruptcy, right?

Or at least that we managed to regulate Wonga into near bankruptcy. For that’s what was done when we imposed limits upon the interest rates that they can charge. We set their business off into a declining spiral which brought them close to bankruptcy:

Britain’s biggest payday lender, Wonga, has received a £10m emergency cash injection from shareholders to save the company from going bust. The short-term loan firm said the development was a way of coping with a surge in claims from former customers seeking compensation.

The claims, said Wonga, related to loans taken out before 2014, when outrage over its payday lending offers prompted new rules to cap the cost of borrowing.

The thing is, lending small amounts of money to people for short periods of time is something expensive to do.

Leading technology venture capital funds Accel Partners and Balderton Capital have taken part in an emergency fundraising in the last few weeks, in news first reported by Sky News.

So, when we insist that people don’t charge enough to cover the costs of that expensive thing then they’re likely to go bust:

Wonga, which employs about 500 people, has been loss-making for the last few years after encountering a string of regulatory hurdles such as the City watchdog’s cap on the cost of short-term loans.

So, as it used to be. Company makes loans with high interest rates. It makes a profit and, obviously, the people taking out the loans were happy enough. Because they took out the loans.

This shocks people who practice GoodThink, that people will be charged that much in interest. So, the law is changed so that high interest rates cannot be charged. What happens next?

Wonga nearly goes bust and large numbers of people aren’t able to borrow the money they want to. Which is a problem, isn’t it? Because the people taking out the loans obviously believed that the high interest rates were worth it to them. It was other people, those GoodThink types, who stopped them. But the GoodThink types haven’t solved the problem of people needing small loans for short periods of time – that expensive thing to provide – they’ve just made it illegal to do so at a price which makes sense.

And yes, it really does work this way. This is the Federal Reserve (like the Bank of England, just in America) on the subject:

Even though payday loan fees seem competitive, many reformers have advocated price caps. The Center for Responsible Lending (CRL), a nonprofit created by a credit union and a staunch foe of payday lending, has recommended capping annual rates at 36 percent “to spring the (debt) trap.” The CRL is technically correct, but only because a 36 percent cap eliminates payday loans altogether. If payday lenders earn normal profits when they charge $15 per $100 per two weeks, as the evidence suggests, they must surely lose money at $1.38 per $100 (equivalent to a 36 percent APR.)

Cap the prices and you abolish the industry. But you’ve still not solved the problem of people needing the loans, have you?

Posted: 8th, August 2018 | In: Money, News | 0 Comments

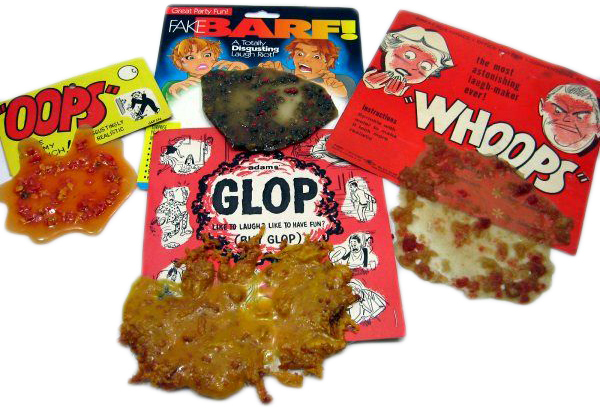

The high price of puking in an Uber

That stench inside the Uber mini-cab might be fart spray. And the vomit some passengers claim they are being charged lots of money to clean up might be a scam. The Miami Herald reports:

“I requested an Uber from Wynwood to the Edgewater area. At one point the driver told me a road was closed and that he could drop me off near my destination to avoid an extra charge. I agreed and got off,” Miami resident Andrea Pérez said about one trip last year.

But the next day Uber emailed her a bill with an additional $98 cleanup charge. It included a photo of vomit on the seat of the SUV she had used.

Real vomit? That fake vomit looks the business. And cleaning effort can be affected by the vomit’s constituent parts: milk sinks into the upholstery. In 2016, New Yorkers claimed they were being scammed by Uber drivers using fake vomit to charge high prices for cleaning their cars.

Says Andrea:

“I immediately contacted Uber through the app. I told them that I was alone, sober, that I was not carrying any drinks and that it was impossible for me to have caused that damage,” she said. “But every new email from Uber came from a different representative and always favored the driver.”

Get that puke down to forensics.

