Money Category

Money in the news and how you are going to pay and pay and pay

Marks And Spencer’s Ethics And Sell-By Dates

IN a bid encourage its customers to go green, Marks & Spencer is to start charging for plastic bags.

IN a bid encourage its customers to go green, Marks & Spencer is to start charging for plastic bags.

The new scheme, starting in the summer, is being trialled at 14 stores in Northern Ireland where customers will have to pay 5p for every carrier bag they use.

If successful, the scheme will be introduced across the UK later in the year with other retailers also likely to follow suit.

While the Republic of Ireland saw plastic bag use fall by 90 per cent when it introduced a tax back in 2002, the British government has continually dodged the issue. However, if the new M&S scheme is successful, ministers may be forced to act.

It is estimated that shops in the UK hand out over 13 billion carrier bags every year with most of them ending up in landfill sites, where they take up to 500 years to break down.

M&S are expected today to announce profits of over £1 billion, up a quarter on last year, with experts attributing this success to the company’s growing image as an ethical retailer.

M&S competitors Sainsbury’s and Tesco are accused of deliberately extending sell-by and use-by dates on fresh food on a BBC 1 ‘Whistleblower’ documentary tonight.

Posted: 22nd, May 2007 | In: Money | 0 Comments

Peter Hain Targets City Fat Cats

PERMA-TANNED Welsh Secretary Peter Hain launched his Labour deputy leadership tilt by declaring war on the City. (Pic: The Spine)

PERMA-TANNED Welsh Secretary Peter Hain launched his Labour deputy leadership tilt by declaring war on the City. (Pic: The Spine)

The apartheid-activist turned Iraq War apologist wants the enormous bonuses paid out in the City to be capped and warned that Government could step in if the “staggering” bonuses aren’t curtailed.

Speaking at the launch of his campaign for the pretty pointless job of Deputy Leader of the Labour Party, the 57-year-old says: “We should take some immediate measures to promote a greater sense of responsibility in Britain’s boardrooms. British citizens who do not pay their tax in the UK should not receive honours, write government reports or become members of quangos. They should not be allowed to serve in a reformed House of Lords.”

An end to City excess? Responsibility in Britain’s boardrooms? Is he deliberately trying to undo everything Tony Blair has achieved in the last 10 years?

Speaking of the outgoing Prime Minister, hundreds of gifts given to Blair during his stint at leader are to be sold off in a high-class yet low-key sale.

Posted: 22nd, May 2007 | In: Money | 0 Comments

Consumers Wising Up As Housing Market Cools

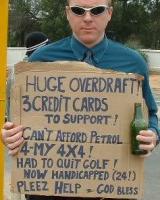

ARE British consumers starting to take care of their finances after a long period of mindless money mismanagement?

According to a new report by the Building Societies Association, mortgage approvals fell in April compared to the same month last year, down from £4.2 million to £3.9 million.

Central to this slowdown in the housing market has been the recent flurry of interest rate rises; according to Hamptons International Mortgages, 70% of borrowers fixed their mortgages before the Bank of England’s last interest hike earlier this month.

This new-found parsimony is also backed up by British Bankers’ Association figures which show that both unsecured personal borrowing and credit card borrowing experienced little change in April compared to March.

BBA statistical guru David Dooks says: “Lower mortgage demand, weaker deposit growth and little change in personal loans or credit card borrowing all point to people paying more attention to their finances. High house prices and increasing monthly repayment costs are causing a slow down in the mortgage market and people are using money from their accounts instead of borrowing to meet their spending needs.”

But the debt is still there to pay…

If you are still willing to splash the cash on a new home, then why not go for “Belle Tout”, a lighthouse on Beachy Head which is on the market for £850,000, just six years after the council sold it for £900.

Posted: 22nd, May 2007 | In: Money | 0 Comments

Andy Warhol Print Goes For Record Sum

CONSIDERING that it was originally picked up for £125 back in 1962, the £14 million paid for Andy Warhol’s ‘Lemon Marilyn’ print represents rather a good bit of business.

CONSIDERING that it was originally picked up for £125 back in 1962, the £14 million paid for Andy Warhol’s ‘Lemon Marilyn’ print represents rather a good bit of business.

The work was one of 13 sought-after silk prints made by the idiosyncratic Warhol of Marilyn Monroe using a still from her 1953 film Niagara.

