Money Category

Money in the news and how you are going to pay and pay and pay

Ofcom Cuts Phone Bills

OFCOM have decided to cut the cost of calling mobiles, says the Times.

OFCOM have decided to cut the cost of calling mobiles, says the Times.

The communications regulator will impose the price cuts until 2011, with the average home phone bills likely to fall by about £8 a year.

Still, anything that gets the big boys to cough up just a little more is worth celebrating, although mobile phone operator 3 are apparently pondering a challenge to the ruling.

Overall, Ofcom puts the consumer savings at between £400 and £500 million a year for the next four years (don’t get too excited, it’s still only £8 a year on a typical home home bill) although mobile phone customers won’t gain at all as any savings will be offset by price increases elsewhere.

Posted: 28th, March 2007 | In: Money | 2 Comments

Building The 2012 London Olympics From Scratchcards

WEMBLEY – the new Wembley – is ready and one day so too will be the new Olympic complex in the East End of London. And Beau Bo D’Or has the pictures to give hope to one and all that it will be ready on time.

But it needs paying for. A huge sports stadium at the less salubrious end of London doesn’t build itself. The budget for the 2012 London Olympics has risen to £9.35bn, nearly four times the £2.4bn estimate when London’s bid succeeded.

Construction is now budgeted at £5.3bn. There is a £2.7bn “contingency fund”, in case builders fail to reach their targets. If they do, the workers can be assured that they will be well paid for extra work.

Do you think the construction companies will need to tap into this massive pot of spare cash?

Maybe. Just maybe. Try it with your loft extension. Tell the builder that if he fails to do the job on time and to budget, you have an extra, say, ten grand in your back pocket that he can have. Let us know what happens.

But the Olympics is a good cause. So an extra £675m will be squeezed from lottery funds – now £1 in every £5 of good cause money goes to the Olympics.

So dig deep. Then deeper. Buy one of our new Olympic scratchcards. Keep the flame alive…

It will happen. Here’s a reminder of how the new Wembley was once a dream…

Posted: 27th, March 2007 | In: Money | 0 Comments

PC’s Supermarket Sweep

AS big corporations continue to get even more money out of us by whatever means necessary, a humble copper has managed to stick one in the eye of big business, albeit illegally.

AS big corporations continue to get even more money out of us by whatever means necessary, a humble copper has managed to stick one in the eye of big business, albeit illegally.

“PC Clubcard” as the Telegraph hilariously (my side are actually splitting) christens policeman Shaun Pennicott, found a loophole in Tesco’s Clubcard system and systematically returned to their stores, day and night, in order to repeatedly scan the same voucher at self-service tills.

All this scanning eventually earned the 42-year-old office a whopping 75,000 points which he then converted into British Airways air-miles.

The Times reports that the 42-year-old, who has a holiday home in Tenerife, initially took advantage of a Tesco promotion involving Bird’s Eye meals, buying 759 of the cheapest meals in three days, thus legally receiving 38,000 Clubcard points.

However, his Clubcard habit grew to the rather mundane point where he was popping into the supermarket at every opportunity.

An £800 fine and an order to do 120 hours community service was the criminal mastermind’s punishment, although apparently, according to Tesco themselves, the loophole is still open as it would be too costly to close down.

Hmmm, I suddenly feel the need for a few hundred fish fingers…..

Posted: 27th, March 2007 | In: Money | 0 Comments

More Council Tax

THAT mess of rubbish strewn on the ground after the bin-men have been, those street-lights than haven’t worked for years, the graffiti on the wall outside that has never been cleaned up (although maybe the latter is a Banksy creation)…

THAT mess of rubbish strewn on the ground after the bin-men have been, those street-lights than haven’t worked for years, the graffiti on the wall outside that has never been cleaned up (although maybe the latter is a Banksy creation)…

Well, it’s all paid for by your council tax contributions and now, according to the Telegraph, you’ll have to pay even more.

The Government are expected to unveil above-inflation council tax increases today, with bills set to rise by an average of 4.2%.

