Money Category

Money in the news and how you are going to pay and pay and pay

BBC Fame Academy: From Poor Talent To Rich Owners

THE neo-Georgian property which was used as the setting for the BBC’s hideous Fame Academy series is set to become Britain’s most expensive home.

THE neo-Georgian property which was used as the setting for the BBC’s hideous Fame Academy series is set to become Britain’s most expensive home.

Property developer Marcus Cooper plans to turn Witanhurst, in Highgate, into London’s first £150million home.

The 1913 property, the second-largest private residence in the capital after Buckingham Palace, is set in five and a half acres. The house itself covers almost 40,000 sq feet, boasting 65 rooms on three floors, including 25 bedrooms, a library, a gym and a sauna.

Cooper, who has bought Witanhurst for £32million, says: “We are planning to carry out major renovation and redevelopment to create London’s first £150 million estate. We will be working with architects and interior designers to create a bespoke and outstanding residence in the middle of Highgate, including all the amenities one would expect.”

Charlie Ellingworth, of PropertyVision, a company which finds homes for uber-rich clients, says: “The obvious buyers would be Russian or Middle Eastern. But there are a lot of very rich people out there. If you are a billionaire, £150 million is small change.”

As well as Fame Academy, the house has also been used as a location for a number of big budget costume dramas such as Tipping the Velvet and Nicholas Nickleby.

Rumours abound that the house remains haunted by the dead careers of former Fame Academy winners David Sneddon and Alex Parks (yes, I did have to look them up).

Posted: 20th, July 2007 | In: Money | Comments (4)

Illegal Bank Charges: £200million Paid Out So Far

THE deluge of irate customers reclaiming unfair bank charges shows no sign of drying up, and already this year, the guilty banks have been forced to cough up around £200million for their sizeable sins.

That’s according to a new report by Credit Suisse, who claim that the banks have been hit hard by the consumer campaign against the dodgy charges, with the payouts costing around one per cent of the major groups’ profits.

The major banks have even been forced to take on extra staff to deal with the mountain of claims and both Barlcays and HBOS have admitted that the repayments have been eating into their profits.

However, HBOS, the group which includes the Halifax and Bank of Scotland, said it intends to separate its costs incurred by the payouts from its earnings.

Jonathan Pierce of Credit Suisse doesn’t buy the HBOS claims. Says he: “’HBOS said the number wasn’t material but that’s subjective and anything above £50m would, in our view, be material in the context of the retail bank and pose a serious threat to management credibility.”

So there you have it – keep those claims coming.

Posted: 20th, July 2007 | In: Money | Comments (4)

The Shameless Six Million Britons On Benefits

HERE’S a story for Daily Mail readers to get their teeth into – six million Britons are reported to be living in households where nobody works.

HERE’S a story for Daily Mail readers to get their teeth into – six million Britons are reported to be living in households where nobody works.

The figures, which come from the National Audit Office, also reveal that these apparently workshy households are costing the great British taxpayer almost £13billion a year in benefits.

Almost three million UK households, home to 4.2 million working age adults and 1.7 children, are now classified as workless; in 80 per cent of these households, nobody is actively seeking work.

Sir John Bourn, head honcho of the NAO, says: “More has to be done to reach out to these households and to increase awareness of the support available and help people to prepare for and find work.”

Matthew Elliot of the Taxpayers’ Alliance isn’t holding back. Says he: “Hardworking taxpayers shouldn’t have to pay out billions of pounds to people who are too lazy to get off their couches to find a job. Many people thought that Shameless was a funny TV comedy. Unfortunately it was depiction of how millions of people live in Britain today.”

Much like that fly-on-the wall reality show The Royale Family…

Posted: 20th, July 2007 | In: Money | Comments (10)

Terrible Husband Scoops £427,434 On Horseracing

HERE’S yet another tale from the Mirror of an ordinary Joe who hits the jackpot and makes the rest of us fume with intense jealousy and outrage.

This time we are invited to judge the lucky man, 40-year-old Adam Phillips, on his dodgy husband and parenting skills.

On a shopping trip with his wife Sue and two-year-old son Charlie, Phillips, a canteen worker, grew bored. In true clichéd man style, he ditched his family and popped to a bookmaker.

Phillips picked six horse race winners in succession. He pocketed £427,434.

The lucky bugger says: “I was bored with our trip to the high street so I put a bet on. When we went home I was watching racing on Channel 4 and I realised I’d the first five horses up. When my sixth race won, I ran down to my local William Hill and got them to check it. When the manager confirmed it, I was shaking.”