The £14,090,452 price of the work was double the estimate. But still small change compared to the record £36.04 million splashed out at Christie’s in New York yesterday for another of Warhol’s silkscreen prints, Green Car Crash (Green Burning Car I). That print, of a 1963 Newsweek photo of a Seattle car crash, is considered the Holy Grail of Warhol’s work. It was bought for £36,000 in 1978.

Both pieces went to private collectors. And should cover that nasty stain on the wall very adequately…

Posted: 18th, May 2007 | In: Money | 0 Comments

NHS GPs’ £300 Million Drug Waste

IN bathrooms across the land, lurking at the back of the cabinet, will be at least one half-used bottle of tablets, years past its use-by-date. Add up all those unused medicines and you have a mountain of medication, and a huge waste of money.

According to a new report by the National Audit Office, Britain’s GPs are wasting over £300 million by prescribing expensive branded drugs to patients or drugs that are never used.

The NAO accuses some doctors of allowing their NHS patients with long-term conditions to build up huge stockpiles of medicines while many patients were either failing to collect drugs from their pharmacy or not bothering to take them when they got home.

More than £8 billion was spent on medicines by the NHS in 2006, equivalent to £22 million a day. And in the last ten years, the primary drugs bill has shot up by 60%.

The report also found that, in relation to the prescribing of more expensive branded drugs, two-thirds of the GPs surveyed blamed local prescribing advisors rather than marketing from the pharmaceutical industry for influencing their choice of medicine.

The other third were too busy out on the golf course. Or in private practice…

Posted: 18th, May 2007 | In: Money | 0 Comments

Come Fly For Free: Ryanair Gives Flights Away

JUST when you thought flights couldn’t get any cheaper Ryanair decides to give flights away for free – paying the taxes, fees and charges.

After the offer went live yesterday at 10am, the Ryanair website collapsed as 4 million attempts by frenzied travellers were made to secure the tickets in the first five hours.

With low-cost airlines experiencing an unexpected drop in demand last month, as well as being hit hard with the recent doubling of air passenger duty, Ryanair are desperate to fill their planes.

According to the company’s spokeswoman: “This is about getting bums on seats. We are paying to get passengers into our planes – we’ll be paying the tax that they would normally have to pay. There’s no point in flying planes empty.”

However, the move has been condemned by Friends of the Earth, with aviation campaigner Richard Dyer calling the giveaway “grossly irresponsible”. Said he: “Passengers may be getting a free ride, but the planet certainly isn’t. It is unbelievable that Ryanair is resorting to such tactics.”

The company hope to recoup the travellers’ taxes it is paying for by encouraging them to cough up for add-ons such as onboard meals and snacks, travel insurance, car hire and hotel bookings.

However, with the likes of Ryanair, EasyJet and even BA all admitting that they are struggling to fill their planes, the industry in general could be about to experience some turbulence.

Posted: 17th, May 2007 | In: Money | 0 Comments

Penalty Pointless: Insurance Firm Ignores Penalty Points

BOY-RACERS will be revving their souped-up engines in joy today after it emerged that drivers with penalty points could see their insurance premiums fall.

In a move that is predicted to be followed by all the major insurance companies, Swinton Insurance announced that those drivers with six or nine penalty points on their licence would now be treated almost as though they had a perfect record.

A Swinton spokesperson tells us: “Penalty points used to be the yardstick for dangerous drivers, but with up to 10 million drivers collecting them, they are so common place that they have almost become pointless. We will be looking at each driver as an individual and not automatically upping the cost of their premium if they have six penalty points on their licence.”

With more than 6,000 speed cameras now in use, trapping around two million motorists a year, clean licences are become far less common. Critics claim this move is an indictment of the system.

Lobby group SafeSpeed’s head honcho Paul Smith says: “This announcement is all the proof we need to know that driving licence points no longer indicate risky drivers. The vast majority of licence points are for speeding offences detected by camera.”

Posted: 17th, May 2007 | In: Money | 0 Comments

Jagger And Hall Can’t Get No Satisfaction

MONEY is consistently cited as one of the biggest causes of arguments in a marriage. And for Mick Jagger and Jerry Hall the subject is still a bone of contention despite their split eight years ago.

MONEY is consistently cited as one of the biggest causes of arguments in a marriage. And for Mick Jagger and Jerry Hall the subject is still a bone of contention despite their split eight years ago.

In response to Hall’s recent claims that her ex was “pretty tight with the day-to-day stuff”, multi-millionaire rock icon Jagger has hit back.

