Money Category

Money in the news and how you are going to pay and pay and pay

Pension Funds To The Rescue! Raiding Private Capital To Build Public Assets

PENSION funds to the rescue! This is being greeted with glee over in leftyland:

PENSION funds to the rescue! This is being greeted with glee over in leftyland:

Ministers are finalising a radical plan to boost investment in UK infrastructure and stimulate the economy, with proposals to pool the vast assets held in British pension funds and use them to back an ambitious programme of road and house building.

Pension and insurance funds are to be encouraged to invest up to £50bn in improving infrastructure, including private and social housing, power stations, super-fast broadband and motorway toll roads.

Hurrah!

Those huge pots of private capital are to be mobilised to build the public assets and infrastructure we need! Take that capitalist bastards!

Read the rest of this entry »

Posted: 14th, November 2011 | In: Key Posts, Money | Comment (1)

Why The Eurozone Is Screwed: Blame The European Central Bank

EVER wonder why the European economy is screwed?

EVER wonder why the European economy is screwed?

No, it’s not just the euro itself, not just the insane idea that 17 different nations could all share the same currency and the same interest rate. There’s also human agency involved. A large part of it is the fault of the European Central Bank.

Here’s Milton Friedman:

But when Anna Schwartz and I examined the history of that period in detail, we found that the situation was very different. In the United States from 1929 to 1933, the quantity of money declined by a third. Similarly in Britain, it declined till 1931, when Britain went off the gold standard. In France, the reason the contraction kept on until 1936 was because France insisted on staying on the gold standard and kept the money supply declining. To go back to the United States, at all times from 1929 and 1933, the Federal Reserve had the power and ability to have prevented the decline in the quantity of money and to have increased the quantity of money at any desired rate.

So in our opinion, the Great Depression was not a sign of the failure of monetary policy or a result of the failure of the market system as was widely interpreted. It was instead a consequence of a very serious government failure, in particular a failure in the monetary authorities to do what they’d initially been set up to do.

A bit wonkish, agreed, but the basic point being made is that if the amount of money in circulation starts to fall then the economy is going to fall, contract, along with it. So the first thing you have to do as a central bank is make sure that the money supply doesn’t fall.

Read the rest of this entry »

China Sets A Minimum Wage: Send For The Tibetans

IN Guangdong, China, workers will get a new minimum wage from Jan 1. Wages could go up by 20 percent. Will prices for goods go up? Or will China just make the stuff you buy somewhere else?

For decades, Guangdong province and China’s Pearl River Delta have been at the heart of China’s economic rise. And while larger manufacturers and state-owned companies have contributed greatly to the boom, smaller and medium-sized private firms have also helped propel China to become the world’s second-largest economy.

As wages, raw material costs and other costs rise, those smaller businesses say they’re being cut out of the mix.

Lau said at the current rate, he expects 30 percent of factories in Guangdong to reduce production or close down this year, in the wake of a minimum wage increase last year. Another 18-20 percent pay rise would decimate the industry.

But Crothall is less than sympathetic, noting that although China’s inflation rate has slowed somewhat, China’s workers still need more to get by.

Read the rest of this entry »

Scotland Can’t Afford Independence: Windmills Will Bankrupt It

SCOTLAND can’t afford independence. This is a fun little set of numbers:

SCOTLAND can’t afford independence. This is a fun little set of numbers:

David Cameron has endorsed an expert report that warned Alex Salmond’s plan for a renewable energy revolution would increase the average household power bill by £875 in an independent Scotland.

Here’s how the number works out.

All those lovely windmills, the solar panels, the attempts at clean coal, all these different methods of trying to make sure that Gaia doesn’t boil us all, are paid for through the electricity bills. There’s no actual tax money (or very little rather) that goes to fund them, the cost of all these things is added to the ‘leccie bills through the feed in tariff (FIT). For example, solar panels installed before now get 45p or so per unit of ‘leccie produced (coal perhaps 10p) and we pay for this by all of us (no, not just those who sign up for “green power”) paying more on our ‘leccie bill.