The upshot is that Uber refused to reimburse Andrea the cost. But her credit card company did get back her $98. Uber canceled her account. And the rest of us should take care: if your Uber puke is only on the car’ easy-wipe plastic parts and contains no hint of your kebab, cry foul.

Posted: 24th, July 2018 | In: Money, News | 0 Comments

Being dead breaches Paypal’s contract terms

It would appear that all of us with a Paypal account should live forever. Presumably Elon Musk’s old firm has some idea as to how this should or even could be achieved. For their contract seems to indicate that the popping of clogs is a breach of their terms.

A widower told last night of his shock after receiving a letter from online banking company, PayPal, threatening his dead wife with debt collection and legal action.

Howard Durdle was contacted by the ‘insensitive’ company, which claimed the death of Mr Durdle’s wife, Lindsay, constituted a ‘breach’ of their rules.

Well, yes and no actually:

The death of the 37-year-old British woman, Lindsay Durdle, who passed away from breast cancer, apparently violated PayPal’s account holder policies. After being notified by her surviving husband, Howard, of her tragic end on May 31, the American company demanded, in a quite peculiar way, repayment of about £3,200 that she owed.

“You are in breach of condition 15.4(c) of your agreement with PayPal Credit as we have received notice that you are deceased,” PayPal scolded, in a letter addressed to Mrs Durdle, after her husband provided copies of her death certificate, her will and his ID.

It’s badly worded, that’s true.

But here’s the full situation. She had borrowed money from Paypal Credit – OK, that’s what it’s for. There are certain repayment terms on such loans – that’s normal enough, when are you going to repay? Death does make following such terms a little difficult. But the debt’s still owed of course. It’s part and parcel of her estate in fact. What she owns is bundled up, what she owes – if secured of course – is also bundled up, one is used to pay the other and then what’s left over is distributed according to her will. This will be true of any other debts she has as well. The whole process is called probate.

So, yes, badly worded, possibly even a source of amusement for us out here, but nothing terribly odd about it at all. Being dead means the last chance they’ve got of getting the loan repaid is her estate. Thus the letter demanding immediate – for which read, the executor of the will out of that estate – repayment.

After all, a little delay here’s not going to harm her credit rating all that much, is it?

Posted: 14th, July 2018 | In: Key Posts, Money, News, Technology | 0 Comments

Yes, let’s legalise cannabis – but not for tax revenue

One of the long running shouting matches out there is over the legalisation of cannabis. It’s worth remembering that it’s only just over a century since it was actually legal. Actually, back in Victorian England everything was legal, yes including the morphine and opium. It was concern over people being able to enjoy themselves which led to both the drugs bans and that idiot Prohibition over in the US.

Given that cannabis doesn’t harm anyone why not undo that historic mistake and make it legal again?

The report from the Institute of Economic Affairs has valued the UK’s black market in cannabis at £2.6bn.

OK, there’s quite a lot of it going on already then.

A report from the Institute for Economic Affairs (IEA) says decriminalising the Class B drug would also lead to savings for the police and other public services.

Well, yes, there’s an awful lot of idiocy that we’ll be able to stop doing.

Margaret Thatcher’s favourite free-market thinktank has called on the government to legalise cannabis, arguing that the move could save more than £1bn generated from extra taxes and other savings in public services.

The thing is though that we don’t really want to do it for the tax take. The point being that we’re only here talking about consenting adults. And it’s a basic matter of freedom and liberty that consenting adults should be allowed to get up to what adults consent to. Sure, some of these things will be wasteful – say, Simon Cowell – some will be damaging – Simon Cowell – and yet that’s the whole point of freedom itself. We get to do as we wish, even Simon Cowell. The only truly moral constraint is when our activities prevent others from enjoying those same rights.

So, legalise cannabis just in order to legalise cannabis.

As the report itself notes, if we do legalise it then we can tax it. Actually, we could tax it pretty highly and still have it being cheaper than the illegal stuff is today. And we’ve got to gain our tax revenue from somewhere. So, yes, tax it and collect some money.

But the reason for the legalisation is because there’s no reason it should be illegal.

Posted: 30th, June 2018 | In: Money, News, Politicians | 0 Comments

Gender Pay Gap: Haim fires agent over male band getting 10x the cash

There is indeed a gender pay gap out there. Some of it is – whisper it gently though we must – entirely justified. Women do tend to take career breaks, there is what is called occupational segregation – people deciding to pursue careers in different occupations – and it does tend to be men who are stupid enough to think that success at work is the be all and end all of life. There are other times it’s entirely justified too – no one is going to be surprised that Tom Cruise gets a higher paycheque than whichever blonde is the arm candy this time around.