Says he: “I find her remarks absurd. I have always paid all expenses for the children as well as the lion’s share of the costs relating to her lifestyle, and been more than happy to do so.”

Jagger has always been a financial squirrel, raking in record profits from the Stones’ seemingly constant touring.

The sixty-something rocker also managed to negotiate a comparatively low £10 million divorce pay-out in 1999 after claiming that his then marriage to Hall nine years earlier wasn’t legal.

Hall is no doubt learning that you can’t, er, always get what you want.

Posted: 17th, May 2007 | In: Money | 0 Comments

Quiz Show Scandals Hurt ITV

ITV, home to such intellectual luminaries as Jeremy Kyle and Vernon Kay, has admitted that the recent phone-in and quiz show scandals have seriously damaged consumer confidence.

Following the revelation back in February that Channel Four’s Richard and Judy show had been misleading entrants in a phone-in quiz, a whole host of similar dodgy premium rate scams came to light, including one concerning ITV’s X-Factor show.

Now, ITV expect to see a substantial drop in the income it receives from phone-ins and quizzes, which brought in £100 million last year.

Ahead of their annual shareholder meeting, ITV said “the poor execution of these services across the sector has reduced consumer confidence and is having a material impact on premium rate telephone service (PRTS) revenues.”

Unfortunately there was no mention of axing “This Is David Gest”…

Posted: 17th, May 2007 | In: Money | 0 Comments

Water Companies Get River Of Complaints

HOSPIPE bans and apparent water shortages have become as synonymous with the British summer as a Tim Henman failure at Wimbledon and wasps.

A new report reveals that many companies who impose the bans have been experiencing increasing levels of complaints from customers.

The Consumer Council For Water says that complaints about water companies in England and Wales rose by 10% last year and are now at their highest levels since the mid-nineties.

Over 13,000 complaints were received by CC Water in the 12 months up to the end of March with many customers enraged by billing errors.

Severn Trent received the largest number of complaints – 2,652, up 36% from the previous year. And South East Water will also be disappointed by the findings – complaints to their company jumped by a massive 74%.

Chairwoman of CCWater, Dame Yve Buckland, says: “We have a right as consumers to expect high quality customer service, even though water companies are monopolies, and therefore most consumers have absolutely no choice over their supplier. Water companies cannot be complacent and should strive not only to satisfy customers’ expectations, but exceed them.”

Expect another summer of drought-ridden lawns. And Henmaniacs…

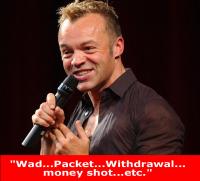

Credit Goes To Graham Norton

TV funny man Graham Norton has been persuaded to disassociate himself from presenting an unpopular award at a finance industry bash to be held on Thursday evening.

TV funny man Graham Norton has been persuaded to disassociate himself from presenting an unpopular award at a finance industry bash to be held on Thursday evening.

The Irish presenter had been pencilled in to present an award for the best home credit lender at the awards ceremony at London’s Grosvenor House Hotel. However, after an appeal from pressure group Debt On Our Doorstep, the comedian has decided to pass on handing out the gong.

The nominees up for the award include Bristol Finance & Credit Services, a company which charges as much as 1,068% APR on loans of £100 when a payment is missed.

Debt On Our Doorstep chairman, Damon Gibbons, says, “There shouldn’t be any place at an awards ceremony for any of these lenders. They rip off the poorest, keep them in a cycle of increasing debt, and degenerate entire communities. We’re delighted that Graham has agreed to sit out that part of the ceremony, and send out such a message.”

Er, not quite. Despite sitting out that particular presentation, Norton will still front the overall event.

Graham Norton and a room full of money people – sounds like a wild night.

A Kewell Customer: Liverpool Backer Wins

LIVERPOOL FC’s oft-injured Aussie star Harry Kewell helped a punter to £178,000 after netting a last-gasp penalty in the Reds’ 2-2 draw with Charlton Athletic.

LIVERPOOL FC’s oft-injured Aussie star Harry Kewell helped a punter to £178,000 after netting a last-gasp penalty in the Reds’ 2-2 draw with Charlton Athletic.

The unnamed gambler from Sawston in Cambridgeshire had correctly predicted the other results from the final day of the Premiership but needed Liverpool to draw in order to complete his accumulator bet.

Then, with only seconds remaining in the game, Kewell tucked away his spot-kick to earn the punter a small fortune.