Read the rest of this entry »

Posted: 9th, November 2011 | In: Money | Comments (6)

Better Than What the Cat Dragged In: Battersea’s Collars And Coats Celebrity Gala Ball

ON November 11th, I’ll be video blogging from the Collars And Coats Celebrity Gala Ball on behalf of Battersea Dogs Home hosted by Peter Andre, who undoubtedly empathises with the cause.

ON November 11th, I’ll be video blogging from the Collars And Coats Celebrity Gala Ball on behalf of Battersea Dogs Home hosted by Peter Andre, who undoubtedly empathises with the cause.

There will be a headlining performances from LULU, straight off of Strictly Come Dancing and Status Quo putting the “old dogs new financial tricks question“ to the test.

Battersea has rehomed over 3 million pets since it’s inception in 1860 and the deliciously luxurious auctions from fashion labels like Alexander Mcqueen, Prada and Aspinal alongside holiday packages will finance aid to the constant influx of needy dogs and cats dependant on donations.

Read the rest of this entry »

Posted: 9th, November 2011 | In: Money | Comment (1)

Malinda Dee: One Alleged Crooked Banker Gets Close To Severe Smack On The Wrist

ANOTHER in Anorak’s occasional studies of the banking beast.

ANOTHER in Anorak’s occasional studies of the banking beast.

Meet former Citibank manager Malinda Dee(aka Inong Malinda) left, being shepherded into a Jakarta District Court today. Lots of pushy journalists were making her planned haute couture entrance a smidgeon shabby. Malinda is accused of embezzling around 17 billion Indonesian Rupiah (about a million quid) in customers’ funds, and faces up to 15 years in prison and Rupiah 200 billion in fines if found guilty.

Read the rest of this entry »

Some Good Sense On The Robin Hood Tax

THIS, it’s absolutely correct in every single particular:

THIS, it’s absolutely correct in every single particular:

The Commission itself points out that a European financial transaction tax would have a serious impact on European growth. It would hit the UK economy, it could reduce European GDP by up to 3.5pc. The Commission takes the central view it would only reduce European GDP by 1.76pc. That is their central estimate that is going to cost 500,000 jobs across the European continent. Those are not my figures, these are the commission’s figures. We have just spent the whole of rest of the morning about how we can get the European economy going, how we can create jobs, how we can make sure we are not priced out of the global economy and then we have discussion about a proposals that commission itself says is going to reduce growth and costs jobs.

“We have to be realistic and truthful to our publics about who pays this tax. There is not a single banker in this world who is going to pay this tax. There are no banks who are going to pay this tax. The people who will pay this tax are pensioners, with pensions. They are taxpayers through their governments because they have to raise money on through sovereign debt auctions. This is not a tax that is paid for by bankers or banks. I am all in favour of taxes that are paid by bankers and banks that is why I have introduced a bank levy in the UK paid for by banks and their shareholders. A financial transaction tax is paid for by the end beneficiaries of financial transactions and that is pensioners. So if you want to go and introduce a big tax on pensioners that is the end result. But at least be honest about who pays this tax.

“We are not being honest about the revenue that is supposed to come from this tax even if all the business didn’t leave the European continent and we were able to collect it. This money has been spent four times over by the people around this table. It is supposed to be contributing to the EU budget, which is the commission’s proposal. It is supposed be helping national government’s fill the hole in their public finances. The third use, is to spend the money on the aid commitments that some countries around this table have not delivered on. The fourth idea, is that it should be spent on climate change commitments. So the same money has been spent four times over.

Read the rest of this entry »

Posted: 8th, November 2011 | In: Money | Comment (1)

Yes, Europe’s Going Bust!

YES, Europe’s Going Bust! I think we all pretty much knew this was happening, there have been enough stories about it just recently. But it does really rather look like Europe really is going bust.

YES, Europe’s Going Bust! I think we all pretty much knew this was happening, there have been enough stories about it just recently. But it does really rather look like Europe really is going bust.

Eurozone finance ministers will on Monday night begin a frantic search for new sources of capital to boost the area’s main bailout fund to €1 trillion after the US and emerging powers refused to commit fresh funds at the G20 summit last week.