Indeed, since New Labour came to power, council tax revenues have more than doubled to £23.5 billion while the bill for an average band D home has shot up by 85% in the same period.

Tony Blair’s home comes with the job…

Barclay’s Diamond Geezer

AS large swathes on the British population continue to challenge their banks over illegal bank charges, let’s spare a thought for the appropriately monikered Barclays president Bob Diamond.

AS large swathes on the British population continue to challenge their banks over illegal bank charges, let’s spare a thought for the appropriately monikered Barclays president Bob Diamond.

The Independent tells us that the 55 year-old could earn a potential £42 million for his work in 2006.

That figure is apparently made up of a “basic salary of just £250,000” (not much more than the minimum wage then), with a cash bonus of £10.4 million and shares worth £4.5 million thrown in.

The Telegraph puts the total figure at a measly £22 million which still makes the passionate Chelsea fan the best paid executive of a British listed company.

Not surprisingly, Barclays did their best to justify the enormous salary package, claiming that it was “linked to performance and should be seen in the light of actual achievement”, while the BBC’s business editor has little problem with the salary either.

Mr Diamond’s overdraft limit is not reported…

Posted: 27th, March 2007 | In: Money | 2 Comments

We Shall Not be Moved By Estate Agents

MOVING house is considered to be one of the most stressful things one can do, along with filling in your tax returns and watching Steve McClaren’s England play.

MOVING house is considered to be one of the most stressful things one can do, along with filling in your tax returns and watching Steve McClaren’s England play.

However, according to the Telegraph, the average homebuyer now has the added pressure of rapidly rising taxes and costs.

Indeed, in the last decade, the cost of moving house has almost tripled to a staggering £10,000.

The BBC takes its figures from a recent survey by Propertyfinder.com and the website breaks those costs down into £5,000 in stamp duty, £3,000 in fees for those lovely estate agents, £1000 for those similarly lovely lawyers and their fees and finally, around £450 for removal costs.

Not surprisingly, with people discouraged by these hideous costs and deciding to stay where they are, the current market has the fewest properties on sale in a decade.

Boom & Gloom

Staying with the wonderful world of housing, the nation’s capital, home to Pearly Kings, Russian billionaires and a never-ending choice of free newspapers, has enjoyed yet another property boom with March experiencing the largest monthly increases in four years, says the Guardian.

In a report by Hometrack, London has apparently become ‘disconnected from the rest of the country’, with property prices rising by 1.8% in March, the biggest hike since the summer of 2002.

With demand for homes in the city from bonus-rich City boys and a shortage of properties in the capital, this metropolitan boom has, according to the Independent, lead to a ‘ripple effect’ in the suburbs, with the likes of Sutton, Merton and Brent all seeing big price increases.

Posted: 26th, March 2007 | In: Money | 0 Comments

eBay & The Web Of Deceit

NOT content with being skinned alive by outrageous bank charges, the innocent consumer has now also been taking to the cleaners by that purveyor of all known evils – the internet.

According to a survey by Get Safe Online in conjunction with the BBC, 12% of us have suffered online fraud in the last 12 months, at an average loss of £875.

Ebay’s Garreth Griffith (a man with the rather woolly title of ‘head of trust and safety’), whose website has been the target of all sorts of fraud and phishing shenanigans, urges its users to read the website’s security information – “Just as people buying a video recorder dispense with the instruction manual so that mentality manifests itself on the internet.”

Good point. But what’s a video recorder?

Posted: 26th, March 2007 | In: Money | 0 Comments

Old Folks’ Homes – The 127-Year Mortgage

BACK to the property game for a tale of either admirable trust or bad business practise, depending on your point of view.

BACK to the property game for a tale of either admirable trust or bad business practise, depending on your point of view.

A 102-year-old pensioner from East Sussex has been given a £200,000 mortgage to be repaid over 25 years, says the Mirror.

The unnamed man, born the same year as Christian Dior, Jean-Paul Sartre and Howard Hughes, will be 127 if the loan runs its full term, beating the world-record for the world’s longest-living person, which currently stands at 122.

