Voodoo Tax Breaks Berry’s Troubled Assets

THIS is reply to Richard North’s post: Why Gordon Brown’s Rescue Package Is Not Going To Work, by Chenier…

THIS is reply to Richard North’s post: Why Gordon Brown’s Rescue Package Is Not Going To Work, by Chenier…

It’s crap.

Sorry, not you FSBFP, the stuff about the accountancy rules.

They already changed them, and I wrote a piece about it at the time; it did f*ck all to improve matters.

John M Berry is being somewhat disingenuous in not mentioning in his article that the SEC had already issued a statement allowing people to take a much more cheery view of their Troubled Assets, but perhaps he just overlooked it in all the excitement.

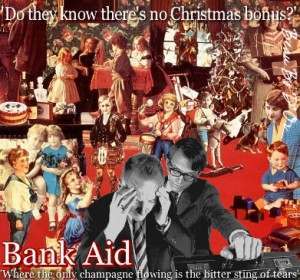

(Image: Beau Bo D’Or)

Equally, John M Berry pointedly ignores a little local difficulty called Enron, which I suppose is unsurprising given that the fraud there involved taking a view of their Troubled Assets so cheery that people ended up doing jail time.

Ironically, he even cites the Sovereign Debt fiasco of the early 80’s, which I have written about, as an excellent example of what a good idea it is to pretend that banks are not insolvent when they are insolvent. I have written about it as an excellent example of how stupid the bankers were in the first place to lend vast sums of money to countries which did not have a hope in hell of servicing the debt, much less repaying the principal.

Voodoo accounting is almost as attractive as voodoo tax breaks to people who want to believe that there really isn’t anything wrong with laisser faire financial markets as exemplified over the last quarter of a century, and that everything would come magically right if they just implemented whatever bee they have in their bonnets.

If you want to look at what people without bees in their bonnets, but with heavy duty financial expertise, think about the debacle then take a look at the article in Forbes entitled:

Dimon, Munger, Rohatyn: No More Vegas:

‘Wall Street giants Jamie Dimon, CEO of JP Morgan Chase; Felix Rohatyn, recently senior adviser to Lehman Brothers; and Charles Munger, Warren Buffett’s curmudgeonly sidekick, predict the end of huge leverage and the return of Wall Street to an earlier era when investment firms were mainly “advising corporations and individuals globally and making solid profits overall”

Munger wants to outlaw all derivatives, which makes him even more draconian than I am.

The bottom line, which John M Berry and Richard are averting their eyes from in the hope that those nasty numbers will just go away, is that the UK, the US and a hefty chunk of other countries need to borrow vast sums of money to pay for the losses generated by the laisser faire financial markets. The subprime lendings are just the tip of the iceberg; there are all those lovely credit default swaps out there, and Dog knows what else.

The only people who have the money are the Sovereign Funds, and places like China.

If you want to persuade someone to lend you money, you need them to trust you; an iron law of the markets which permits no exceptions. They have been burned before; it is delusional to believe that taking a cheerier view of your Troubled Assets will do anything other than than make them run, not walk, from the building.

I don’t know whether Brown’s plan will work, though the fact that he is following Warren Buffet’s example is cheering; I do know that Warren Buffet, and his curmudgeonly sidekick, thinks that the mark-to-market rules have nothing to do with this disaster.

In fact, Munger is furious with the accountants, not because they were too harsh, but because they were too lenient; in particular for letting Wachovia report actual profits on accrued interest from risky mortgages when, in fact, the interest wasn’t paid but added to the principal amount due on the mortgages…

Warren Buffet Is Lender Of Last Resort

Why Gordon Brown’s Rescue Package Is Not Going To Work

Brown Declares Jihad On Bankers

1983 And All That: Let’s Bomb Switzerland

It’s Those Damn Atheists Again

Posted: 14th, October 2008 | In: Back pages Comments (7) | TrackBack | Permalink