Phillips chose the final winner, Countdown (6/1), because he’s apparently a fan of Carol Vorderman.

Next week, a man once banned from driving wins big on a scratchcard…

Posted: 20th, July 2007 | In: Money | Comment (1)

£44,000 eBay Playstation Surprise

YOU never know what you might find on eBay – a stuffed platypus, used knickers or maybe even forty four grand stuffed in a Playstation box. That’s what an unnamed 16-year-old found after paying £95 for a second-hand games console on the auction site.

On finding the £44,000 in euros in the box, the boy, from Aylsham, Norfolk, told his parents who immediately contacted the local police and handed over the money to officers.

The original supplier of the Sony PS2 is believed to be British and the police, who were first approached by the family on March 20, were granted an order by Norwich magistrates on June 22 to hold the money for an additional three months.

A police spokesman says: “’If we find the rightful owner of the money and they have a legitimate reason for having it, the money will be returned to them. If it is found to be the proceeds of crime then the courts will be able to seize the cash for public funds. However, if ownership cannot be ascertained then this boy’s family could apply to keep it under the Police Property Act.”

Let’s hope they can keep it.

Indeed, maybe there was more than £44,000 in there in the first place and they tucked a little aside before giving the Old Bill a call.

Maybe it is the proceeds of crime and the boy is cleverly laundering via the police?

Posted: 19th, July 2007 | In: Money | Comment (1)

BBC Admits Deceiving Viewers

JUST what exactly is going with dearest Aunte Beeb? The corporation seems to be smack bang n the middle of some kind of nervous breakdown.(Pic: The Spine)

JUST what exactly is going with dearest Aunte Beeb? The corporation seems to be smack bang n the middle of some kind of nervous breakdown.(Pic: The Spine)

With the furore over the Queen’s portrayal in a BBC documentary still ringing around the hallowed halls of White City, it has now been revealed that the phone-in controversy which had previously affected Blue Peter, is actually rife, out of control and running around the Beeb’s offices like Michael Barrymore in a tutu.

In an attempt to save Auntie Beeb from committing suicide in front of a watching nation, director-general, Mark Thompson has decided to suspend all phone-in shows on the BBC until everything is sorted out once and for all.

An editorial review sparked Thompson’s dramatic decision after it was revealed that even high-profiles charity shows such as Comic Relief and Children In Need had misled viewers and used fictitious winners of phone-in competitions. Yes, that’s right – charity shows misleading the public!

A red-faced Thompson says: “There is no excuse for deception. I know the idea of deceiving the public would simply never occur to most people in the BBC. It is far better to accept a production problem and make a clean breast to the public than to deceive

Other shows which breached the broadcasting standards includeBBC1’s Sport Relief in July 2006 (yes, another charity show!) and BBC 6 Music’s Liz Kershaw Show in 2006.

Something is definitely rotten in White City. With all this deception you’d be justified in thinking that even the BBC news doesn’t always get the facts right. Now that could never happen, could it?

Nurses Depressed By Low Pay Rises

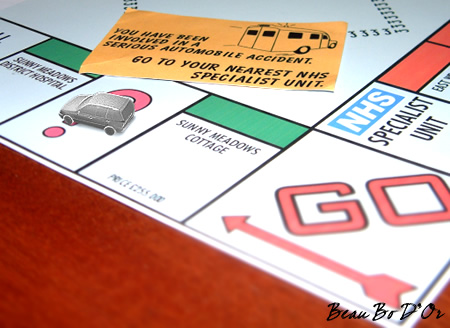

A NEW survey by the Royal College of Nursing has found that Britain’s nursing staff are less than happy with their lot, with only 34 per cent believing that the profession offers a secure job, down from 71 per cent in 2005. (Pic: Beau Bo D’Or)

A NEW survey by the Royal College of Nursing has found that Britain’s nursing staff are less than happy with their lot, with only 34 per cent believing that the profession offers a secure job, down from 71 per cent in 2005. (Pic: Beau Bo D’Or)

The survey, which questioned 9,000 members also found that 35 per cent claimed they were afraid of redundancy, a rise from just seven per cent two years ago.

One in four nurses also said they would leave the profession if they could while less than half said they would recommend it as a career.