Corals, who paid out the money, said it was one of the betting company’s biggest-ever pay-outs. “It’s cost us a fortune,” says a spokesperson through gritted teeth, “but we have to congratulate him.”

The £10 bet came in at staggering odds of 17,841-1, about the same price you’d get on Kewell going though next season without picking up another injury.

Posted: 16th, May 2007 | In: Money | 0 Comments

Over-The-Odds Home Insurance

HOME insurance may make us all sleep a little bit better at night, but new research by the Post Office is sure to give us all a wake up call.

According to the Post Office, over eight million homeowners are paying too much for their home insurance, with the overall national figure overpaid reaching at least £1 billion.

The survey found that one in ten thought it was compulsory to buy their mortgage lender’s insurance while one third were convinced that their mortgage would be at risk if they shopped around and bought elsewhere.

The Post Office also claim that over 60% of homeowners could save £90 by switching insurance and a further 10 per cent up to £173.

However they failed to explain why they lose so many of our bloody letters.

Posted: 16th, May 2007 | In: Money | 0 Comments

Don’t Bank On Justice: Illegal Overdraft Charges

WITH banks settling out of court left, right and centre over their infamous illegal overdraft charges, it seemed that finally, the big boys were getting what they deserved.

WITH banks settling out of court left, right and centre over their infamous illegal overdraft charges, it seemed that finally, the big boys were getting what they deserved.

However, news that a claim against Lloyds TSB has been dismissed by a judge in Birmingham county court will no doubt cheer the banking industry and unfortunately make new claimants thing twice about going head to head with the financial titans.

In throwing Kevin Berwick’s claim for £2,545 out of court, Judge Cook said, “Having held that the charges complained of are not charges for breach of contract but part of the price of the services provided by the bank… he has not satisfied me that he has any ground in law for recovering from the bank the amount of any charges which he has paid to it,”

However, despite the ruling, MoneySavingExpert.com founder Martin Lewis remains positive. Says he: “To all those reclaiming charges it’s a case of ‘don’t panic’. Across the country the banks are still paying out many tens of thousands of pounds a day and the weight of huge numbers of successful reclaims so far easily outweighs this one anomalous result. The banks seem to have got lucky with a sympathetic judge.”

A judge who, no doubt, doesn’t need an overdraft.

Posted: 16th, May 2007 | In: Money | 0 Comments

Watching You: Child Support Agency Spies

IT seems that hardly a day goes by without some security bungle or other by a government agency.

IT seems that hardly a day goes by without some security bungle or other by a government agency.

This time it’s the Child Support Agency in the firing line after it was revealed that CSA staff have been allowed to carry out credit checks on friends and neighbours. Just for the hell of it.

According to the Mirror, inexperienced staff were allowed to utilise credit search agency Equifax to snoop on individuals’ personal finances.

According to an unnamed CSA source, “This is a scandal. They gave access to part-time and temp workers they knew nothing about. They could get info on anyone in the country with a credit history.”

While former Scotland Yard fraud office Tom Craig is also concerned. He says the “risk is colossal – it is a major data protection breach”.

What is all the more worrying is the news that CSA bosses were fully aware of the situation.

We might as well all just write our bank details on our foreheads in indelible ink.

Posted: 16th, May 2007 | In: Money | 2 Comments

Paid By The Inch: Chelsea’s Michael Ballack Wins

MICHAEL Ballack, Chelsea’s expensive makeweight is £35,000 better off.

MICHAEL Ballack, Chelsea’s expensive makeweight is £35,000 better off.

No, Ballack, who earns around £130,000 a week at Chelsea, has not collected a bonus for being Chelsea’s most expensive flop of the season – that golden donkey goes to Andriy Shevchenko.

Ballack has won the money by way of legal settlement from the German sex-shop chain Beate Uhse.

Last year, the shops introduced its World Cup edition vibrator, in honour of their country’s captain.

Ballack was unimpressed with the vivid red, seven-inch vibrating plastic penis. So he commenced legal proceedings. And a court in Hamburg weighed up the evidence and found in his favour.

Judges ruled that the player’s rights had been breached.

And so it is that Ballack is £35,000 better off. Which works out at £5,000 an inch.

Which is just shy of what Ballack earns for walking about Stamford Bridge…

Posted: 15th, May 2007 | In: Money | 2 Comments

The Great £1 Property Giveaway

WHAT’S this? Has the property market collapsed overnight?

