Money Category

Money in the news and how you are going to pay and pay and pay

There Is No Such Thing As Web 2.0

THERE Is No Such Thing As Web 2.0:

Web 2.0 has been picked up as a term by the entrepreneurial community and its corollaries in venture capital, the press, analysts, large media and Internet companies, and Wall Street to describe a theoretical new category of startup companies.

Or a “space”, if you will.

As in, “Foobarxango.com is in the Web 2.0 space”.

At its simplest level, this is just shorthand to indicate a new Web company.

The technology industry has a long history of creating and naming such “spaces” to use as shorthand.

Before the “Web 2.0 space”, you had the “dot com space”, the “intranet space”, the “B2B space”, the “B2C space”, the “security space”, the “mobile space” (still going strong!)… and before that, the “pen computing” space, the “CD-ROM multimedia space”, the “artificial intelligence” space, the “mini-supercomputer space”, and going way back, the “personal computer space”. And many others.

But there is no such thing as a “space”.

Posted: 23rd, February 2008 | In: Money | Comment (1)

Darren Minnikins Is Northern Rock’s First Victim

AS noted here and here, the first person Gordon Brown is going to evict from his home is Darren Minnikins (he’s the likely answer to the question we posed yesterday):

AS noted here and here, the first person Gordon Brown is going to evict from his home is Darren Minnikins (he’s the likely answer to the question we posed yesterday):

In Bishop Auckland right now the “People’s Bank” is attempting to make Darren Minnikin homeless.

Claim 8PA12900:

Northern Rock plc versus Mr Darren Minnikin

Says Guido Fawkes, the blogger: “Congratulations Mr Minnikin. You are the first victim of socialist economics today…”

Is he? Mr Minnikins was probably in trouble with his repayments a while back. And because Northern Rock is nationalised – and we are stake holders in it – all to the good that our money is being chased and punishment to defaulters meted out.

The interest will come when others default on their mortgages in the Labour heartlands and a General Election looms…

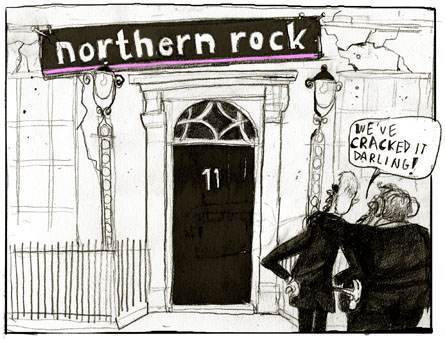

Pic: Poldraw

Posted: 20th, February 2008 | In: Money | Comments (8)

Northern Rock: Who Will Be First?

NORTHERN ROCK – Which will be the first family evicted from ther home by the gordon Brown and his Government of all the talents?

Posted: 19th, February 2008 | In: Money | Comments (11)

Northern Rock: British Leyland

THE 1970s are back. Northern Rock:

THE 1970s are back. Northern Rock:

Posted: 18th, February 2008 | In: Money | Comment (1)

Northern Rock Watch: Adding The Numbers In Today’s Media

NORTHERN ROCK is nationalised. It is now as Safe as the Bank of England.

NORTHERN ROCK is nationalised. It is now as Safe as the Bank of England.

Hereunder is a round-up of Northern Rock facts in today’s media.

Northern Rock money is now your money, so it’s good for journalists to be precise:

DAILY EXPRESS (front page): “NORTHERN ROCK: NOW IT’S A TAXPAYERS’ NIGHTMARE”

This time last year, the bank was worth around £5.3 billion. It is now worth just £375 million.

DAILY MAIL (front page): “£100m GAMBLE WITH YOUR CASH”

The move severely dented Labour’s reputation for economic competence and leaves taxpayers responsible for the crippled bank’s £100billion in mortgage debts – just as the housing market has entered a downturn.

Facts:

The Conservatives claimed the decision meant every family in Britain was effectively being saddled with a “second mortgage” of £4,000…

The Government now faces the prospect of being blamed for the repossession of the homes of defaulting Northern Rock mortgage-holders and for job losses from the bank’s 6,500-strong workforce in Labour’s North-Eastern heartland…

There is also likely to be a drawn-out legal battle with the 180,000 shareholders who face getting nothing back from their investment.