RCN general secretary, Peter Carter, says: “To have such a large part of the nursing workforce genuinely worried about the security of their employment is simply unacceptable. Despite feeling undervalued, underpaid and under threat, our nurses continue to put in the hours and dedication to deliver high-quality patient care. But this survey demonstrates to the Government that nurses’ goodwill is at breaking point.”

Norman Lamb, the Lib Dems health spokesman is unimpressed. Says he: “Things can only get better was what Labour said when it came to power. Ten years on, nurses’ morale is at rock bottom and the Government has got to take responsibility for that. We should be very concerned because when staff morale suffers, patients suffer too.”

Indeed, 55 per cent of nurses questioned also felt that they were too busy to provide the care whey would like.

Nurses in Wales, Scotland and Northern Ireland are set to receive a 2.5 per cent pay award all in one go, but for English nurses the increase will be staggered, reducing its value, says the Mail, to 1.9 per cent over the year.

So think before you complain that your hospital dinner is cold. The nursing profession is not in the mood.

Posted: 19th, July 2007 | In: Money | Comments (5)

Gisele Bundchen Worth Four Of Kate Moss

KATE Moss may be the current darling of the tabloids, but when it comes to money, even the Croydon supermodel trails behind Brazil’s Gisele Bundchen.

KATE Moss may be the current darling of the tabloids, but when it comes to money, even the Croydon supermodel trails behind Brazil’s Gisele Bundchen.

The former squeeze of actor Leonardo DiCaprio earned £16million last year, almost four times more than the £4.4million Moss raked in.

German model Heidi Klum ranks third with a piffling £3.9million.

The Sun takes the news as an excuse to show a slideshow of the big-earning Bundchen. As you’d expect it to.

Posted: 19th, July 2007 | In: Money | Comments (3)

£135,000 Abbey Bank Blunder Blown In Weeks

SARAH-Jane Lee is in trouble. Big trouble. The struggling single mum had gone to withdraw just £10 from a local Blackburn cash machine when she got a rather big surprise – an extra £135,000 was apparently available in her account.

Was this a generous donation from a friend who had won the lottery? Or maybe it was a secret gift from a millionaire philanthropist? Well, no, unfortunately it was nothing more than a mistake by the bank.

Yet 20-year-old Lee still decided to splash the cash, booking a £10,000 holiday in Florida, buying plasma screen TVs and luxury carpet and, according to the Daily Mail, giving away almost £100,000.

Says she: “’When I realised how much money was in my account I felt nervous, numb, sick. All it said on the statement was “account adjustment” and I didn’t touch the money for a day.

“The day after the money had gone into my account, I went in to the bank and drew out £500. They should have realised then that it was their money. I asked them what ‘account adjustment’ meant but they couldn’t tell me. They just asked me if I wanted to open a savings account with the money.”

However, after two weeks the Abbey bank did realise its mistake and froze her account and now Lee is, rather harshly in my book, facing a jail term for wrongful credit and 11 charges of theft.

The Mail also mentions that she spent thousands at sex shops such as Ann Summers and Simply Pleasures. So not only is she a thieving single mother with no job, but she’s also a pervert. If only she was a Muslim immigrant.

Posted: 19th, July 2007 | In: Money | Comments (6)

Sting Stung By £24k Compo Claim

HE may have been decades ahead of the likes of Al Gore when it comes to saving the planet, but it seems that poor old Sting has more trouble dealing with his own staff than he does with Amazonian Indians. (Pic: The Spine)

HE may have been decades ahead of the likes of Al Gore when it comes to saving the planet, but it seems that poor old Sting has more trouble dealing with his own staff than he does with Amazonian Indians. (Pic: The Spine)

The Geordie superstar and his wife, Trudie Styler, have been ordered to pay their former chef, Jane Martin, £24,000 compensation after she won a claim for sexual discrimination.

Martin, 41, claimed that Miss Styler sacked her from the couple’s Wiltshire estate after she fell pregnant.

According to Martin, things started to go wrong the minute she announced that she was expecting. The abuse culminated in Sting and Styler’s decision to give her eight tulips on her 40th birthday instead of the Tiffany jewellery and Hermes watch she had received on previous occasions.

Eventually, staff from the couple’s management company, Lake House Estate, told her that her services were no longer required.

However, Sting and Styler have already been given the right to appeal.

A spokesman for Styler says: “The financial award made by the tribunal to Jane Martin is virtually meaningless since the whole case is subject to appeal which was granted in response to our submission that the original hearing displayed bias against Trudie… It remains Trudie’s position that she, as a woman and a mother, has never in her life sexually discriminated against anyone and never would do so.”