However, while more and more pensioners are looking to boost their savings with investments in property, Age Concern’s Gordon Lishman is indeed concerned.

Says he: “It’s crucial they think through the long-term implications. Changes in circumstances, such as retirement illness and disability, divorce and bereavement can all contribute to debt problems later in life”.

One suggests that it’s the ‘bereavement’ bit that may have the most relevance in this case.

Posted: 26th, March 2007 | In: Money | 2 Comments

Arsenal Takeover Mystery

AS Arsenal buy yet another teenage prodigy in Arsene Wenger’s quest to field the first-ever pre-pubescent Premiership team, Arsenal fans’ interest has turned to boardroom shenanigans.

AS Arsenal buy yet another teenage prodigy in Arsene Wenger’s quest to field the first-ever pre-pubescent Premiership team, Arsenal fans’ interest has turned to boardroom shenanigans.

As the last of the big four Premiership clubs to remain in English hands, somewhat ironically considering their penchant for foreign talent, fears are rising that a takeover bid from either Russia or the Middle-East could be on the cards, according to the Times.

The north Londoners’ largest shareholder, diamond dealer Danny Fizman, has recently offloaded some of his stake in the club, a move which has seen the club’s share price rise £900 to £6,200 in just a week.

However, just who has been buying Fizman’s shares (659 of them at £5,975 a pop) remains to be seen. Although the Arsenal powers-that-be continue to deny takeover rumours, a spokesman for the Arsenal Supporters’ Trust admitted, “It is all very intriguing. We know who is selling, but we don’t know who is buying the shares or why”.

Could it be a Russian oligarch? A Qatar billionaire? A mild-mannered janitor? Or maybe it’s a Royal Bank of Scotland director?

Posted: 23rd, March 2007 | In: Money | 0 Comments

George Osbourne’s Tuppence Worth

AS the dust settles on Gordon Brown’s less-than-exciting two penny budget, people wanting to claim for the government’s tax credits scheme will have to wade through a voluminous 60 page booklet before filling in a fiddly 12 page form, says the Sun.

AS the dust settles on Gordon Brown’s less-than-exciting two penny budget, people wanting to claim for the government’s tax credits scheme will have to wade through a voluminous 60 page booklet before filling in a fiddly 12 page form, says the Sun.

Shadow Chancellor George Osborne is the first to bemoan the system. Says he: “Gordon Brown has increased taxes on hard-working families and then he expects them to fill in a complicated form to try to get back their own money”.

Fill in a form? In order to get money back? 12 whole pages? The cheek! The inconvenience! The injustice! Etc…

Posted: 23rd, March 2007 | In: Money | 0 Comments

Don’t Bank On It – RBS Staff Brought To Account

WHAT with underhanded bank charges and a colourful history of dodgy dealing, one could be forgiven in thinking that the banking establishment had all the morals of a money-grabbing ethically bankrupt dog. (Albeit one who could deal with the intricacies of the global financial market while weeing against lampposts).

WHAT with underhanded bank charges and a colourful history of dodgy dealing, one could be forgiven in thinking that the banking establishment had all the morals of a money-grabbing ethically bankrupt dog. (Albeit one who could deal with the intricacies of the global financial market while weeing against lampposts).

Surely not?

Well, according to the Guardian, the Royal Bank of Scotland is the latest bank to show its nasty side.

In a letter from the bank’s chief executive of retail market operations, Gordon Pell, RBS’ own staff has been threatened with disciplinary action if they decide not to open an RBS account. “Failure to do so will represent a breach of group policy and I will be obliged to write directly to your line manager asking them to progress this matter according to the group’s disciplinary policy”, writes Pell.

Apparently at interview stage, potential RBS staff are told that, in order to receive their salary, they will be required to open an account with the bank, a policy which has understandably angered finance union Amicus says the BBC. “If you work for Tesco you won’t be disciplined for buying your groceries from Sainsbury’s”, says union official Rob MacGregor, “RBS’s disproportionate and heavy-handed approach is counterproductive and bad for morale”.