DAILY MIRROR (front page): “WHAT IT MEANS FOR YOU”

At the moment, taxpayers are propping up the Rock with £55billion in loans and guarantees. The bank, worth £5.3billion this time last year, is now worth just £375million

THE SUN: “Crisis Rock To Be Nationalised”

But Chancellor Alistair Darling said it was the only way to safeguard the £26billion of taxpayers’ cash that had kept the bank from going under…

An independent panel will decide the amount of compensation for the bank’s shareholders — at least 150,000 of whom are small investors

Read the rest of this entry »

Posted: 18th, February 2008 | In: Money | Comments (9)

Northern Millstone: Anorak Scooped Them All On The Rock

THIS again comes in the category of we told you so, ahead of anyone. Northern Rock. Northern Millstone.

THIS again comes in the category of we told you so, ahead of anyone. Northern Rock. Northern Millstone.

Today’s Mail On Sunday is telling of secret, hush-hush, bonus payments paid to staff and directors of Northern Rock…after the biggest bank crash in UK history. Anorak told you four weeks ago.

The Bank of England is propping up Northern Rock to the tune of around £55bn…forget the BBC figures of £25 to £35bn, it’s nowhere near…We told you so.

If the Chancellor doesn’t act at once everything will be lost and the Bank of England’s multi-billion loan goes out with the bathwater … and guess what? Anorak told you that first too.

Meanwhile the fat cats who did such a totally rubbish job get their bonuses. (As we have already said. We told you…)

Just a thought, will SuperJock Gordio make Hain supremo of the newly Nationalised Northern Millstone. If it wasn’t a distinct possibility, it would be frighteningly laughable.

See: Secret Bonus

Join Mic and the other Northern Rockers In the Forums

Read the rest of this entry »

Posted: 17th, February 2008 | In: Money | Comment (1)

A Chance For Prisoners To Work For A Living Tax Free

“CHERIE Blair, wife of the former prime minister, is leading a drive for prisoners to earn up to £10,000 a year doing work in jail for firms which are household names.” So reports the Times.

“CHERIE Blair, wife of the former prime minister, is leading a drive for prisoners to earn up to £10,000 a year doing work in jail for firms which are household names.” So reports the Times.

“She has endorsed a pilot scheme in a category C prison in which serious offenders are paid the minimum wage – £5.52 an hour – to work for companies such as Kentucky Fried Chicken and Clifford Chance, the City law firm.” It light-fingered lickin’ good.

Who better to employ villains than lawyers and a take-away food shop? Perhaps call centres, with their innate fondness for small cubicles and battery-farmed workers. Or public schools.

Interestingly, because inmates pay no rent on their cells, no council tax and need incur no transport costs they could be left better off than low-paid workers outside.

In fairness, though, the Howard League for Penal Reform suggests the prisoners pay income tax, “but the government is refusing to accept contributions because the inmates might then have workers’ rights.”

The last thing you want is for a prisoner to bring a case of constructive dismissal…

Posted: 17th, February 2008 | In: Broadsheets, Money, Politicians | Comment

Mark Steel Has No Idea About Non Doms

IN The Independent: “Mark Steel: A taxing problem: should the rich pay for cheese?”

Says Steel:

New Labour certainly keep their promises. Before they were elected, they promised to reform the loophole that enables the super-rich to avoid paying tax, by claiming “non-domicile tax status”. And now, 11 years later, they’re still promising to do it.

But the non-doms don’t avoid paying tax. Non-doms pay tax on all their UK earnings. They also pay UK tax on earnings they bring into the UK. They are not non-residents. They are non-domiciles. The clue is in the name.

Read the rest of this entry »

Posted: 14th, February 2008 | In: Broadsheets, Money | Comment

Project Lifeline, Coming To The UK?

CAN ‘T pay your mortgage:

WASHINGTON — The Bush administration and six major mortgage lenders unveiled their latest response to the continuing turmoil in the housing market, offering to “pause” the foreclosure process for seriously troubled homeowners.

Although the announcement of “Project Lifeline” was couched in tones of optimism, officials cautioned that it is only an incremental step that would not guarantee help for every homeowner facing the loss of their home.

“No program can bring every struggling borrower into the counseling and evaluation process, and we cannot help those who choose not to honor their obligations,” said Treasury Secretary Henry Paulson. “None of these …

And:

Project Lifeline will indeed help, but not as much as some would like:

The pilot program, dubbed Project Lifeline, is supported by Treasury Secretary Henry Paulson and will further encourage borrower contact as well as broaden Paulson’s moratorium announced in December, 2007, which froze interest rates on certain adjustable-rate mortgages, to include all kinds of home loans. Homeowners won’t qualify for the 30-day-freeze if they are in bankruptcy, if they already have a foreclosure date within 30 days or if the loan was for an investment or vacant property.