News is that if you have a solitary pound in your pocket you can bag yourself a swimming pool, or what about an old hospital or even a disused pub!

A new Government scheme means disused public buildings are to be sold to community groups for as little as £1 in an attempt to revive the nation’s ailing local facilities.

Ruth Kelly, Secretary of State for Communities and Local Government, and Celebrity Opus-Dei member, will launch the new initiative in Sheffield, where she will announce a £30million fund to support the project (before consoling fans of relegated Sheffield United with six hours of prayer and self-mortification).

The scheme, which chimes with PM-in-waiting Gordon Brown’s desire for more community involvement in local decision-making, follows a report published by Lewisham Council bigwig Barry Quirk, which argued that communities are strengthened when public assets are handed back to them.

Up to 1,500 community organisations are predicted to benefit from the scheme. But a spokesman for the Local Government Association remains unconvinced. Says he: “Serious questions must be asked as to whether a prime piece of real estate that is owned by taxpayers should be sold for as little as £1.”

And how buildings funded by the taxpayer was allowed to fester…

The Bank That Likes To Say Yes: Halifax Fraud

A CUSTOMER adviser who worked at the Halifax bank in Bexleyheath has been jailed for four years after helping fraudsters steal £2.3 million from accounts.

Twenty-four-year-old Shana Campbell passed confidential bank details to criminal mastermind Olawasegun Adekunle. The cash funded his lavish lifestyle which included a luxury apartment overlooking the Thames and a £87,000 Bentley Continental.

Victims of the massive fraud include a vicar, pensioners, businessmen and even a Nigerian prince, while former BBC war-correspondent Rageh Omar had a lucky escape after a telephone caller posing as the journalist tried unsuccessfully to access his account.

Council janitor Steven Fabian was also convicted for money laundering while a number of car dealers involved in the dastardly plan were also sent down.

Campbell’s claims that she only acted under duress were dismissed by the judge who told her, “Yours was a sustained, determined dishonesty. In my judgment, you were enthusiastically dishonest, even taking work home with you.”

If only all bank staff were as eager to please.

Phish And Chips: Chip And Pin Readers For Home Shoppers

IN the never-ending battle to thwart online fraudsters, high street banks such as Barclays and NatWest are sending out millions of Chip & Pin card-readers to online customers who want to transfer money over the web.

IN the never-ending battle to thwart online fraudsters, high street banks such as Barclays and NatWest are sending out millions of Chip & Pin card-readers to online customers who want to transfer money over the web.

After inserting your card and entering your pin into the device, a randomly generated number will appear which you then type into your computer for authorisation.

With online fraud reaching near epidemic levels, the banking giants are hoping that the new system will scupper the uber-sophisticated fraudsters who dredge the net for unprotected money.

However, James Roper of online retail lobby group IMRG, is less than enthusiastic. Says he: “It’ll confuse people, it’ll be compromised and it’ll be out of date by the time it comes on the marketplace”. So there.

If the trial is successful, the gizmos, which are the size of a pocket calculator, could also be used for online shopping.

If it flops, you’ll have a piece of technological history which you can flog on eBay for £1.50.

Posted: 15th, May 2007 | In: Money | 0 Comments

Pretty Vacant: Lack Of Skilled Labour

COMPANIES in Britain are struggling to fill all their job vacancies, according to a report in the Guardian.

A survey by the snappily monikered Chartered Institute of Personnel and Development and accountants KPMG found that 48% of employers are anticipating recruitment problems in the current quarter, a rise of two percentage points on the previous term.

While increased immigration has provided a healthy supply of labour in recent years, a number of white-collar industries are starting to struggle to fill all their vacancies.

The report also predicts pay rises will remain modest for the moment although the threat of higher pay inflation has increased.

So hold off on asking your boss for a raise.

Posted: 14th, May 2007 | In: Money | 0 Comments

Unpaid Old Bills: Police Want Their Money

THE Government has come under fire from police forces across the land for failing to cough up £7million owed to the nation’s law enforcers.

The Mirror reveals that police spent over £11.3million locking up prisoners to help ease overcrowding in the country’s jails, working almost 300,000 extra hours in guarding thousands of prisoners and even paying private security firms to take inmates.

However, so far, the new and rather Orwellian-sounding ‘Ministry of Justice’ has failed to pay up, angering the likes of the Metropolitan Police, who are apparently owed £2.7million and Greater Manchester Police who have received just £85,368 of its £576,173 bill.