Here’s the thing you need to understand. That €1 trillion bail out fund, the one that’s going to save everyone and everything. They want to go and borrow the money for that €1 trillion bail out fund. And no one wants to lend them the money: quite wisely really.

Read the rest of this entry »

Posted: 7th, November 2011 | In: Money | Comments (3)

Finding Complete Bollocks In The Guardian: Banking Balls

NO, no, I know, it’s not a total surprise is it, finding something in The Guardian which is simply complete, total and utter bollocks. And yes, it’s in the comments section but it is still important. Important both for who said it and for who believes it.

NO, no, I know, it’s not a total surprise is it, finding something in The Guardian which is simply complete, total and utter bollocks. And yes, it’s in the comments section but it is still important. Important both for who said it and for who believes it.

Of course banks handle deposits, but as anyone who has reviewed rates available to depositors for the last few years will know just how contemptuous banks have been of those who wish to use their services for this purpose. There is good reason for that: banks do not (and never have) needed depositors for enable them to make loans. The simple fact is that the money banks lend is created by them out of thin air. It’s offensively easy for them to do so. All that happens when someone asks for a loan is to credit a current account with the amount of the loan and debit a loan account with the same sum. That’s it: that is how 97% of all money in the UK is created, but as is clear, deposits play no part in that process. Instead banks literally create the cash they lend and can get away with this trick so long as people think they’re good for their promise to pay – which they will be so long as, as is now the case, the government clearly considers them too big to fail and explicitly and implicitly guarantees all they do. The insult to the injury is that having made this cash out of thin air they then charge heavily for it – vastly more than they pay for deposits. No wonder an organisation that can costlessly create what it sells is so profitable.

Bob Diamond acknowledges none of this, and the fact that much of the profit he and his colleagues supposedly generate is effectively licenced to them by the fact that the government has failed to claim for itself the right to he profit made on the creation of money; money which only the state can legitimise, but which banks have claimed for thei own benefit and which they have used to speculate at considerable social cost to society at large, as Adair Turner and others have noted.

Read the rest of this entry »

Posted: 4th, November 2011 | In: Money | Comments (5)

The Robin Hood Tax Will Give London The Entire EU Financial Market

THIS has to be the best paragraph in any of the newspapers today. The Guardian reports:

THIS has to be the best paragraph in any of the newspapers today. The Guardian reports:

Treasury sources said Britain would hit the 0.7% target without an FTT, adding that the European commission’s plans would see individual countries using the extra revenue for deficit reduction rather than development. They added, however, that the UK would not seek to prevent other countries introducing an FTT if they wanted to do so.

It’s all about the financial transactions tax, that Robin Hood tax thing. The idea being floated at the moment (‘coz Bill Gates supports it) is that in comes the FTT, then the money is used to provide aid to poor countries. Or, as the European countries are suggesting, to prop up the shaky finances of the European countries.

Read the rest of this entry »

Posted: 3rd, November 2011 | In: Money | Comment (1)

The New £50 Note Is An Object Of Desire

HAVE any of you been fed a new £50 note? Right now, only four cash machines in the UK hold the note. Can you guess where they are? Hull? No? Tony Blair”s wallet? Could be. The City of London? Yes!

HAVE any of you been fed a new £50 note? Right now, only four cash machines in the UK hold the note. Can you guess where they are? Hull? No? Tony Blair”s wallet? Could be. The City of London? Yes!

Posted: 3rd, November 2011 | In: Money | Comment (1)

Ultimate Greek Tragedy: A Tale of Well-Heeled Swine Bankers

“EUROPE’S leaders should have paid more attention to the distress of ordinary Greeks and less to the distress of well-heeled European bankers. Rather than trying to punish the “profligate,” they should have thought about the consequences of condemning Greece to years of negative growth, soaring unemployment and rising taxes with nothing promised in return except that maybe, a decade from now, its ratio of debt to gross domestic product might get back down to the problematic levels of 2008-9.”

“EUROPE’S leaders should have paid more attention to the distress of ordinary Greeks and less to the distress of well-heeled European bankers. Rather than trying to punish the “profligate,” they should have thought about the consequences of condemning Greece to years of negative growth, soaring unemployment and rising taxes with nothing promised in return except that maybe, a decade from now, its ratio of debt to gross domestic product might get back down to the problematic levels of 2008-9.”