Look out for RBS employees in the firm’s complaints department complaining to themselves about the bank’s high bank charges…

Gordon Brown – Because He’s Worth It

GORDON Brown has stopped.

THE Royal Mint has moved quickly to ensure that there will be enough two pence pieces in circulation in time for the drop in income tax announced by Chancellor Gordon Brown in the Budget.

Said the Mint’s chairman, Sir Marmaduke Copperbottom on Thursday: ‘We are now minting new “Gordons”, as the coins are already known, and they should fill the demand.’

Posted: 22nd, March 2007 | In: Money | 0 Comments

Flare Is Flare

WITH the Beebs’ hit cop drama ‘Life On Mars’ giving us a weekly retro-hit of the Seventies, some of the era’s most memorable icons are shaping up for a court-room drama all of their own.

WITH the Beebs’ hit cop drama ‘Life On Mars’ giving us a weekly retro-hit of the Seventies, some of the era’s most memorable icons are shaping up for a court-room drama all of their own.

According to the Mirror, those high-priests of tartan (and crap hair-cuts) the Bay City Rollers are suing Arista Records for millions of pounds in unpaid royalties.

According to the band’s lawyers, the Rollers have only received one royalty cheque for £129,940, paid in 1997, since they finally split at the beginning of the eighties and have been forced to say ‘bye bye baby’ (it’s the only song of theirs I know) to countless other millions.

Considering the fact that, according to the same lawyers, Arista’s excuse for not paying out a penny more is due to the fact that the record industry giant apparently “does not know who to pay”, the ageing former Scottish teen idols may have a strong case.

The Mirror also tells us that singer Les McKeown is still touring while “another Roller became a plumber”. Great research.

Posted: 22nd, March 2007 | In: Money | 0 Comments

Homes Under The Hammer

WHILE most of the nation will be unenthusiastically pondering the few quid they are likely to have gained from the Budget, those living in the Surrey stockbroker belt are enjoying the booming sound of wrecking ball on concrete, writes the Telegraph.

WHILE most of the nation will be unenthusiastically pondering the few quid they are likely to have gained from the Budget, those living in the Surrey stockbroker belt are enjoying the booming sound of wrecking ball on concrete, writes the Telegraph.

It seems the new fad of the uber-wealthy residents of the exclusive Weybridge enclave of St George’s Hill is to demolish their country piles and start all over again.

The gated estate which has been home to the likes of Tom Jones, John Lennon and Cliff Richard have become the source of rich pickings for local contractors as “passé and old fashioned” mansions, considered ‘chic’ only 20 years ago, are being replaced by open plan, wi-fi ready ‘contemporary’ pads which sell for anything up to £15 million.

It seems that the original development created by WG Tarrant back in 1911, one of the first super-posh enclaves to be built around a golf course, has lost its charm for the new breed of super-rich.

So spare of thought for the suffering millionaires of St George’s Hill as we all know just how stressful it can be to have the builders in.

Posted: 22nd, March 2007 | In: Money | 2 Comments

Gulping Gordon Brown’s Budget – Drugs Dealers Delighted

GULPING Gordon Brown’s last minute Budget proclamation that the Stalinist/Socialist/Thatcherite (delete where applicable) would cut income tax by a whole 2p is greeted with unbridled hysteria and near-orgasmic ecstasy by the Mirror.

“Gordon Brown yesterday paved the way for his triumphal march into No 10 by delivering a sensational 2p tax cut that left David Cameron and his cronies reeling” it decries.

However, according to the Guardian, “average earners will be less than £1 a week better off” following Brown’s final budget speech with Lib Dem head honcho Menzies Campbell deriding it as “an income tax cut for the wealthy dressed up as a tax cut for the poor”.

The Mail is eager to highlight the accusations that the tax cut in nothing more than a “tax con”, with the scrapping of the 10p starter rate of income tax and the raising of the ceiling for National Insurance cancelling out the 2p concession.