An additional claim for £1million by Martin for having to constantly listen to Sting’s bland world music/jazz noodlings has yet to be ruled on.

Posted: 18th, July 2007 | In: Money | Comment (1)

The High Cost Of Country Living

THE fresh air. The cosy village pub. The close-knit community spirit.

THE fresh air. The cosy village pub. The close-knit community spirit.

There’s a lot to be said for country living if, of course, you discount the bigoted, narrow-minded attitudes, the smell of manure and the ever-present possibility of coming across the organic Hugh Fearnley-Whittingstall butchering a pig with his bare hands.

Oh, and the cost of actually living there which, according to the Commission for Rural Communities, is actually quite a lot.

A study by the Commission has found that living in the countryside costs £60 a week more than in urban areas, with rural households spending an average of nearly £480 a week.

The average weekly disposable income in the countryside was found to be £522 with outgoings hitting almost £480 a week. This compares to urban areas where the figures were £476 and £419.50.

The report also found that the non-UK migrant workforce in rural England had risen by 209 per cent from 20,970 in 2003 to 64,870 in 2006, which is sure to put rather a lot of countryside noses out of joint.

Commission for Rural Communities chairman, Dr Stuart Burgess, says: “The sheer scale and speed of immigration has put a big strain on rural local authorities, both in their ability to provide services and ensure that new migrants are successfully integrated into their host communities.”

No doubt Gordon Brown will soon make it compulsory for immigrants moving to rural areas to wear waxy jackets, shoot anything that moves and get intimate with their own family members.

John Puts The Council Tax Cats Among The Pidgens

POOR old John Pidgen. All he was trying to do was right an injustice and fight an unfair system. Yet the 69-year-old has upset the neighbours.

The pensioner, who lives in Portslade, East Sussex, had discovered he was paying more council tax than his neighbours living in identical homes and decided to protest to the local council that he was paying over the odds.

However, rather than simply decrease Mr Pidgen’s bill, the council calculated that the other homes on his street needed to pay £298 a year or £30 a month more.

“Wouldn’t have thought I am the most popular man in the street now,” says agents Pidgen.

Catherine Biggs, 46, one of those affected by the pensioner’s investigations, is less than pleased. Says she: “I’m really angry. It just seems so unfair that we’ve had this increase put on us by one person complaining and then it going the wrong way.”

Pidgen first learned of the discrepancies over council tax when he was chatting to a neighbour.

Who would speak to him now?

Gordon Brown’s Great Britain – Land Of Inequality

IT will come as little or no surprise to hear that the rich in Britain are getting richer. (The Spine)

IT will come as little or no surprise to hear that the rich in Britain are getting richer. (The Spine)

According to a new report by the Joseph Rowntree Foundation, the UK is currently experiencing the highest inequality levels for 40 years.

The study shows that the traditionally wealthy south-east of England, along with a number of other moneyed parts of the country, have become disproportionately wealthy over the past four decades.

In areas of some cities, over half of all households are now deemed to be “breadline poor”, which means that they have enough to live on and are just above the level of total poverty, but don’t have to access to opportunities the rest of society has.

The study goes on to say: “Poor, rich and average households became less and less likely to live next door to one another between 1970 and 2000.”

The report claims that during the 1990s, the personal wealth of the richest one per cent of the population grew as a percentage of national share, jumping from 17 per cent in 1991 to 24 per cent in 2002.

Gordie Brown has a big job ahead of him.

Posted: 17th, July 2007 | In: Money | Comment (1)

Charity Fatigue A Myth: Britons Donate Billions

DESPITE the Government doing its best to destroy the nation’s community spirit and turn us into money-grabbing, soulless little automatons, we Brits remain a generous nation. Really, we do.

DESPITE the Government doing its best to destroy the nation’s community spirit and turn us into money-grabbing, soulless little automatons, we Brits remain a generous nation. Really, we do.

According to figures released by the Charities Aid Foundation, £10.9billion was donated to the top 500 charities in the UK in 2006, an increase of almost £1billion on the previous year. The charity sector has also enjoyed an 8.6 per cent rise in income year on year, over three times the growth rate of GDP.

Oxfam’s head of new income, Barney Tallack, is understandably pleased by the figures. Says he: “It’s great news that the whole sector is up and shows that ‘donor fatigue’ is a bit of a myth. There has been a lot of innovation over the last two years, with charities finding new ways of engaging with the public.”