So says the The New York Times.

An opinion most could agree with:

Maybe We Finally Get to Jail A Banker: The MF Global Dream

Bankers: Prosecute The Swine

Sexy Fred Goodwin’s Grubby Secret: Shagging On The Glass Ceiling

As the The New York Times Comment says in its punchline paragraph:

“Chancellor Angela Merkel of Germany, President Nicolas Sarkozy of France and others are now rushing to blame the Greeks for the summit package’s rapid unravelling. They need to take their own full share of responsibility for this crisis — and finally fix it. “

So Is It Going To Be France Next To Go Bust After Greece?

SO. Is France alls et to follow Greece? Well, no, obviously it’s not going to be France going bust next: we’ve Spain Italy and Portugal to get through first. But the markets are moving to the point where France might well start to look like it’s in trouble.

SO. Is France alls et to follow Greece? Well, no, obviously it’s not going to be France going bust next: we’ve Spain Italy and Portugal to get through first. But the markets are moving to the point where France might well start to look like it’s in trouble.

Yields on French 10-year government bonds just exploded, now up over 6% on the day to 3.14%.

The spread between French 10-year bonds and German bunds is up even more dramatically — more than 10 bps or a full 9% on the day.

You need another little bit of information to understand this:

Casualty of “market conditions” on Wednesday – the EFSF’s latest bond issue.

The EFSF had mandated Barclays Capital, Credit Agricole and JP Morgan on Monday to price off a ‘no-grow’ €3bn 10 year deal to finance Ireland’s next bailout loan tranche, due in November.

Read the rest of this entry »

Maybe We Finally Get to Jail A Banker: The MF Global Dream

ARE we about to finally jail a banker? That would be nice, wouldn’t it? finally being able to sling into prison a banker or two?

ARE we about to finally jail a banker? That would be nice, wouldn’t it? finally being able to sling into prison a banker or two?

And it really could happen too. No, not because they lost all our money playing silly buggers with houses and the like, not because they’ve been lending money to Southern European spivs.

Rather, a company called MF Global has just gone bust. Used to be part of the Man Group (same people who brought us the Man Booker prize for books) but was sold off in 2007. Not exactly a really sexy company, it was a futures broker more than anything else. Basically ye people who took your phone order and went and did the actual trade for you if you wanted to lose your money in pork bellies and the like.

They brought in the ex-head of Goldman Sachs (and then Senator and Governor of New Jersey), a bloke called John Corzine, who decided to make it a much more sexy company. Instead of just processing orders for other people and taking a few cents on each, they’d start playing in futures with their own money and make fortunes!

Read the rest of this entry »

Posted: 1st, November 2011 | In: Money | Comment (1)

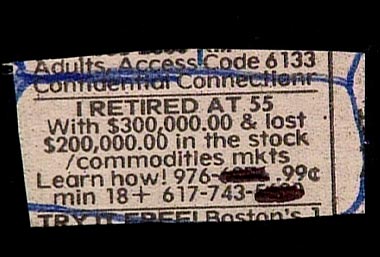

How To Really Make Money on the Stock Market: The Misinformation Edge

IT’S very difficult to make money on the stock market: most fund managers don’t even manage to bet the general rise (or fall) in the main markets themselves. And if those peeps making £hundreds of thousands a year can’t do it, why would we think that we would be able to do it?

IT’S very difficult to make money on the stock market: most fund managers don’t even manage to bet the general rise (or fall) in the main markets themselves. And if those peeps making £hundreds of thousands a year can’t do it, why would we think that we would be able to do it?