Not surprisingly, the Police Federation have called the delays “unacceptable”.

Posted: 14th, May 2007 | In: Money | 0 Comments

Things Get Even Worse For Web Fraud Victims

WHAT could be worse than having your credit card details nicked? How about then being accused of being a paedophile?

According to the Daily Mail, hundreds of Britons fingered in the country’s biggest internet child pornography investigation were simply the victims of credit card fraud.

Police from the enquiry codenamed ‘Operation Ore’ have admitted that a number of people on the list of 7,200 suspects were nothing more than victims of card fraud although they claim that none of those innocents have been prosecuted.

Simon Bunce, who was accused of using one Texas-based child porn site before having all charges dropped, is understandably less than happy. Says he: “Thirty-nine people committed suicide after being accused of what I was accused of. I reacted in a different way. I investigated it diligently and I established I was the victim of credit card fraud.”

Perhaps the credit card issuer should now be charged for failing to protect a customer?

Posted: 11th, May 2007 | In: Money | 0 Comments

The Dead Poole: Barclays Lay Off 1,100

DESPITE making enormous profits of £7 billion last year, Barclays, those kings of the bank charge, have decided to axe over 1000 job yesterday from their offices in Poole, Dorset.

DESPITE making enormous profits of £7 billion last year, Barclays, those kings of the bank charge, have decided to axe over 1000 job yesterday from their offices in Poole, Dorset.

Barclays House, a landmark building in Dorset, housed an IT support team but will now be closed as the banking giants transfer most of the work overseas.

1,100 jobs will seem like a drop in the ocean, however, if Dutch bank ABN Amro complete their £45 billion takeover of Barclays. If that deal goes ahead, up to 30,000 workers will face the chop.

Not surprisingly, union officials such as Unite’s Steve Pantak are less than pleased. Says he: “ They’re (the bank workers) in a state of shock. There have been rumours that the building was going to close, but at least Barclays is planning to open another site nearby.”

So that’s alright then. Expect a new cash machine in Poole very soon…

Posted: 11th, May 2007 | In: Money | 4 Comments

Interest Rates On The Up And Up

THOSE financial boffins at the Bank Of England just can’t stop fiddling with interest rates, can they? Yesterday’s quarter point increase to a six-year high 5.5 per cent is the fourth such hike since August and is yet another kick in the privates for the nation’s homeowners.

THOSE financial boffins at the Bank Of England just can’t stop fiddling with interest rates, can they? Yesterday’s quarter point increase to a six-year high 5.5 per cent is the fourth such hike since August and is yet another kick in the privates for the nation’s homeowners.

The increase, introduced to combat rising inflation, will add around £16 a month to a typical £100,000 mortgage bill, while homeowners with a £200,000 repayment mortgage have seen their repayments increase by over £1000 since last August.

Indeed, Adam Sampson of housing charity Shelter said that these latest rises could be “the final nail in the coffin for many borrowers hoping to keep their homes”.

He adds: “Thousands of families are already overstretching their finances to keep a roof over their heads”.

While some doom-mongers are predicting even more rate rises in the summer, CBI bigwig Ian McCafferty has a more rosy outlook. Says he: “While we fully accept the need for today’s rate rise, we see no reason for a further increase at present, as the impact of the 1% increase in rates since last August should be sufficient to keep inflation pressures into 2008 under control.”

Anyone believe that?

Posted: 11th, May 2007 | In: Money | 0 Comments

Immigrant Orange

“THEY come over here and take our jobs. And our homes. And our women. And our men”.

“THEY come over here and take our jobs. And our homes. And our women. And our men”.

No matter how much immigrants contribute to the economy, state services and to the fabric of these islands, there will always be those loveable dissenters.

However, Orange is the latest company to welcome the new arrivals with open arms and view them as they do all of us – as another way to make money.

The phone company has now launched a cheap international phone service that will allow immigrants and foreign workers in Britain to call overseas from their mobiles at a cheaper rate than those offered by international phone cards.

With people forking out around £800 million on international call cards every year, the market is enormous and with Orange’s new service, customers won’t have to deal with the fiddly pin numbers, poor call quality and high costs.

Instead, they can purchase the “Orange Call Abroad” pay-as-you-go SIM card for £5 and call home, wherever home may be, from their mobile.

Posted: 10th, May 2007 | In: Money | 0 Comments