Major global causes such as poverty, humanitarian aid, disaster funds and children’s charity accounted for 27.7 per cent of all voluntary donations, with international charities enjoying a 22 per cent increase in revenues last year.

Yet still they can’t heal Pudsey bear’s gammy eye.

Actually, come to think of it, maybe Comic Relief veteran Terry Wogan is continually hurting Pudsey in a classic case of Munchausen’s Syndrome by proxy?

Give til it hurts…

Posted: 16th, July 2007 | In: Money | Comments (6)

NHS Uses Toyota Body Parts

THE Mirror reports that health bosses splashed out £84,000 on sending a delegation to Japan in a fact finding mission to find out to how to “increase efficiency”.

Even Mirror readers can’t miss the irony in that. Fourteen doctors and chief executives studied Toyota’s “lean management” techniques.

So are the NHS about to diversify into the automobile industry – have your tonsils out and get an MOT for your car at the same time?

Posted: 16th, July 2007 | In: Money | Comments (3)

Paying Injuries To The Student Bodies

THE Sun is fuming once again as the PC-brigade continues to ruin this once great nation.

THE Sun is fuming once again as the PC-brigade continues to ruin this once great nation.

Rifling through findings on Local Education Authorities released through the Freedom of Information Act, the newspaper finds that one secondary school student, from Leicestershire, was awarded £5,700 in compensation after breaking into a school and then injuring himself whilst swinging on a gate.

The offending gate in question apparently collapsed when the boy climbed up on it. The claim formed part of an estimated £2million paid out to children who were injured on school property last year.

The Sun goes on to tell us about a £21,500 payout for a pupil in Derbyshire who suffered back strain in a drama lesson after “not receiving adequate instruction”.

Other claims include £11,334 for a boy in the West Midlands who fell after trying to retrieve his schoolbag from the top of a pile of chairs and a student in Lincolnshire who pocketed £3,000 for back injuries sustained from carrying a saxophone.

A National Union of Teachers spokesman says: “There may be circumstances where injury could not be avoided and it is likely the pupil will be awarded compensation. But this will mean higher insurance premiums for the school, taking money away from every child’s education.”

A Taxpayers’ Alliance spokesman says: “The vast majority of claims are people out to make a quick buck at the expense of taxpayers.”

Meanwhile a small boy is being eaten by a wolf. Come quick. Why d’yer mean you don’t care..?

Posted: 16th, July 2007 | In: Money | Comments (2)

Peter Hain Seduces Lone Parents Back To Work

PERMA-TANNED Peter Hain, the Secretary for Work and Pensions, has lone parents in his sights as plans are unveiled to get them back into the workforce by using “tough love”.

Hain delivered a Green Paper to the Cabinet last week, which recommended that single parents should be forced to seek work once their youngest child is 12 years or over.

The plans are based on a report by David Freud, an investment banker who reviewed the Government’s welfare-to-work strategy last year.

According to Freud, the threshold, which currently stands at 16, should be reduced to 12 years for the youngest child in a move to try and get 300,000 more lone parents back to work.

A senior Government source says: “Freud found that lone-parent families can be better off if the parent does manage to find work. We think this may be tough love but it can help people out of poverty.”

And into debt…

Sleep-Deprived Workers Costing £120million

THE Monday morning rush hour resembles a scene from Dawn of the Dead as sleep-deprived zombie workers struggle to kick-start their working week.

What with staying out all night clubbing or stalking your friends on Facebook ‘til the early hours, Britain’s working population just is getting enough sleep. And it’s costing the country £120million.

That figure comes courtesy of recruitment firm Office Angels, who found that only 51 per cent of workers said they slept for eight hours on a Sunday, with two thirds of those surveyed claiming to return to the office on a Monday morning feeling cranky and unproductive. But surely most workers feel that way every day?

It is estimated that these sleep-deprived workers are costing £120million in wasted wages, as they each spend around 20 minutes a day daydreaming and making strong coffee before settling down.

With the military already using a “wakefulness promoting agent” drug called modafinil to keep soldiers awake for days, expect big corporations to start providing it free to workers. After all, nothing should stand in the way of profit.

Tesco Admit Asda Are Cheaper

IN an aggressive new £4million TV advertising campaign, Tesco will champion its low prices to the nation. However, the supermarket giant will also admit that one of its main rivals, Asda, is often cheaper.