But most importantly of all to us proles, what about booze and fags? Well, the BBC tells us that ciggies are set to go up by 11p a packet, beer by a penny a pint and wine by 5p a bottle.

Cocaine and cannabis look cheaper…

FSA Grab City Boys, Conrad Black, Property & Premiership Pay

A hot-shot City analyst was fined by the FSA after being found guilty of improper conduct, writes the Independent. Citigroup analyst Roberto Casoni will have to cough up £52,000, around the price of one of his handmade Italian driving gloves, after the FSA caught the 42-year-old rapscallion tipping off favoured clients about “hot” companies. The fine, says the Telegraph, was reduced from £75,00 after the honourable chap graciously co-operated with the FSA investigation. The Times even lists the biggest fines dished out to the City by the FSA, with GLG hedge fund management partner Philippe Jabre copping a chart-topping £750,000 fine following some dodgy market shenanigans last year.

Courtroom Drama

Across the Atlantic, the great Conrad Black was himself cast as little more than a common thief, says the Guardian. As the media mogul’s trial on $60 million racketeering charges got underway in Chicago, a windy city well used to gangsters, US attorney Jeffrey Cramer had a right go at Black in his opening statement. “Bank robbers are masked and they use guns”, he said, “These men dressed in ties and wore a suit”. However, Cramer wasn’t only concerned with Lord Black of Crossharbour’s fashion sense, and according to the Independent, “scowled and shouted directly at Lord Black” as the ballsy attorney went on to list the most damaging charges against his famous target including mail, wire and tax fraud, money laundering and obstruction of justice. A Hollywood courtroom drama based on the case (starring Tom Cruise and Jack Nicholson) must surely be in development.

House Frenzy Raises Interest

The Mirror worries that interest rates could rise again next month after mortgage lending hit its highest-ever February total of £24.6 billion. That’s an annual increase of nine per cent as the housing boom continues to, erm, boom. A”steep jump” in air fares last month also helped to push annual consumer inflation back to 2.8%, says the Times, with Gordon Brown’s decision to double air passenger duty back in December having a major effect on the disappointing figures released ahead of his final budget today.

A Premier Slice Of The Pie

Many Cuban cigars will be smoked and much expensive wine coiffed today as Premiership chairman get together in London today to discuss how to carve up the recent £2.7 billion television windfall. The Telegraph reports that a number of the top division’s smaller clubs, lead by Charlton Athletic, are deeply concerned over just how the new riches will be distributed around the league. The league’s chief executive, Richard Scudamore has even forecasted that, unless something is done, the winners of next year’s Premiership will net £20 million more than the team finishing in last place, a significant increase on the £13.6 million difference for 2005/06.

Money Blog

WHILE Barclays Bank continue to deal with the now national movement to reclaim illegal overdraft charges, the giant is currently cosying up to Dutch rival ABN Amro, according to the BBC, with a merger worth an estimated £80bn on the cards. Such a move would, says the BBC, “create a bank with 47 million customers and 220,000 staff worldwide”. The Independent claims the move will vault the British Bank “from 15th to 5th” in the world banking league table. However, the Telegraph suggests that the Dutch bank really wants to get jiggy with Spaniards BBVA and Santander and is using stuffy old English Barclays as nothing more than a “stalking horse”.

Bnks R Gr8

WITH only an estimated 19% of Kenyan adults holding bank accounts, the Guardian reports that a new mobile phone based system is set to revolutionise the country’s banking system. The country’s biggest phone operator will allow subscribers to send cash to other phone users by SMS as well as hold up to £370 in a “virtual account” on their handsets. With mobile giants Vodaphone behind the big idea, the system, if successful, could well spread across the globe, giving people usually excluded from the banking world access to an account. No doubt a message saying your getting a few quid will make a nice change from inane texts and happy slapping videos.