There’re also times when it’s rather less justified. And the answer there is for women to take matters into their own hands. To complain and demand that is. Which is exactly what Haim have just done:

All-female band Haim say they fired an agent after discovering they were paid just a tenth of the amount of a male artist on the same bill at a festival.

The US rock group – made up of sisters Este, Danielle and Alana – called the pay gap “insane”.

For those who don’t know these things, band pay at a festival will vary wildly. There will be those there just to get the exposure and maybe thereby get onto the radio. There will be others whose presence on the bill is what sells the tickets to the whole gig. Those latter will gain very much higher pay of course:

“We had been told that our fee was very low because you played at the festival in the hope that you’d get played on the radio,”

Well, that’s OK, as long as everyone knows the deal on the way in.

“We didn’t think twice about it, but we later found out that someone was getting paid 10 times more than us. And because of that we fired our agent.”

Maybe that is OK and maybe it isn’t. But that is the correct answer even so. Not to complain to the world nor to insist that the law must be changed, but to fire the person who negotiated the price you didn’t like.

Of course, it’s always possible that demanding more money means no bookings to play festivals but as these things work out this would also mean no gender pay gap, wouldn’t it? For we do only measure the gap among people who get hired. Those entirely unemployed aren’t included in our numbers.

Posted: 27th, June 2018 | In: Key Posts, Money, Music, News | 0 Comments

The financial crisis is over; US Fed raises interest rates, ECB ends QE

Most of us have noted that the past decade hasn’t been all that hot on the economic front. That grand and resounding crash back in 2008 has led to government and bank finances being near obliterated, the follow on effects being not much to no economic growth, wages stagnating and so on. The good news though is that it’s all pretty much over.

Yes, a decade is a long time, yes, it’s even possible that different economic policies would have made recovery faster. Even, that not having the excess in the first place would have meant no crash. But it is still good news that it does, finally, seem to be over.

To think like an economist for a moment – yes, OK, so we all insist they don’t know anything. And yet they are the only experts we’ve got about this economy type thing. And they will be saying that these two events mark at least the beginning of the end. We’re now properly into recovery, rather than continuing crisis.

The US Federal Reserve has voted to raise the target for its benchmark interest rate by 0.25%, citing solid economic expansion and job gains.

The widely-anticipated decision will lift the target for the central bank’s benchmark rate to 1.75%-2%, the highest level since 2008.

When the economy goes kablooie the first thing we do is lower interest rates. The counterpart to that, the other side of the coin, is that when the economy has recovered and we’re worried again about inflation, not that kablooie, then we raise interest rates. Among economists who are not central bankers there’s a little muttering about whether interest rates should rise right now, or perhaps in a month or two – for the US that is. But that they should rise is agreed, the crisis is over and recovery well under way.

The European Central Bank said on Thursday it will end its unprecedented bond purchase scheme by the close of the year, taking its biggest step in dismantling crisis-era stimulus a decade after the start of the euro zone’s economic downturn.

When you’re really in the hole and you can’t reduce interest rates any further then you have QE. No, don’t worry what it is, it’s just what you do when there’s deep economic doo doo ahead. And if you stop doing QE then that’s the indication we need that the doo doo has been avoided, we’ve turned the corner and we’re back on the upturn. It’s not as good a sign as raising interest rates again but it’s a necessary precursor to it at the very least. The US stopped QE a few years back, has even started to reverse it – not something the ECB is starting to even talk about yet – and it took them a few years to then raise rates. So Europe is perhaps three or four years behind the US in recovery here, something which sounds about right to be honest.

The other way to put this is that if the crisis were over we’d be stopping QE and raising interest rates. We are stopping QE and we are raising interest rates, thus we should conclude that the crisis is over.

Posted: 18th, June 2018 | In: Money, News | 0 Comments

Middle-class nightmares: Guardian readers panic over post-Brexit au pair shortage

Brexit matters trouble the Guardian’s readers as they made their way to Jezfest, aka Goodstock. What would it all mean for au pairs? One of the most-read stories on the Guardian’s website begins: “Au pair shortage sparks childcare crisis for families.” This from the paper that mused: “Is au pairing the new slavery?” and “Au pairs on a pittance: the young women minding kids.” And so to the looming Brexit disaster for the Guardian’s caring readers:

Many families are facing a childcare crisis following a 75% slump in the number of young Europeans willing to work as au pairs, as Brexit, plus other factors such as last year’s terrorist attacks in London and Manchester, deter young people from coming to the UK.