IN an aggressive new £4million TV advertising campaign, Tesco will champion its low prices to the nation. However, the supermarket giant will also admit that one of its main rivals, Asda, is often cheaper.

What an honest bunch those massive corporate supermarket chains are.

The new campaign, which stars the voice of veteran star Bob Hoskins, will explain to viewers that while Tesco is cheaper for 1,354 items, Asda has even better prices on 888 offers.

The new campaign is based around the Tesco Pricecheck website where consumers can compare the cost of around 10,000 products at the four main supermarkets.

Richard Brasher, Tesco’s commercial director, says: “In 1995 we tried to convince ourselves we were cheaper than Asda but that wasn’t the case. Now there’s barely the width of a credit card between us.”

With their new interest in honesty and openness, expect to see an additional ad campaigns explaining how Tesco and their fellow supermarket giants are killing Britain’s high-streets.

Taxpayers’ Alliance Diagnoses The Obese NHS Computer Sytem

WHILE the great British public struggles to keep their finances in check, news that the Government is struggling to kept its spending within budget is rather worrying.

In a new report, the pressure group, the Taxpayers’ Alliance, has revealed that more than half of 300 public sector schemes half gone over budget.

The schemes range from the NHS national computer system to a new fleet of submarines and that overspend adds up to £23million – £900 for every household in the country.

Topping the list of money black holes is that controversial NHS computer system which was originally estimated to cost £2.3billlion. Now the total cost of the project is expected to reach a whopping £12.4billion, over five times more than the original total.

The report also reveals that 14 major public sector projects have racked up bigger overruns than the infamous Millennium Dome, which went in excess of £200million over budget.

Andrew Allum of the Taxpayers’ Alliance says: “It’s astounding that the Government is currently overseeing more than a dozen domes. Having had first-hand experience of public sector capital projects, it’s clear that the politicians and civil servants in charge lack the management experience and subject knowledge to run them effectively. The Government needs to reduce the enormous scale of overruns to give taxpayers better value for money.”

It should make us all feel a little less guilty about our credit card bills. Although unfortunately, unlike the Government, we can’t call on the taxpayer or the Lottery fund to help us out of a tight spot.

Posted: 13th, July 2007 | In: Money | Comment (1)

You’re Burgled: What Alan Sugar’s Apprentice Did Next

IT’S been an eventful couple of weeks for the surprise winner of The Apprentice, Simon Ambrose. The bland public school archetype has been celebrating his new job with Sir Alan Sugar.

IT’S been an eventful couple of weeks for the surprise winner of The Apprentice, Simon Ambrose. The bland public school archetype has been celebrating his new job with Sir Alan Sugar.

But news is that the 27-year-old’s wealthy grandfather had been tied up and robbed at his home. Ambrose Jnr is “in shock”, according to the Mail.

Wealthy jeweller Percy Ambrose, 83, who runs the ‘Frocks n Rocks’ boutique at Frinton-on-Sea, Essex, with his wife Naomi Collins-Ambrose, had been sleeping when two men forced their way into his plush home.

Says Percy: “When I woke up I was confronted by two hooded men. I thought I was dreaming. They filled up five enormous bags with paintings and jewellery.”

Dearest Simon, who is, according to the Mail, “very close” to his grandfather, is currently eschewing the high-life in order to comfort the old man.

But the diamond merchant hasn’t lost his bottle. Says the posh pensioner: “This is the fourth time I have been robbed. I have had a gun put up my nose three times. I am getting used to it.”

Maybe he should get better security so he won’t have to ‘get used to it’ again?

Sneaky Lenders Pulled Up By FSA On PPI

FOR the vast majority of us, organising any kind of loan is an arduous task akin to some really hard maths homework at school. And banks, well aware of just how easy it is to blind us with numbers and complicated small print, have been making the most of our financial ignorance.

FOR the vast majority of us, organising any kind of loan is an arduous task akin to some really hard maths homework at school. And banks, well aware of just how easy it is to blind us with numbers and complicated small print, have been making the most of our financial ignorance.

The automatic addition of payment protection insurance (PPI) has been one of the most lucrative and sneaky japes instigated by lenders, with millions of pounds made each year from the ‘add-on’ sales of this extra cover, cover which is often totally useless.

But now the Financial Services Authority has decided to clamp down on the unscrupulous practice, forcing banks and loan companies to stop automatically including PPI when customers sign up for new financial products.