Off-Peak Practice

IN a new initiative to glean even more money from the common or garden commuter, South West Trains have come up with a cunning new plan, says the Times. The train operator has cleverly decided to fit in a new price in between peak and off-peak fares, hitting those lazy and conniving workers who use trains after 10am and before 12.49. This new “super off-peak” fares will cost up to 20% more than the current off-peak ticket prices, says the Independent, and come on top of increases made back in January. The Mirror says that these fare hikes, which have unions and passenger groups fuming, come on the back of plans by SWT’s owners Stagecoach to pay shareholders a £700 million dividend. With Stagecoach boss Brian Souter landing an estimated £175 million windfall, those cramped and now even higher-priced journeys will be even harder to take, no matter what time you travel.

Charging The Sick

HARDLY the most fun places to visit at the best of times, NHS Hospitals have now been accused of kicking people when they are down and charging extortionate parking fees. The Telegraph reports that more than £95 million was made by the NHS last year from parking charges with patients and visitors stung for up to £3.50 an hour. Cancer charity Macmillan, who uncovered these cynical charges after obtaining the details under Freedom of Information Act, called for the Government to put a stop to the “shameful” charges. Southampton University Hospital was the biggest beneficiary, earning a whopping £2,414, 672 from its car park. The sick of the Solent beware!

Victoria Beckham & Mary-Kate’s $45,000 Urban Satchel

VICTORIA Beckham’s getting one. Mary-Kate Olsen and Ashley Olsen are hawking them. And it’s so much better than the $45,000 Louis Vuitton Tribute Patchwork Bag that is already sold out.

VICTORIA Beckham’s getting one. Mary-Kate Olsen and Ashley Olsen are hawking them. And it’s so much better than the $45,000 Louis Vuitton Tribute Patchwork Bag that is already sold out.

As 14 writes, much discussion has erupted over the recent announcement of those $45,000 bags.

And to alleviate the pain of missing out on one of those creations, 14 has created the Loius Vuitton $150,000 Urban Satchel debuting for Spring 2008.

As the blub goes: “Made of the world’s finest Italian leather, this one-of-a-kind luxury handbag is hand-crafted with carefully chosen ‘urban charms’. The proud owner of this exclusive handbag will be able to flaunt her impeccable style and lavish taste to a world that can only dream about owning such a rare and precious possession.”

As the blub goes: “Made of the world’s finest Italian leather, this one-of-a-kind luxury handbag is hand-crafted with carefully chosen ‘urban charms’. The proud owner of this exclusive handbag will be able to flaunt her impeccable style and lavish taste to a world that can only dream about owning such a rare and precious possession.”

Buy one and be the envy of all your enemies…

Posted: 19th, March 2007 | In: Money | 4 Comments

Money Blog

FOLLOWING the recent controversy over the hugely-inflated overdraft fees charged by banks, it now appears that withdrawing cash with your credit card could also be costing you more than you think, says the BBC. According to a report by Uswitch, due to a complicated way of calculating the interest rate, the interest on cash withdrawals may be far higher than that advertised. With withdrawal fees and compound interest not taken into account in those advertised interest rates, consumers are regularly being stung at the cash-point. However, the Telegraph reports that the banks aren’t having it all their own way. A con-man “armed with only chocolates and charm”, smooth-talked his way into an ABN Amro bank vault in Belgium before making off with an estimated £15 million of diamonds. The thief, who posed as “Carlos Hector Flomenbaum”, an “Argentinian businessman”, used no violence in his outrageous heist, even buying chocolates for the bank staff…

Online Insecurity

WHILE “Carlos Hector Flomenbaum’s” antics may bring a sly grin to our faces, the fact that, according to the Independent, “confidential data on tens of thousands of people is being sold to criminal gangs for as little as £1” is sure to wipe those grins right off. Internet security company Symantec reports that there has been an “alarming” increase in online criminal activity with a fifth of Londoners estimated to have had their bank details stolen and used illegally. While residents in the capital will also be unhappy with the claim in the report that 36% of the world’s computers that have been taken over by remote control “bots” are in London.