May, June and early July are when most au pair placements are arranged, before the beginning of the school term in September, but Guardian Money has learned that some agencies are unable to find a single young European for British families to even interview.

Or to put it another way not versed in the paper of the knowing liberal who outsources child rearing on the cheap: ‘Brexit ends au pair slavery’; and: ‘Brexit ends scandal of teens minding other kids.’ Says the paper, at pains to assure readers that an au pairs shortage affects not only middle-class professionals who can’t afford full-time staff:

While families who have an au pair are often characterised as well off, agencies say many are “ordinary” people such as doctors, nurses, firefighters and academics who work long hours, have long commutes or do not work nine to five, which means breakfast clubs and after-school clubs often do not benefit them. An au pair can be an affordable alternative to employing a nanny.

Since when did GPs and university dons become anything other than middle-class and wealthy? Does the Guardian really think GPs – average wage: £100,000 per annum – are anything but well off?

Posted: 17th, June 2018 | In: Key Posts, Money, News, Politicians | 0 Comments

England’s World Cup kit made by starving waifs in Bangladesh

The headline is roughly the story from the Telegraph, that the workers who make the England replica kit over there in Bangladesh are starving helots who deserve very much better. It’s also not quite true. Those garment factory workers have a pretty good deal – by the standards of Bangladesh that is. That’s why they flock to work in those factories. And yes, I have been there, I have seen it.

England’s World Cup football kit is being made in a factory in Bangladesh where workers are paid as little as 21 pence an hour, an investigation by The Telegraph can disclose.

The official England shirt and shorts, part of the most expensive England kit ever, are made at a factory inside a restricted government-controlled zone where employees are paid as little as £1.68 a day and described having to live “hand to mouth”.

The currency of Bangladesh is “taka.” The minimum wage in Bangladesh is 1,500 taka a month. The minimum wage in the garment factories is 5,000 and change taka. They’re doing pretty well by the standards of the time and place that is. That’s around and about £50 a month, true, which we’d think to be not very much at all. But then Bangladesh is a ery poor couontry still. It’s about as poor as Britain was back in 1700 AD or so.

No, really, that’s where they are and we were. That’s after we account for inflation. They’re 300 years behind us in economic development. Not their fault and all that but there’s the truth of it. And that’s why wages are shite – just as they were in England in 1700 in fact.

It’s also not much of a Telegraph investigation that uncovered this. For this is really a press handout from an NGO:

The Clean Clothes Campaign, which strives to improve conditions in the global garment industry, said: “With the minimum wage set at 5,300 BDT (£47), garment workers in Bangladesh are some of the most poorly paid in the global garment industry.

“Their wages do not even cover basic needs, much less enable them and their families to have decent lives.”

The group said that a living wage in Bangladesh would amount to 37,661 BDT (£335). This equates to £1.62 per hour.

The problem here is that that is higher than near all wages in Bangladesh. It’s about what a Commander (the same as a Major in the Army) gets per month. It’s about twice what a teacher preparing people for A Levels gets, four ties what a state school teacher does. The insistence is that the girl sewing zippers on a month after walking out of the paddy field should get that much?

It’s not a sensible demand, is it? As I’ve said elsewhere the last time this point came up, a year back:

What our doughty fighters for fashion equality are arguing is something very different. They’ve constructed an income that they think it would be nice if people had. This much food, that much leisure, this sort of housing and so on. It would undoubtedly be nice if we could guarantee a minimum quality of life for everyone. But people can only have that if production can support it. Which, in the still poor places of the world, it can’t. The demand is akin to insisting that people in 1800 should have had lives as rich in physical consumption as those in 1950 did.

The 30,000Tk demand is asking that garment workers in Bangladesh should be earning the same amount as garment workers in Malaysia, a country well over 10 times richer. This does not show a great deal of economic understanding.

Wages are lower in a poor country because productivity is lower. It’s a poor country because productivity is lower and, to complete the circle, low productivity means poor wages. They’re all different versions of the same statement of fact.

Frankly, they’re nutters and the Telegraph has been taken in by them. Wages are low on Bangladeshi garment factories because wages are even lower in Bangladesh in general. The reason for that is that it’s a poor country.