Posted: 13th, February 2008 | In: Money | Comment (1)

Vladimir Outin Slays Them In The Aisles

VLADIMIR Putin is a comedian:

Vladimir Putin has announced that if NATO does not act in a manner more to his likely in future negotiations, he will take action to let them know he is not to be trifled with by unleashing an arms race.

So Russia (GDP $2.08 trillion) is threatening the EU (GDP $14.44 trillion) and USA (GDP $13.86 trillion) with an arms race?

How mnay bombs do you need to win a race, and who decides on the winner?

Posted: 10th, February 2008 | In: Money, Politicians | Comment

Hillary Clinton’s Money

HOW does Hillary Clinton finance her campaign?

Clinton, unlike rival Barack Obama, has not released her tax returns. But disclosure forms that Clinton filed with the Senate provide some clues to her family finances. They show Bill Clinton has earned tens of millions of dollars in recent years giving speeches at rates of up to $450,000 apiece. During one week in 2006, the former president collected $1.7 million for talks in Europe and South Africa. (He also collected speaking fees from Citigroup, Goldman Sachs, the Mortgage Bankers Association and other big firms.) The documents are more circumspect about other Clinton financial interests, including his annual income as a “partner” in billionaire pal Ron Burkle‘s businesses and from Vinod Gupta‘s InfoUSA. Both payouts are listed as “over $1,000″—a description that is legally adequate but not very enlightening.

Money and politics

Posted: 10th, February 2008 | In: Money, Politicians | Comment

Smokers Pay For Health

SMOKERS for health:

It is well known that smokers tend to subsidize non-smokers because the former pay so much in taxes and die before they can collect their due in social security and Medicare benefits.

Barack Obama Worth $1.3million

THE Presidential candidates’s money – Salon.com and Money magazine:

|

Candidate |

Net Worth |

| Mitt and Ann Romney | $202 million |

| John and Elizabeth Edwards | $54.7 million |

| Rudy Giuliani | $52.2 million |

| John and Cindy McCain | $40.4 million |

| Hillary and Bill Clinton | $34.9 million |

| Fred Thompson | $8.1 million |

| Barack and Michelle Obama | $1.3 million |

Vote Obama – he needs a raise…

Posted: 9th, February 2008 | In: Money, Politicians | Comments (6)

Jerome Kerviel Is Jailed

THE Paris appeals court has ordered the Societe Generale trader Jerome Kerviel should be detained because of the “necessities of the investigation” and the risk that he could flee the country.

Now he will be put in “provisional detention” while the case is being investigated.

Kerviel might be innocent. French sources tell us that he was known as something of a workaholic in Paris circles, putting in a 30-hour working week…

Posted: 8th, February 2008 | In: Money | Comments (3)

Praying For Money And Reduced Interest Rates

“HELP!” screams the front page of the Express.

“HELP!” screams the front page of the Express.

Readers run to the scene, afraid that the Rogarians have stormed Blackfriars, Princess Diana is dead and Madeleine McCann has been found hiding under the bed. RIP Daily Express.

“HELP! Why millions of us have been paying for another cut in loan rates today.”

Good to learn that in this godless society we have been praying, although whether praying for money is deemed spiritual is a point best lest to others.

Of course, millions of others are praying, and hoping, that interest rates rise and give them greater value to the savings.

Much depends what god who worship…

Exxon Mobile Pays Half America’s Income Taxes

IT SEEMS: “Just one corporation (Exxon Mobil) pays as much in taxes ($27 billion) annually as the entire bottom 50% of individual taxpayers, which is 65,000,000 people!”

Posted: 6th, February 2008 | In: Money | Comments (2)

The Damp Northen Rock Fire Sale

RICHARD Branson’s Virgin Group and its backers and an in-house team were last night left as the only potential buyers for the mortgage bank (supported by YOUR money) Northern Rock as the government’s attempt to engineer a bidding war crashed and burned.

Did you read it anywhere else at all? Couldn’t have been right in little ol’ Anorak could it? It will be interesting to see what desperate spin Messrs Brown and Darling (the UK’s top politicians in case you’ve forgotten) come up with on this one today. Nationalisation of the bank is looking inevitable since a sale to either of the remaining bidders may be considered financial and political suicide.

Virgin and the board of Northern Rock both submitted proposals for the company’s future before yesterday’s deadline.

Olivant Partners, whose chairman is former Abbey and UBS chief Luqman Arnold and had submitted plans earlier in the process, announced it was pulling out of the race only eight minutes before stock markets closed.

A lightening quick swift sell-off in Northern Rock shares followed and they dropped to 88p.