The answer lies in the information edge. If you know something that the rest of the market doesn’t then you can make money: if you don’t have that extra knowledge then you can only make money through pure blind luck. And today I’m going to give you one of those pieces of extra knowledge:

If the Proshares are underperforming, there’s a simple arbitrage here. Take the ‘Ultras’, which offer 2x leverage, and the ‘UltraShorts’, which offer the opposite, -2x exposure. Going short both stocks generates a very low-risk portfolio pair, because on a daily basis when one goes up 1% the other will almost surely go down about 1% by design; the positions will offset each other. But the drift for both is negative, as they burn money. Since ProShares has been very busy adding ETFs, this simulated strategy started with 23 pairs in 2008, and is now up to 45. Below is a graph of the total return to going short all the Ultra and UltraShort pairs offered by Proshares since 2008. I rebalanced every week. The annual return was 14%, and the annualized standard deviation was 12%.

Read the rest of this entry »

Gaia Will be Angry With Us: Solar Power Subsidy Cut

GAIA will be angry with us. But we should still welcome this as good news.

GAIA will be angry with us. But we should still welcome this as good news.

Under current plans, the level of the feed-in tariff is likely to more than halve, from 43p per kWh to 20p. The solar industry says it can broadly live with that level, but some companies warned that schemes to provide disadvantaged communities and households with low-cost power and heating would be the most likely to be scrapped under the changes.

We might want to ask ourselves why, if the solar companies can live with this lower level of subsidy, they’ve been allowed to stick their hands into our wallets for the higher amount. Subsidy should be, after all, only just enough to get things moving, not twice the amount it needs to be.

Read the rest of this entry »

Don’t Fear The Greek Default: It’s A False Alarm

TO a large extent all this alarm about what’s going to happen when Greece defaults is just that: alarm. Alarm with no real basis in anything that’s really likely to happen.

TO a large extent all this alarm about what’s going to happen when Greece defaults is just that: alarm. Alarm with no real basis in anything that’s really likely to happen.

There’s two things you need to know, over and above the usual background.

That usual background being that Greece owes around €350 billion and there’s no way it can pay it back. So, default it will have to be.

The two things? The first is that banks don’t just sit there and wait for the default. They do what is called “mark to market”, or at least are supposed to, and this means that when a loan or a bond is going sour they write down the value of that bond or loan. In effect, they take the loss they think they can see coming now, rather than waiting for that loss to actually arrive. We’ve seen in recent days that RBS has written their Greek debt down to 50% of face value and so too has Deutsche Bank. We’re pretty sure actually that all of the UK and most of the German banks have done this. We worry a bit that most of the French ones haven’t but that is Sarkozy’s problem, not ours.

Read the rest of this entry »

Posted: 27th, October 2011 | In: Money | Comment (1)

Facebook Founder Sean Parker Finds Being Stinking Rich Awkward: He Is The 0.0000001%

SEAN Parker was once the President of Facebook. He’s now very rich and lives in a house so large you can see the curve of the Earth in his TV room. Parker want you to know that life is now all easy. Being stinking rich is hard. He tweets:

SEAN Parker was once the President of Facebook. He’s now very rich and lives in a house so large you can see the curve of the Earth in his TV room. Parker want you to know that life is now all easy. Being stinking rich is hard. He tweets:

“You guys are really attacking me for being the 1%. I was broke and couch surfing just a few years ago… I have a whole new set of problems to deal with now: security, extortion attempts, kidnapping threats, death threats, etc. Life better b4?“

Read the rest of this entry »

Occupy Michael Moore: How Rich Is Mr 99%?

MICHAEL Moore explains the percentages.Piers Morgan wants him to admit that he is more 1% than 99%:

MICHAEL Moore explains the percentages.Piers Morgan wants him to admit that he is more 1% than 99%:

MORGAN: I need you to admit the bleeding obvious. I need you to sit here and say, I’m in the one per cent, because it’s important.

MOORE: Well, I can’t. Because I’m not.

MORGAN: Because the validity of your argument – you are, though.

MOORE: No, I’m not. I’m not.

MORGAN: You’re not in the one per cent?

MOORE: Of course I’m not. How can I be in the one per cent?

MORGAN: Because you’re worth millions.

MOORE: No, that’s not true.

MOORE: I don’t associate myself with those who do well …

Read the rest of this entry »

If The Euro Fails, Europe Fails: Hurrah!

ANGELA Merkel tells us that if the euro fails then Europe fails: to which the correct response is Hurrah!