Oh, and the thing that’s making it richer? Richer about as fast as any place, ever, has become richer, at 6 to 8% a year? That we all buy those clothes made in those factories. If you’re really concerned about those wages the answer is clear. Check the labels, see where something is made. If it’s in Bangladesh then buy two, not just then one. Because that is what makes poor people richer, that we buy what poor people, in poor countries, make.

Posted: 2nd, June 2018 | In: Money, News, Sports | 0 Comments

Are people richer In London?

We all know that wages in London are higher than they are in the rest of the country. When we start talking about inequality then that’s as far as people go. They get paid more money so they’re richer, inequality must be this much then.

That’s not quite how an economist would try to guide the conversation though. What’s important is not how much someone can earn but what can they consume? So, we talk about the concept of disposable income. And, to the economist, the important one is disposable income after housing costs. Because that’s what you can spend on everything else. Wages, or income if you like, after taxes, benefits and housing costs. That’s the important number to be using when discussing inequality.

This inequality is a lot less than what we’re generally told it all is across the country. A nice example being this:

The sharp differences in household incomes across the UK have been set out in official government statistics.

The average disposable income per person (the ONS calls this household income), once taxes and benefits are accounted, was £19,432 in 2016.

But in Kensington & Chelsea and Hammersmith & Fulham in west London the average income was more than three times this at £58,816.

In contrast, in Nottingham – which has the lowest household income – the average income was £12,232.

This is before housing costs. This is rather important because we can look up what housing costs are by borough (for London) or region (for the rest of the country). We should take the median – 50% of households pay less than this, 50% more.

Nottingham is East Midlands and median rent is £500 a month. Kensington and Chelsea is £2,000 a month. So, the economists’ inequality is rather lower. Because we’d say that disposable income after housing costs, is £6,000 a year in Nottingham, £38,000 a year in K&C. Sure, this is still a big difference. But it’s a smaller difference than the one generally being used.

Sure, incomes are higher in London, but so are the costs of living there. National inequality is lower than what we’re usually told it is.

Posted: 29th, May 2018 | In: Money, News | 0 Comments

New Look charges the fat more for their clothes

This is being trailed as something of a scandal but it’s actually just great, the way the system should work. Some people should be charged more:

High street retailer New Look has been criticised by shoppers for allegedly imposing a “fat tax” across its plus-sized range.

What’s the standard complaint from fatty lardbuckets the average sized British woman?

Here, she found that the Green Stripe Tres Jolie Slogan T-Shirt was being sold for £9.99 in the standard range and £12.99 in the Curves range – a 30 per cent difference in cost.

So, what’s happening here then?

Firstly, realise that no one does price things by adding up their costs then trying to sell them at that plus a profit. So, arguments that larger sizes require more cloth don’t work. Instead, what everyone does is look at absolutely the maximum they think they can get away with charging. Then they charge that.

Hey, that’s capitalism, every producer of absolutely everything really is out to screw you. It’s markets which temper this. So, someone realises that there’s loads of fatty lardbuckets average sized British women out there looking for clothing more attractive than a Soviet potato sack circa 1955. They go make and sell them and make a fortune doing so. They really do set out to screw those fatty lardbuckets average sized British women. And they do screw them – unlike anyone else to hear the complaining.

Then other manufacturers spot those profits and copy what they’re doing. Prices fall, the range available expands, everyone – other than the original manufacturer – is happy. That’s just how the system works. It’s also how it’s supposed to work, it’s all in Adam Smith.

If New Look can get away with charging higher prices to fatty lardbuckets average sized British women then this tells us that there aren’t enough plus sized ranges out there with decent looking clothing. And the fact that New Look can charge higher prices is what will create the competition and cure the problem.

No, really, markets do in fact work. Which is why we’re not all in Soviet potato sacks, you know, the place which abolished markets and the price system?

Posted: 22nd, May 2018 | In: Money, News, The Consumer | 0 Comments

Chinese corruption crackdown screwed Cartier watches

These aren’t things you’d really think would be connected. How much corruption there is or isn’t in the Chinese economy and the profits of a Swiss watchmaker. But there is indeed a link and it’s worth about £400 million.

The connection is that when people Out East make buckets of cash money from doing something they shouldn’t have done then they’ll invest some of the proceeds in a good looking watch. And the brand matters – because the watch is a signifier of being one of the rich guys. Therefore it has to be one of the brands which is seen as showing that you’re one of the rich guys.