Olivant’s Arnold blamed the government’s financing terms, which had been arranged by investment bank Goldman Sachs, for the end of its bid.

“Despite working intensively, we have been unable to formulate a value creation proposal which meets our investment criteria whilst also respecting the government’s proposed financing terms and the interests of other stakeholders in the company,” he said.

That was longhand for:

“It will never work”,

“It is a dead cat and it will not bounce sufficiently for us to wash our face, grab the loot and sod off”,

“No thanks, we’re outta here” … Things like that.

So, the superior banking consortium contender (in terms of actually knowing what they are talking about) is out of it.

When bankers are considering whether to give you a loan they use a mnemonic…SPARS.

S……Suitability (is the client a worthwhile risk?)

P……Purpose (what’s the money for? it should be none of their business)

A……Amount (what’s the least we give this toe rag?)

R……Repayment (what sort of interest can we screw out?)

S……Security (there must me no risk at all to the lender.Grab the home)

The ONLY contenders are a management team which (at best) was complicit in the disaster from which they are trying to rake even more of your money for themselves…and… a group headed by low cost expert Richard Branson. Branson has no banking licence, or experience, and in the past has been known to burst into tears when employees ask to be allowed to form a union. Apparently, the multi-millionaire regards union membership as some sort of betrayal of the House of Virgin. Some basic negotiating flaws there perhaps?

Do you think either team meet the SPARS rule?

Flikr Users Against Microsoft

BILL Gates is finding out that money cannot buy you love. Microsoft are intersted in buying Yahoo!, and:

BILL Gates is finding out that money cannot buy you love. Microsoft are intersted in buying Yahoo!, and:

As soon as the news hit the wires that Microsoft is proposing a $44.6 billion bid for Yahoo, Flickr users began posting anti-Microsoft images, satirical “Flickr Live” logos and announcing they will abandon Flickr if it falls into Microsoft hands, fearing such a move would mark the beginning of the end.

“Well then, I’m outta here!” announced one Flickr user who goes by the name Judland. While Microsoft has established its dominance on the desktop, its web properties lag behind those of Yahoo and others.

Source, Via

Posted: 4th, February 2008 | In: Money | Comment (1)

Canadian Currency T-Shirt, With Flag

CANADIANS are.. not Americans.

CANADIANS are.. not Americans.

And they are keen to show that they are not from the greatest country on Earth by sticking Maple Leaf flags on their clothes and knapsacks, and wearing T-shirts that celebrate their own, er, mighty dollar…

Two Million ‘Wrongly Get Benefit’

A NATION of shopkeepers kept shoppers:

Up to two thirds of people claiming incapacity benefit are not entitled to the state handout, the Government’s new welfare adviser warns today.

That’s 1.9million of us.

Says Tim: “Anybody at all who has looked at these figures knows that Incapacity Benefit has been a parking place for long term unemployed”

Posted: 2nd, February 2008 | In: Broadsheets, Money | Comments (3)

Derek Conway’s Family Business

TORY MP Derek Conway has been upbraided for using taxpayer-funded expenses to pay his teenage son almost £50,000 as a “researcher” – “even though there is no evidence of any work having been done.”

It emerged that Derek Conway had also employed his eldest son, Henry, as a researcher while he attended Cambridge

Mr Conway’s son, Frederick stopped “working” for his father last August after the scandal became public and is now understood to be studying at Sandhurst military academy.

It also emerged yesterday that Mr Conway used to employ his elder son, Henry, as a researcher while he was at Cambridge.

Henry was also paid £10,000 a year between July 2001 and October 2004. It was reported that he earned £32,000 over that period.

Frederick who at the time was a geography student at Newcastle University, was paid up to £11,773 a year, plus bonuses, for almost three years. In total, he received a gross salary of £45,163 plus pension contributions worth another £4,500.

Geography students: Discuss…

Posted: 29th, January 2008 | In: Money, Politicians | Comments (6)

Work For The State Or Work For McDonalds

YESTERDAY’S news that McDonalds’ is to offer its own qualifications “equal to GCSEs”, occupies the Guardian’s leader writer.

YESTERDAY’S news that McDonalds’ is to offer its own qualifications “equal to GCSEs”, occupies the Guardian’s leader writer.

“The fear that education would fall prey to the profiteers emerged yesterday after it was announced that authority to award A-level-style qualifications was being given to three firms: the airline Flybe, Network Rail and, most iconically, McDonald’s. If McQualifications were to displace traditional study, that would surely do for erudition what fast food has done for the diet.”

The Guardian is like that American teacher who gives their failing students an F-grade and an McDonald’s application form. This will inspire them to become more academic, not just give up and get a McJob.