ANGELA Merkel tells us that if the euro fails then Europe fails: to which the correct response is Hurrah!

Germany’s chancellor Angela Merkel today warned that the failure of the euro would lead to the fall of Europe as she outlined a plan to bail out Greece’s stricken economy.

However, rather sadly, this isn’t in fact true. If the euro fails it does not mean the failure of Europe, nor even of the European Union. It means just the failure of a particular idea of it. Sadly here can be a matter of taste of course: I’m so eurosceptic I’ve even stood as a UKIP candidate, a position that I’m aware quite a lot of you won’t share.

Read the rest of this entry »

The Times Says Copenhagen Is New Capital Of Sweden

THE Times’ Danny Forston has news that Sweden has been relocated:

We have it easy, don’t you know. Yes, the Big Six energy companies make big profits. And yes, one in four of us is “fuel poor”. But spare a thought for the poor Swedes. They pay four times what we do, on a cents per kilowatt hour basis, for gas. Electricity in Copenhagen is twice as dear as it is in London.

Posted: 26th, October 2011 | In: Money | Comment (1)

When Governments Lie: Following The Argentina Model

GOVERNMENTS lie all the time of course for you know that a politician is lying when you see his lips move. However, there are lies and lies: we all know that “Vote for me a it’ll all be fine” is a lie. We might not know that “US poverty is at an all time high” or “Rents are unaffordable for many families” are for they depends upon detailed statistics which are simply too geektastic for most of us to give a shit.

GOVERNMENTS lie all the time of course for you know that a politician is lying when you see his lips move. However, there are lies and lies: we all know that “Vote for me a it’ll all be fine” is a lie. We might not know that “US poverty is at an all time high” or “Rents are unaffordable for many families” are for they depends upon detailed statistics which are simply too geektastic for most of us to give a shit.

But just as an example, Shelter released a report last week which said that private rents are now unaffordable in 55% of British cities. And, well, sorta, but not in the way it’s being reported. Yes, rents are high, because houses are expensive.

However, what Shelter said is that rents are too high as a percentage of take home pay. What is being reported they said is that rents are too high as a percentage of household income. These are not the same thing at all: take home income is wages after taxes. Household income is wages after taxes plus benefits.

Read the rest of this entry »

How To Have Good Sex At Occupy Wall Street: Open A Czech Bank Account

ARE you having good sex with the love vibes at Occupy Wall Street?

The Man’s Guide To Love #603 from themansguidetolove on Vimeo.

Feel the love:

The Man’s Guide To Love #603 from themansguidetolove on Vimeo.

Read the rest of this entry »

How Legalising Marijuana Can Save The Economy

TEXAS is doing well. You can thanks the Meixcan drugs trade:

[E]xperts who have studied the impact of drug money say it is undeniable that in a tough economy, trafficking has helped boost employment and economic growth in the state’s border regions, from the Rio Grande Valley to Laredo to El Paso. “It does play a role in the life of many people,” said Jay Garcia, a sociologist at the University of Texas-Pan American in Edinburg who grew up in a migrant farm labor family in Starr County in deep South Texas. Drug money “trickles down to the drivers, the ‘mules,’ the leg breakers, people in all positions.”

It’s supply and demand…

European Union To Ban Free Speech

THE European Union has banned free speech. That’s the implication of this little nugget of news:

THE European Union has banned free speech. That’s the implication of this little nugget of news:

BRUSSELS—The European Commission is leaning toward proposing a ban on the issuing of sovereign credit ratings for countries in bailout talks, a top official said on Thursday.

“I think it’s legitimate to have a special treatment when a country is in negotiation or is covered by an international solidarity program with the IMF or a European solidarity” program, said Michel Barnier, European internal market commissioner.

Should the commission, the executive arm of the European Union, come to view these sovereign ratings are inappropriate, “we could ban it or suspend the rating for the necessary time frame,” he said. “I am studying this matter very seriously.”

The thing is, you see, a credit rating is only Fitch (or S&P, or Moody’s, or any of the other 40 odd more minor ones) saying “You know, we think these peeps might find it difficult to pay back their debts“.

Read the rest of this entry »