Sure, it’s showing off but with a purpose. It shows you’re a player and if you can show you’re one of those them more games to play in will be offered.

Then what happens with a crackdown upon corruption? Fewer people have the cash to buy them of course. But also, even those who can legitimately buy them from properly earned money won’t – who wants to be market out as a player when there’s a crackdown?

The company took action after stocks of its wristwatches began building up in display cabinets in Asian markets amid a crackdown on corruption in China, where luxury products such as watches and whisky had been dished out as lavish gifts to curry favour with officials, as well as a wider sales slowdown. It was worried that unsold stock would end up being discounted in the so-called “grey market” of unauthorised resellers, damaging the image and pricing power of its brands.

There’s also that point that fewer “presents” were being bought. The effect is rather large:

Shares in Richemont fell sharply on Friday after the Swiss luxury goods group reported annual profits had been hit by more than €200m spent buying back excess stocks of watches to protect its brands from “grey market” discounted sales.

It was a couple of hundred million the year before too.

The real lesson here is that the world economy is a hellishly complex place. Less corruption in China means smaller Swiss watch profits. How can anyone plan something of this complexity? And that really is why planned economies don’t work, it’s just not possible to even know what’s going on let alone predict what will.

Posted: 19th, May 2018 | In: Key Posts, Money, News | 0 Comments

Standing in a betting shop made women want me

They shoot horses and put greyhounds out to graze on the hard shoulder. And now there’s “bloodbath at the bookies” featuring human beings. The Star is labouring under the impression that bookmakers give two hoots about their staff as it leads with how the Government has “slashed maximum stakes at fixed odds betting terminals from £100 to £2”. This will, we’re told, lead to job cuts among the people detailed to scoop up the proceeds of the pitiless gambling industry and deposit the filthy lucre into the burgeoning bank accounts of the big companies running the show.

The Association of British Bookmakers warns that curbs on “crack cocaine” betting machines will lead to the loss of 21,000 jobs as 4,000 high-street bookies shut. All balls, of course. The big betting companies spend fortunes telling us to bet online, offering inducements for a more fun sporting experience from your smart phone. They don’t do that to improve the lot of their shop workers. Online bookies are often based overseas. They’re happy for British punters to chuck their money to non-British workers.

Switch on pretty much any televised sporting event and someone will tell you how betting is for hard men – men ‘hard’ to argue with, like actor Ray Winstone, or ‘hard’ to touch, like the priapic saddos who think betting on Harry Kane will get them laid, possibly with an actual flesh-and-bone woman.

Inside today’s Star there are plenty of adverts for gambling. “Bets plan is a loser,” says the Star’s editorial. The adverts agree – it’s free FUN and you GET YOUR MONEY BACK:

Page 50: topless stunna Michelle Marsh advises readers to “BET HARD & FAST” (see above). Subtle it ain’t.

Pages 46- 48: horse racing times are wrapped round adverts for tipster hotlines (£1.50-a-minute); and more ads for Ladbrokes and Coral – “Bet £5.. .& Get £20 in Free Bets” – “When The Fun Stops Stop – Be Gamble Aware.” Yeah, right.

Pages 27-30: An entire section advertising Paddy Power bets on the FA Cup final – “The Craziest bets punters have placed this weekend.”

And it’s all done to keep people in work and the high-street bustling. It’s selfless stuff…

Posted: 18th, May 2018 | In: Key Posts, Money, News, Tabloids | 0 Comments

Former Arsenal player invited to join pale and shadowy World Economic Forum

Former Arsenal midfielder Mathieu Flamini, 34, has been invited to join the World Economic Forum’s community of Young Global Leaders (YGL). We know what that is – and what it aims to be – from the group’s website.

The YGL was “established in 1971 as a not-for-profit foundation and is headquartered in Geneva, Switzerland.” No profits and it’s based in Switzerland, with a big annual meeting in Davos? What are the wages and perks like? Why do they host their shindig away from other humans and flowers – are they scared they petals will wilt and fall as the selfless do-gooders walk by?

The Transnational Institute describes the World Economic Forum’s main purpose as being “to function as a socializing institution for the emerging global elite, globalization’s ‘Mafiocracy’ of bankers, industrialists, oligarchs, technocrats and politicians. They promote common ideas, and serve common interests: their own.” Bono calls them “fat cats in the snow”. It is the “most exclusive private social network in the world”.