Too Posh For Becks

WHILE the Telegraph says the country is headed for a worsening shortage of new homes over the next 20 years – apparently due to” higher-than-expected number of EU immigrants and more people living alone” – a couple of expats to the US are having dreadful problems of their own. According to The Sun, Posh and Becks have apparently been “put-off” by the £20 million price of a dream Beverly Hills pad, resplendent with “and outdoor pool, tennis courts, movie room and a two-storey guest house”. However, according to “sources”, England’s finest couple are “careful with investments”. Could the same be said of LA Galaxy?

Posted: 19th, March 2007 | In: Money | 0 Comments

Red Nose Appeal

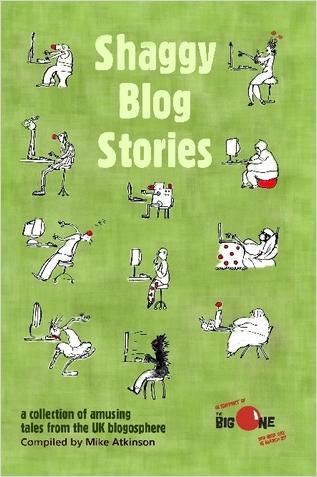

IT is Comic Relief day today. Whoopee indeed.

Actually, it is whoopee this year for there’s a book out in support of it.

Cobbled together Tightly edited over the past seven days by Mike Atkinson, it’s a collection of 99 funny (as in funny ha ha) pieces from across the British blogosphere. There are professional writers, at least one stand up comic, names I recognize and many I don’t and am looking forward to.

There is also, to round it out to 100, a piece from me. This one.

Also, Mike has not only managed to get all of us to donate our efforts, he’s also got Lulu.com to donate their margin as well. So of the price, some £ 3.60 (roughly $6.50 or so?) will go to charity.

Clearly, everyone is going to want a copy of this fabulous book. But can I offer you one further encouragement? By the beneficience and intercession of Him and His Noodly Appendages I can inform you that if you buy the book then you are free from the requirement to watch the damn TV shows about Comic Relief all weekend.

Posted: 17th, March 2007 | In: Money | 0 Comments

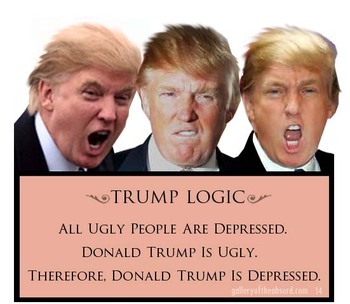

Donald Trump’s Inner Rosie O’Donnell

DONALD Trump, he of the tidal wave hair-do, has been talking of late.

And 14 wonders if Donald Trump is suffering from depression?

According to his own Trumpian logic, the American tycoon publically admits his depression during an interview on The Insider.

When discussing his favourite punching bag, Rosie O’Donnell, Trump says: “When she looks in the mirror she suffers from depression. If I looked like Rosie, I’d suffer from depression too, believe me.”

Take look at Trump. And remember that you can shave in his mirrored building, New York’s Trump Tower.

So we see ourselves as others see us? Or does money make us more attractive? Discuss…

Posted: 16th, March 2007 | In: Money | 4 Comments

Stardust In Their Eyes

NEWS to gladden the hearts of they who seek to new do down Manchester’s new super casino before it’s opened – a video of the Las Vegas Stardust Hotel-Casino being crushed to so much, well, dust.

The Church may like to save this one for future reference…

And the Lord said, Because the cry of Sodom and Gomorrah is great, and because their sin is very grievous;

I will go down now, and see whether they have done altogether according to the cry of it, which is come unto me; and if not, I will know.

— Genesis 18: 20-21 (KJV)

Rouble At (Heather) Mills – Roman Abramovich’s Divorce

WITH Heather Mills’ divorce turning out to be something less than advertised (what happened to the £200million she was getting?), the paper spots Roman Abramovich.

WITH Heather Mills’ divorce turning out to be something less than advertised (what happened to the £200million she was getting?), the paper spots Roman Abramovich.

So much for Paul McCartney and his make-do £1billion. This is Abramovich, the man who the Mirror says is worth £11billion.

And that was blonde Irina Abramovich, his now ex-wife.