And then this: Gordon Brown yesterday warned of the dire fate that would befall Britain if it failed to close its skills gap…The response is a mixed one, Mr Brown proposes heavy-handed welfare reforms along with welcome expansion in public sector apprenticeships. His plans are far from perfect, but it is to be hoped they will do the trick, because, for all yesterday’s McFlurry of publicity, McQualifications will not be enough.”

So, you can learn from the state – good – but learning from a hugely successful private enterprise is bad? And how do you get the money to fund State-run apprenticeships?

Posted: 29th, January 2008 | In: Broadsheets, Money, Politicians | Comment (1)

Heath Ledger Was Killed By Manhattan

HEATH Ledger lived in New York. He died there, too:

HEATH Ledger lived in New York. He died there, too:

The city that likes to think of itself as blasé about the many stellar presences shining in its midst is anything but. It must be written into the New York estate agent code of practice that they inform potential buyers or renters as soon as possible of any celebrity infestation in the area…

The Anorak once stood in a New York shop next to Jennifer Lopez and can only recall how short she was. There is fun to be had in spotting a celebroty. Of course, we do not all live in New York. Celebrities spotted around Anroak Towers feature Rusty Lee, the 1980s Ainsley Harriott, Page 3 stunna Nichola McLean, a footballer named “Smudger” by people who recognise him and the one not called Noel from Hear’Say.

And if stars help to define an area, some believe the reverse can also be true. Ledger’s death has been spun in some parts of the local press as a sort of morality tale, his two-mile move across the East River laden with symbolism. Old pictures were dug out of him out in the Brooklyn sunshine with pushchair and baby, a challenge to subsequent reports of late nights partying with models and Olsen twins after he’d split up with his fiancée and moved to the wicked big city.

Killed by Perth. And now offed by Manahttan. Which city really did for Heath Ledger..?

Westboro Baptist Church To Picket Heath Ledger’s Funeral

Posted: 28th, January 2008 | In: Celebrities, Money | Comments (3)

Tony Parsons On Heath Ledger And The Meaning Of Tragic

In “IT BROKE MY HEART”, the Mirror’s Tony Parsons manages to combine Heath Ledger’s death and the actions of Le Rogue Trader Jerome Kerviel.

In “IT BROKE MY HEART”, the Mirror’s Tony Parsons manages to combine Heath Ledger’s death and the actions of Le Rogue Trader Jerome Kerviel.

“It makes me laugh to read that the French trader who lost £3.6billion for Societe Generale was driven by two tragedies – splitting up with his wife and the death of his father,” says Parsons, laughing.

Tony is capturing the synergy between the showbiz press and the world of high finance. It take a columnist to spot links in what you or I may see as a non-sequitur. It’s what makes him a legend in Fleet Street.

Parson notes: “Splitting up with someone is not a tragedy. Nor is burying a parent when you are in your 30s a tragedy. These are the knocks we all suffer in everyday life. Calling them tragedies is overkill.

“Look at the faces of Heath Ledger’s devastated parents – burying your child is a tragedy.

“Think about Heath Ledger’s two-year-old daughter Matilda – that little girl never knowing her father is a tragedy.”

Tragic stuff…

Posted: 28th, January 2008 | In: Celebrities, Money, Tabloids | Comment (1)

Jerome Kerviel Anti-Anglo French Hero

JEROME Kerviel has committed the biggest individual fraud in history. In France, he’s a hero:

France behind the biggest ‘rogue trader’ scandal of all time. Some 300 miles west of Paris, in his home village of Pont l’Abbé on the Brittany peninsula, Kerviel is a hero – particularly with the ladies in the hair salon his mother used to own.

‘He was your ideal son-in-law,’ said 62-year-old Martine Le Pohon, who remembers Jérôme helping his mother out on Saturdays at Un Monde Imagin’ Hair. ‘And if it turns out that he has stood up to the system to the tune of €5m, well, as far as I am concerned, that makes him even more ideal.’

Maryvonne Even, 40, said Kerviel was a scapegoat. ‘He was probably caught fiddling – a bit – and the bosses decided to blame him for all their losses,’ she said.

But this is not just local Breton solidarity. In France, where there is profound popular distrust for big finance, strong opposition to ‘international capitalism’ and a belief in the ‘French model’ as opposed to ‘savage Anglo-Saxon liberalism’, the views of the ladies in Pont l’Abbé are widespread.

It’s all our fault…

Posted: 27th, January 2008 | In: Broadsheets, Money | Comments (5)