A look at the Board of Trustees reveals not a single black face – which seems a peculiar oversight for an outfit keen to improve the entire world and the lot of its peoples. There is also not a black face on Managing Board. There is one on the Executive Committee. So that’s one black face in 82 leading positions in an institution that will “bring attention to challenges that affect the future of global society”.

One hundred of the world’s most promising artists, business leaders, public servants, technologists and social entrepreneurs have been asked to join the World Economic Forum’s community of Young Global Leaders. They are joining a community and five-year programme that will challenge them to think beyond their scope of expertise and be more impactful leaders. They were nominated because of their ground-breaking work, creative approaches to problems and ability to build bridges across cultures and between business, government, and civil society.

They want Flamini. But why would Famini want them? He works with GF Biochemicals, which works to develop technology to produce sustainable alternatives to oil-based products. His company produces levulinic acid, which could be an alternative to petrol. But not air fuel for private jets – not yet.

Posted: 10th, May 2018 | In: Arsenal, Money, News, Sports | 0 Comments

The scandal of Motorway coffee costing more

The Daily Mail has noticed that a coffee at a motorway services station costs more from McDonalds, Costa or KFC than it does from the same outlets not at a motorway services station. The explanation for this is really very simple – rent – and it’s the one explanation that we’re not given. Which is a pity because it is a very simple explanation.

Breaking up your journey with a coffee stop at a motorway service station? You may find it breaks the bank too.

An investigation has found that roadside stores charge up to 28 per cent more for a medium latte – costing motorists an extra 74p compared with the high street.

How desperately awful, eh?

Breaking up your journey with a coffee stop at a motorway service station? You may find it breaks the bank too.

An investigation has found that roadside stores charge up to 28 per cent more for a medium latte – costing motorists an extra 74p compared with the high street.

We’re given varied reasons for this, including the station operators claiming that it’s more expensive to operate such stations than general run of the mill services so therefore prices are higher. But it’s why costs are higher than matters and that’s rent.

The basic underlying story here goes all the way back to the very dawn of economics when David Ricardo published his book on rent, in 1817. If you can produce more crop from a piece of land then the rent on it will be higher than land that produces less. We can say the same thing by insisting that the cost of the land will be higher where there’s more money to be made. A third way of saying just that same thing is that the landlord always gets a chunk of whatever can be produced from a piece of land.

This is actually why Starbucks was making no profit – thus paying no tax – a few years back. They had lots of leases on lots of buildings that would be good to sell coffee out of. Because the landlords get a piece of that action places good to sell coffee out of have higher rents. Starbucks wasn’t making a profit selling lots of coffee but the landlords were doing just fine.

But that’s where there are lots of shops around. Starbucks couldn’t raise the price of coffee in those expensive places because if they did then we’d go to the one around the corner. Where prices were lower because they were paying less rent. That landlord’s share was thus coming out of Starbucks profits, not ours, the customers.

Now replay the same game but where there isn’t another shop just around the corner. We all know that lots of money can be made running a services station. Once people have decided to go there they’re a rather captive market though. So rents are high. But instead of those high rents coming out of the profits of the operators, they come out of our pockets in the form of higher prices. Because once we’re there we cannot go to another coffee shop.

There is no solution to this either. Just because there are only so many service stations, and once we stop at one we’re going to be doing our buying there, there’s lots of money to be had from running a service station. That means high rents – and that will, because of the lack of competition, lead to higher prices.

It really is all there in Ricardo’s book from 1817. It’s about time everyone understood it too, isn’t it? Two centuries being long enough?