From January next year, customers will have to actively decide to purchase the insurance, in a move which could hit lenders and banks hard. However, the new rules will only apply to internet deals.

Vernon Everitt of the FSA says: “We are pleased that firms have agreed to change the way they sell PPI over the internet. This change means that it will be up to the customer to actively choose to buy PPI rather than it being sold automatically.”

Sign here if you don’t agree…

Sky Is The Limit For TV Giant

DESPITE its recent shenanigans with bitter rival Virgin Media, satellite TV giants BskyB are still attracting a massive number of new customers, with around 1,000 a day signing up to the satellite service.

Sky boss James Murdoch, son of the lovely and harmless Rupert, says that the company signed up an incredible 349,000 new customers in the three months up to the end of June and when customers who left the service are taken into account, it still leaves Sky with 90,000 more users in that period.

That figure is 17 per cent up on the same period in 2006 and means that the giant now has nearly 8.6 million customers.

The Sky+ service, which cleverly allows you to record, pause and rewind live TV, saw 207,000 new customers sign up while another 259,000 users signed up for the company’s broadband service.

However, a rather high 30 per cent of homes in the UK, particularly in rural areas, still can’t access the service.

Steve Weller of uSwitch says, “While people cannot take advantage of the same deals as those in more populated areas, they are effectively being treated as second-class citizens.”

What a sign of the times, people up in arms over a lack of satellite TV.

Posted: 12th, July 2007 | In: Money | Comment (1)

Music Download Insurance Lacking

THE jump from gatefold sleeves and ‘music-centres’ to MP3s and iTunes has been as revolutionary as it has been fast, however, a new report from the consumer watchdog Which? may well wipe the smug smiles of the faces of music download addicts across the land.

THE jump from gatefold sleeves and ‘music-centres’ to MP3s and iTunes has been as revolutionary as it has been fast, however, a new report from the consumer watchdog Which? may well wipe the smug smiles of the faces of music download addicts across the land.

According to Which?, many music collections which have been downloaded over the internet may not be covered by computer insurance policies.

Less than half of the 46 insurance providers investigated in the survey actually provide cover for music and other digital downloads if their computers develop technical or virus problems and the collection is lost forever. Indeed, digital music stores very rarely offer refunds for lost downloads even though are well aware of the problem.

David Griffiths, editor of the music technology boffins’ bible, Future Music, says: “I know lots of people who have lost hundreds of pounds because their computers have broken. People know they should burn their music files on to a backup disc but they never do.”

While Abigail Waraker, editor of Computing Which? magazine, tells us: “Downloading music online is widely accepted as being the easiest way to buy music. But it seems insurance companies are determined to stay behind the times.”

The message is back-up. And then back-up the back-ups.

Fat Taxes Could Saves Lives

HAVE you seen Jamie Oliver recently? The self-styled champion of healthy eating looks to have put on rather a few pounds himself. I wonder if his mother is feeding him burgers and chips through the railings outside his restaurant?

HAVE you seen Jamie Oliver recently? The self-styled champion of healthy eating looks to have put on rather a few pounds himself. I wonder if his mother is feeding him burgers and chips through the railings outside his restaurant?

Anyway, while the face of supermarket giant Sainsbury’s took his fight to school kitchens, a new report by Oxford researchers suggests that if VAT was slapped on fatty foods, more than 3,000 fatal heart attacks and strokes could be prevented in the UK each year.

The study, in the Journal of Epidemiology and Community Health, claims that a 17.5 per cent rise on fatty, sugary or salty foods would decrease the number of heart and stroke fatalities by 1.7 per cent, with the researchers saying that the time is now right to debate the introduction of a “fat tax”.

The boffins, from the Department of Public Health at Oxford University, used economic data to work out how demand would fall after the price of unhealthy foods increased, and which foods people might turn to instead. They then used the results to predict the health benefits the population would enjoy as a result.

However, Maura Gillespie of the British Heart Foundation remains unconvinced. Says she: “The debate on unhealthy diets is important as it is estimated that 30% of deaths from coronary heart disease are caused by unhealthy diets. Further evidence is needed on the effect of targeted food taxes before we can support a fat tax.”

With Jamie Oliver’s healthy school dinners crusade back-firing badly, surely the Government could at least slap a tax on the chubby-cheeky-chappy Mockney if he ever appears on our screens again?

Posted: 12th, July 2007 | In: Money | Comments (5)