This is the Mirror’s “WORLD’S BIGGEST SPLIT” – bigger than the Mills-McCartney split. When it comes to splits, this is the Great Rift Valley to Mills’ Cheddar Gorge.

As a statement says: “Mr and Mrs Abramovich have divorced on a consensual basis. They have agreed terms in respect of arrangements for their children and a financial settlement.”

No tales of stabbings, crawling to the toilet and missing limbs. Just an agreement.

But it costs nothing to speculate. So who gets what?

And who is the girl in the bikini waving at Mail readers? Why, she’s Miss Daria Zhukova, a model. And news is that Roman could get to keep her.

The Mail spots the 24-year-old talking and walking with Abramovich in Paris on Monday. The Mail says the couple had been staying at Fouquet’s hotel, where the top suite costs £5,775 a night.

Has this dalliance had any influence on the settlement? As the Sun notes (“There may be rouble ahead”), Irina could be line for £5,5bn.

Or not…

Posted: 14th, March 2007 | In: Money | 4 Comments

Does ITV Add Up?

MUCH has been made of the ITV quiz show scandal.

And in the interests of fairness, we now reproduce a quiz question that featured on the broadcaster’s Make Your Play station.

Question – as delivered to late-night telly watchers (insomniacs, drunks and journalists):

“Add the pence, listed: Two pounds, 25p, £1.47, 16p and fifty pence.”

Can you do it?

Tell us your answers. ITV charged 75p a time. The prize was £30,000. After three hours, no-one won.

Look out for a clue coming later.

And then we will tell you how to solve it.

The answer is either:

A) 438

B) 39

C) 506

Answer later…

Answer:

C.

Two pounds is 200p plus 2p (two p) and 1p (p at the beginning of “pounds”) which makes 203p

-25p: 25p plus 5p and 1p (the p symbol) = 31p £1.47 = 147p 1

-6p: 16p plus 6p and 1p (p again) = 23p

-Fifty pence: 50p plus 50p (fifty p, a shortening of pence), 1p (reference to pence) and 1p (p only) = 102p

-Adding 203p, 31p, 147p, 23p and 102p gives a total of 506p

Posted: 13th, March 2007 | In: Money | 5 Comments

You’re Never Alone With A Casino

YOU’RE never alone with a casino. So says the advert.

YOU’RE never alone with a casino. So says the advert.

From September, casinos, betting shops and internet gaming sites in the UK will be able to advertise on radio and TV. Gambling advertising has been limited to billboards and print.

Good news for the gambling industry, which seeks to profit from the Gambling Act. And, one imagines, good news for broadcasters now able to earn from the industry.

Perhaps this will encourage ITV to do away with its phoneline quizzes, which can resemble the back-of-the-suitcase game of Find The Lady as contestants try to find Rawl Plugs and a balaclava in a woman’s handbag.

But not everyone is happy. And in the Mail there are dark warnings from the Church.

Toby Scott, a spokesman for the Methodist Church, tells the paper: “The whole purpose of these adverts is to encourage more people to gamble.”

Who says the Church does not have its finger on the cultural pulse?

He goes on: “The fear is that – with more people taking part in gambling – there will be more people who develop a gambling problem. That in turn could lead to more families suffering, because the money they need is being diverted elsewhere.”

A Church Of England Spokesman adds: “We have strong reservations about the effects of liberalising the law.”

But before the Church is forced to open its coffers and spread its wealth to the poor, we read of the rules.

As the Guardian reports, the advertising will fall under the auspices of the Advertising Standards Authority.

Adverts must not imply that winning massive amounts at a casino are a solution to financial problems. We already have the National Lottery and scratch cards for that.

They should not appeal to the young and children. So no Ronald McDonald-style figure palming out tubs of Casino Chips and doing battle with Black Jack.

And the adverts must not link gambling with getting more sex from more attractive partners.

This is not to say that such a thing is impossible, just that it should not be advertised.

Well, you know how it is, once you’ve learned the secret of pulling, you’ll be hooked…