Image: The Drive of Our Lives – The Heyday of the Motorway Service Station

Posted: 8th, May 2018 | In: Key Posts, Money, News, The Consumer | 1 Comment

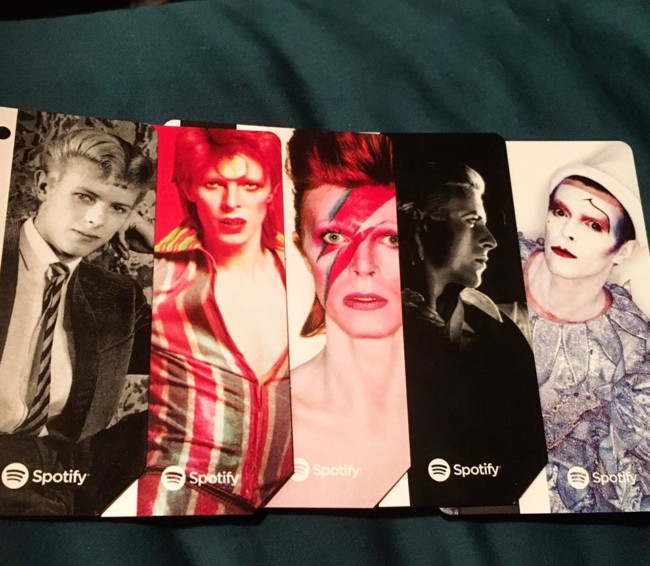

Musical David Bowie MetroCards Go On Sale In New York City

There are no photos of David Bowie riding the New York City subway to and from his home near to SoHo’s Broadway/Lafayette, not far from CBGB. Undeterred by evidence – the lack of it – the city’s Metropolitan Transit Authority is selling a David Bowie-themed MetroCard for $1 a pop. It’s part of a deal Spotify to create 5 limited edition MetroCards, most with a scannable Spotify code which triggers a sound file.

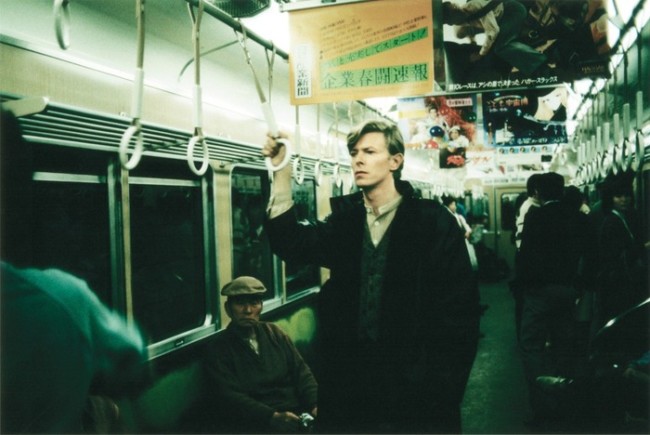

Finally, here’s Bow in the Tube in…Japan:

Spotter: Open Culture, Flashbak

Posted: 23rd, April 2018 | In: Celebrities, Money, News | 0 Comments

Martin Lewis Is Suing Facebook – Good Luck With That

Martin Lewis we all know as the money saving expert who set up – and made a fortune from – MoneySavingExpert. Which is why various people trying to flog scam cryptocurrencies have been using him to push their wares in Facebook ads. We know of Lewis as being pretty savvy about money so why not try to co-opt his image?

Well, one reason why not is that it will obviously piss him off:

The founder of MoneySavingExpert and well known money saving expert Martin Lewis is to began a lawsuit against Facebook in London’s High Court on Monday.

Lewis said he had taken the decision “to try and stop all the disgusting repeated fake adverts from scammers it refuses to stop publishing with my picture, name and reputation.”

There’s a problem here of course. One such being that people who saw the ads might well have been mislead into investing into entire and complete duds:

He claims Facebook has published more than 50 fake posts bearing his name in the last year, causing vulnerable people to hand over thousands of pounds to criminals.

Mr Lewis told the Press Association the legal action was the result of months of frustration with scammers piggybacking on his reputation and preying on Facebook users with outlandish get-rich-quick scams.

He said people have handed over money in good faith, only to find the advert has nothing to do with Mr Lewis or his company.

That’s a significant problem, of course it is. But there’s another one here as well:

Today (Monday 23 April), I will issue High Court proceedings against Facebook, to try and stop all the disgusting repeated fake adverts from scammers it refuses to stop publishing with my picture, name and reputation. To explain it, below is the official press release announcing the action.

You see, in law, Facebook isn’t the publisher. Therefore a claim of defamation doesn’t work. The actual publisher, the person responsible in law, is the person who wrote the post, or made the ad. Not Facebook itself. The situation here is akin to the telephone company or Royal Mail. Sure, both systems of communication can be used to do illegal things. And the people who do so are guilty of using them to do illegal things. But the systems themselves aren’t guilty. They have a legal status called “common carrier.” They’re responsible for what they do themselves which is illegal but not for what other people use the system to do.

And at least as far as we know the internet giants like Facebook are given this common carrier status.

A suit against those posting or making ads would almost certainly succeed. One against Facebook not so much. And you shouldn’t be buying cryptocurrencies because of Facebook ads anyway, no matter whose face appears in them.

Posted: 23rd, April 2018 | In: Key Posts, Money, News, Technology | 0 Comments